The adoption of artificial intelligence is still in its early stages and many investors are underestimating its impact, according to Sanlam’s Chris Ford.

Ford is the manager - alongside Tim Day - of the £631m Sanlam Artificial Intelligence fund, formerly the Smith & Williamson Artificial Intelligence fund.

He said that 2020 was a very important year for AI demonstrating tangibly what it can actually do.

“We're only at the beginning of the adoption of AI, almost all of this opportunity still stands ahead of us,” Ford said.

“In the course of last year, we saw huge breakthroughs in the healthcare sector, in particular with the result of the use of novel artificially intelligent systems to address some of the very pressing needs of the world's population, most notably the requirement to develop a vaccine or vaccines for Covid-19.

“The fact that the vaccine developments were so quick last year was in no small part on the back of the very significant engagement with data science in a way that pharmaceutical companies have typically been very loath to do.”

Ford has observed over the last 12 months that companies engaged with artificial intelligence are developing “significant economic moats” around their businesses.

He added: “Those who've been engaged with these technologies for some time have enhanced those economic moats to the point where others are now falling over themselves to play catch up or alternatively beginning to have to accept defeat.”

Ford said one example of this can be seen in the North American healthcare sector, where there has been a pickup in mergers and acquisition activity to close the gap in data and AI between competitors.

He highlighted United Healthcare, the largest US healthcare business, which is also an insurer and an owner operator of healthcare facilities.

Ford said: “They have invested vast sums in their AI platform over the course of the last decade to the point that we'll know that they are the largest participants in that market.

“They're actually outgrowing the overall market, which is a fairly extraordinary place to find themselves, something which is not typical in large, mature, consolidated businesses elsewhere.

“In the health insurance businesses in the US, companies are falling over themselves to try to find a way to compete effectively with the largest player in the market that continues to pull away from everybody else.”

Share price performance of United Healthcare over 5yrs

Source: Google Finance

When it comes to the Sanlam Artificial Intelligence fund, Ford is focused on the ability of companies to develop these significant competitive economic moats around their businesses to enhance their competitive positioning.

“AI that transforms the businesses, it creates compelling investment opportunities, and that's what we care about,” he said.

“We're using AI as the feature that we can observe from outside the organisation - the vapour trail, if you like - that we can follow to find those companies which we think are doing really very interesting things to disrupt organisations.”

He added: “Critically, the investment community just doesn't understand what's going on here.

“In many cases the investment community - particularly the sell side research community - doesn't even have the vocabulary to understand what's going on under its own nose.”

He said this could be seen with Netflix and Tesla, but also it continues to be seen in different parts of the economy are disrupted.

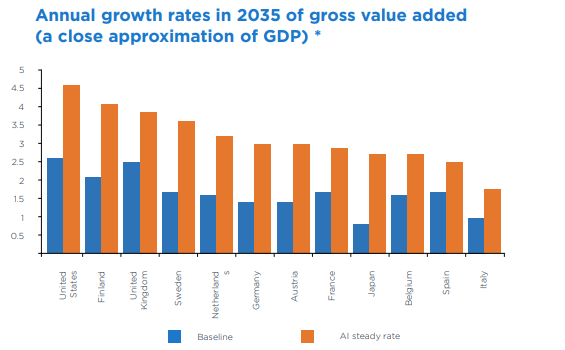

Ford said AI has the potential to double economic growth rates over the next 20 years: “We need to stand back, squint a little bit, and understand that we're not talking about traditional levels of GDP growth here - we're looking at transformational levels of growth.”

Source: Accenture, Frontier Economics, Sanlam Investments

Ford said: “We see the breadth of the opportunity that AI prevent presents across regions, but also the magnitude of the uptick from a baseline level of economic activity to what can be then incrementally added as a result of the engagement with AI platforms.

“You'll see here some of the countries which are most typically affected by low levels of underlying economic growth for some very well understood reasons, such as demographics in Japan for example, actually stand to benefit most significantly from the deployment of AI.”

However, Ford doesn’t just blindly buy companies that are involved in AI. He has avoided investing in US big data analytics firm Palantir – which sells a machine learning and AI platform to governments and businesses.

“One of the reasons that we are a little bit leery of Palantir is that we're not convinced that a long run business model is as high return as that which we can see elsewhere,” Ford explained.

He prefers companies that provide him a more software-like margin structure at scale and, while Palantir has some of the “best AI scientists” in the world, he believes its valuation is too high.

He said: “Palantir is unquestionably a thought leader in the AI space. It has very significant contracts with the federal government which brings with it a kind of badge of credibility from a functionality perspective.

“But of course, that also brings within it a certain amount of opaqueness in respect of what they're able to talk about and what they're doing - which I don't particularly like because I prefer to know better what the what the companies in which we invest are actually up to.

“If it comes down to a reasonable valuation that justifies us to having a look at it, then we'd certainly love to consider it for the AI fund.”

The fund, which runs a concentrated portfolio of 35 to 40 stocks, has its largest positions in Alphabet (6.8 per cent), followed by Microsoft (4.4 per cent) and Netflix (3.1 per cent).

Since inception in June 2017, Sanlam Artificial Intelligence has delivered a 135.02 per cent total return compared to 21.21 per cent from the IA Specialist sector and 45.99 per cent from the MSCI World index.

Performance of fund since launch

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.82 per cent.