Investors who hold one of the best-performing funds in the rebound from the coronavirus crash shouldn’t get complacent, as these are unlikely to continue leading the market – if the recoveries from previous crises are anything to go by.

The FTSE All Share bounced back to its pre-coronavirus peak (in total return terms) on 15 June, taking just under 17 months to return to the level reached on 17 January 2020.

This makes it its fastest full recovery in 40 years from a crash of more than 30 per cent.

The question now is, will the best-performing funds in the recovery continue to lead the market?

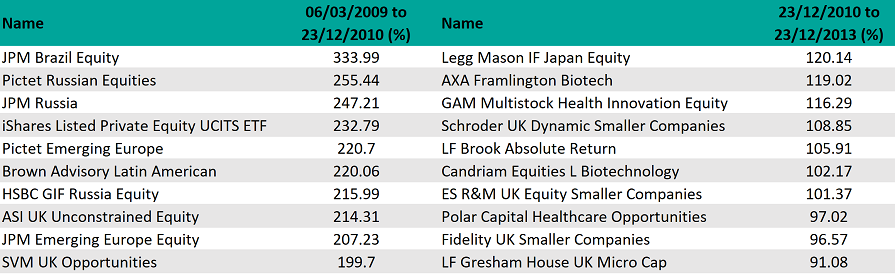

The list of top performers from the point the market bottomed out after the financial crisis, on 6 March 2009, until it returned to its pre-crash peak, on 23 December 2010, is dominated by Brazil/Latin America and emerging Europe/Russia funds.

This performance can be explained by the performance of commodities, including oil, which these two regions rely heavily upon. The hit to demand in the financial crisis caused prices to collapse, but they bounced back to some extent in the recovery, bringing the Latin American and emerging Europe markets along with them.

Best-performing funds after financial crisis trough

Source: FE Analytics

This was as good as it got for both regions, however. Years of oversupply meant the prices of many commodities never fully recovered, and not a single fund that was on the list of 10 best performers in the recovery from the financial crisis made the top-10 over the next three-year period.

The leadership moved away from Brazil/Latin America and emerging Europe/Russia towards UK small caps and healthcare/biotech, each with four funds in the top-10.

Another fund, Legg Mason IF Japan Equity, focuses on Japanese small caps, although its return of 120.14 per cent during this period was about four times that of the sector.

Smaller companies tend to be among the worst-hit sectors in recessions, as investors panic and liquidity dries up, but also tend to be among the top performers when conditions improve and confidence returns.

Healthcare/biotech is more complicated. Like small caps, its early-stage companies were hit hard by the lack of liquidity in the financial crisis, but it saw a boom in M&A activity in 2010 as many of these start-ups sold out: the value of biotech deals in the US rose from $33bn in 2009 to $82bn in 2010.

In addition, the American Recovery and Reinvestment Act of 2009 allocated $155bn to healthcare to aid the sector’s recovery, while several ground-breaking technologies matured during this time, including genetic sequencing and antiviral drugs.

The anomaly is LF Brook Absolute Return. This fund uses long/short strategies with the aim of making a positive return on a 12-month rolling basis, and although it can go through extended periods without eking out much of a return, it can also make spectacular gains in a matter of months. It returned 105.91 per cent during the period in question, compared with just 8.4 per cent from its IA Targeted Absolute Return sector.

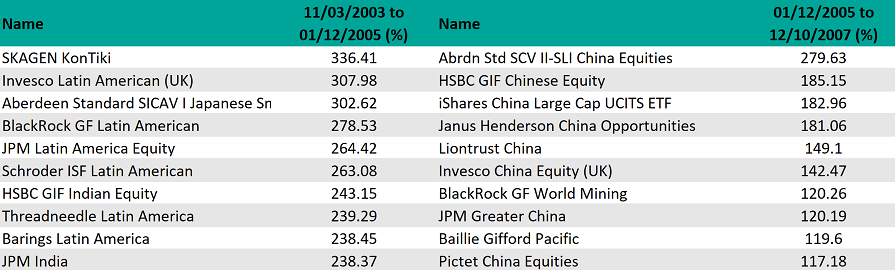

Next up is the dotcom bubble. Between the point the FTSE All Share bottomed out on 11 March 2003 and when it rebounded to its pre-crisis peak on 1 December 2005, six of the 10 best-performing funds were focused on Latin America. The resource-rich region was ideally placed to benefit from the commodities super-cycle of the early 2000s as growth in emerging markets boomed – which helps to explain why funds focused on one or more emerging markets account for another three spots on the list.

The next part is more difficult: three years after the point the index recovered to its pre-dotcom bubble high would take it to December 2008, the middle of the financial crisis.

If instead we take it from 1 December 2005 until the point the market reached its next pre-crisis peak – 12 October 2007 – the leadership had moved to China, accounting for eight of the top-10 positions in the IA universe. Another fund, Baillie Gifford Pacific, had a heavy exposure to China.

Best-performing funds after dotcom bubble trough

Source: FE Analytics

The last spot on the list is taken up by BlackRock GF World Mining, showing the commodities boom continued past the original recovery and into the beginning of the next cycle. Many Latin American funds weren’t too far behind.

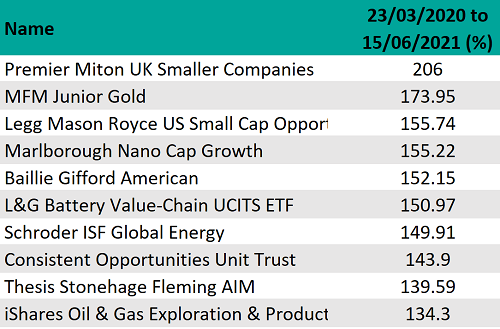

But what about the funds that have topped the table since the FTSE All Share bottomed out on 23 March 2020?

Five of the 10 best performers since then have a focus on small caps. However, another three funds have a specific focus on commodities, meaning their performance from this point on is of course dependent on the price of the resources they focus on.

Best-performing funds since 23/03/2020

Source: FE Analytics

Notably, two of these are focused on oil & gas and received a major boost in the recovery period as the Bloomberg Brent Crude Spot index rose by more than 160 per cent since it bottomed out last April.

Meanwhile, the small-cap fund that beat the lot – Premier Miton UK Smaller Companies – which made 206 per cent since the market bottomed out in March 2020, has about one-third of its portfolio in basic materials, compared with 5.87 per cent from the wider sector.