Henderson Opportunities, Augmentum Fintech and BlackRock Energy and Resources were all significantly cheaper in June, according to QuotedData, and could represent good value for investors today.

When a trust trades at a discount or premium to its net asset value (NAV), its shares trade below or above the value of the underlying investments.

Changes like this can happen for a number of reasons, such as investor apathy towards a sector, a short-term sentiment change in the fund, or a strong surge by the underlying companies that have yet to be reflected by investors.

Trusts on a wide discount can act as a useful entry point for bargain-hunting investors, although a persistent discount to NAV can be a sign of long-term underperformance. The key is finding trusts that are cheap relative to their historical averages.

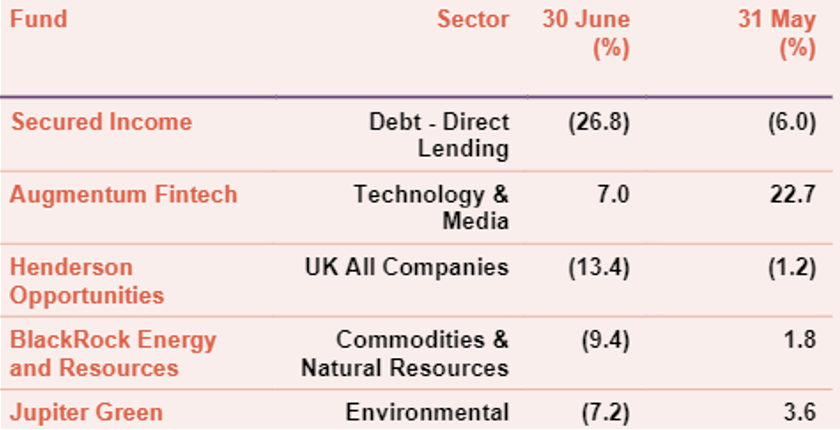

As such, with statistics from QuotedData, Trustnet looks at the investment trusts which have become cheaper relative to NAV over June.

Trusts that are cheaper relative to NAV - 31 May to 30 June

Source: QuotedData

The £31m Secured Income trust was on a 27% discount in the first week of July, after bad news about its film finance portfolio came to light. However, as of 20 July it is now at a premium of 5% after it bought back £3m worth of shares.

Next on the list is Augmentum Fintech, the £263m trust that invests in UK and European fintech companies. The portfolio is diversified across different areas including banking services, wealth and asset management, as well as fintech enablers.

The high premium of 22% dropped in June, although it still trades higher than its NAV at 7% today.

Jayna Rana, investment company analyst at QuotedData, said: “The company revealed excellent results for the year to 31 March 2021 while also sharing details of an amendment to its investment policy and plans to raise £40m at 135.5p – a 4% premium to the NAV at the time.”

This is significant as over the three-year history of the fund it has mainly stayed at a low premium, apart from the 45% discount it hit after the March sell-off in 2020. The trust is now trading at an 11% premium to NAV, still some way from its June highs.

From the IT UK All Companies sector, the £110m Henderson Opportunities Trust went to a wider discount over June, going from 1% to 13% in a month.

While the discount of the trust, managed by James Henderson and Laura Foll, has narrowed slightly, it still stands at an attractive 7%.

The trust has a large proportion in FTSE AIM stocks and was boosted by the dual-tailwinds of Covid-19 vaccines and a Brexit trade deal, which revealed considerable valuation opportunities in the UK small-cap space.

Also looking cheaper over June was the BlackRock Energy and Resources trust, managed by FE fundinfo Alpha Manager, Tom Holl and Mark Hume.

Performance of trust vs sector over 5yrs

Source: FE Analytics

The £107m trust has made a total return of 67% over five years, while the average peer in the IT Commodities and Natural Resources sector posted a 48% gain.

BlackRock Energy and Resources invests in a combination of mining and energy companies, with the allocation changing to reflect the macroeconomic views of Holl and Hume.

According to Winterflood Investment Research analysts, the trust’s increasing allocation to companies expected to benefit from the move to a lower carbon economy is an interesting differentiator within the peer group.

One area Holl is keen on is hydrocarbons, which he said was an important part of the energy story and the transition will likely take time.

The manager noted: “Infrastructure still needs to be developed, and the entire energy value chain will be required to adapt to support a new energy mix while also ensuring reliability. The magnitude of this transition will need to be managed and will take time.”

Going from a small premium of 2% at the end of May to a 9% discount at the end of June is quite the swing, made even larger when compared to its premium at the end of April of 7%.

As of 20 July, the discount was at 7%, an attractive entry point for investors looking to play the energy transition theme.

Finally, from the IT Environmental sector, Jupiter Green, which has been managed by Jon Wallace since February, appears an appealing option for investors.

Rana said: “The trust is back trading on a meaningful discount for the first time since last October, although the board is supposed to keep this under control.”

It reached a high of an 8% premium in February and started June on a 4% premium, but ended that month on a 7% discount. It now stands on a 5% discount to NAV.

While environmental concerns and environmental, social and governance (ESG) fervour reached highs during 2020, those attitudes have cooled in recent weeks, as shown with the recent failure of the Liontrust ESG float.

However, with climate issues back in the spotlight after devastating floods across Western Europe, the trust could be back in vogue in the coming months.