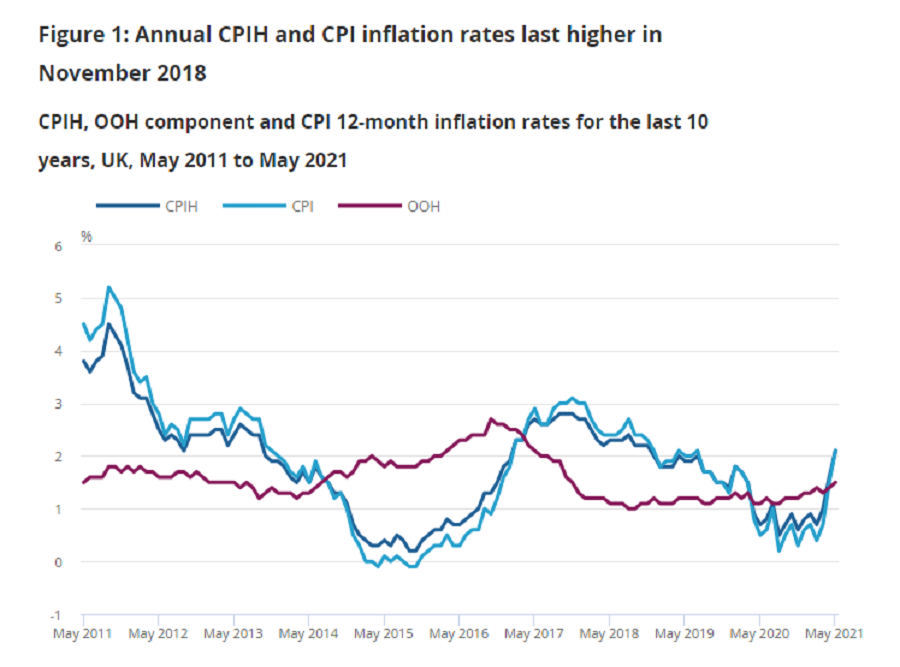

UK inflation jumped to 2.1 per cent in the 12 months to May 2021 and surpassed the Bank of England’s (BoE) 2 per cent target, data from the Office for National Statistics (ONS) shows.

The consumer prices index (CPI) measure of inflation rose from 1.6 per cent in April, according to the ONS, surpassing previous forecasts of a rise to 1.8 per cent.

This is the highest inflation has been since before the pandemic.

Source: ONS

The rising prices for clothing, motor fuel and recreational goods as well as increased reactional spending with the easing of lockdown were the main contributors to the CPI spike, according to the ONS.

Rising inflation has been a growing concern for several months, since the Covid-19 vaccine rollout ushered in a recovery period for markets and economies.

Ben Laidler, global markets strategist at multi-asset investment platform eToro, said that this increase in inflation was predictable with the easing of lockdown and “inevitable as the government released the shackles from Britain’s lockdown economy”.

“The fact that annual inflation is now running at or above the Bank of England’s 2 per cent target for the first time in two and a half years will spook some investors, who will no doubt see soaring prices as a sign that a rate rise is coming closer,” he added..

“However, we are not at that point yet. The Bank of England has stated a number of times that it sees the most recent bought of inflation as ‘transitory’. Or, in other words, temporary.

“Wages are set to grow slower than prices and therefore this will act as a natural cap on inflation in the coming months.”

Still, there is some speculation on whether the BoE could let inflation run even higher, like has been seen in the US. Recent data there shows inflation increased by 5 per cent in the 12 months through May, making it the largest yearly increase since August 2008.

Emma Mogford, fund manager of Premier Miton Monthly Income fund, said: “The step up in inflation this morning is a sign of the continued strong economic recovery in the UK. While the overall figure is no cause for concern, there are obviously inflationary pressures building in certain sectors.

“UK inflation is below the level in the US, as the UK has been slower to lift Covid restrictions and sterling strength has helped keep imported goods prices low. With further opening up of the economy and potential for bottlenecks in both goods and labour post Brexit, the UK number could follow the US inflation number higher.”

However there is also the path of increased interest rates to tighten inflation, which Derrick Dunne, chief executive of Beaufort Investment, highlighted was what the BoE chose to do last time inflation began to spike.

“But the Bank of England may soon have to take tightening measures. Let’s not forget a few years ago when it started cautiously raising the base rate in the face of a post-Brexit inflation surge,” he said.

“That being said, the latest delay to our so-called ‘Freedom Day’ and the impending end of the furlough scheme should temper price rises in the short-term, but the breach of the Bank’s stringent 2 per cent target may already be provoking discussion of a monetary policy adjustment.”

For investors Dunne said that they should ensure their portfolios can withstand both inflationary pressures and a potential rise of the base rate.

“At this stage, nothing is off the table,” he said.