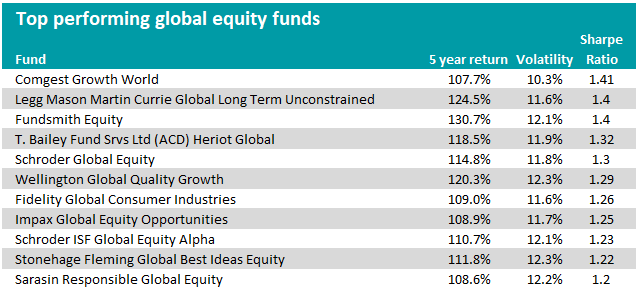

Fewer than 4% of global equity funds have achieved top-ranked returns over the past five years whilst also delivering top-ranked low volatility and risk, according to data from FE Analytics.

Out of the 322 funds with a five-year track record in the Investment Association Global sector, just 11 funds have managed to achieve this feat.

Investors benefit from the effects of compounding returns if they stay invested over a long period but this can be difficult to do if performance is extremely volatile.

Often sector-beating returns coincide with high volatility as nearly all the top-returning funds in the sector rank bottom quartile for volatility. Yet a select few have managed to smooth the ride without sacrificing returns.

The table below shows the 11 global equity funds that have top-quartile returns and first quartile (lower) annualised volatility.

The funds were ranked by their Sharpe Ratio – which measures a fund’s return relative to its risk. The risk-free rate used was the weighted average Fed Funds rate over the past five years: 1.24%.

Source: FE Analytics

The £946m Comgest Growth World fund run by Laure Negiar, Zak Smerczak, Alexandre Narboni and Richard Mercado, delivered a top-ranked 107.7% return over the period.

It also had the highest Sharpe Ratio of those in the table of 1.41, which suggests that investors were highly compensated for the level of risk taken. It also had the lowest volatility of those in the table of 10.3%.

Manager Negiar attributed much of the fund’s low volatility to the fact that its investment approach is focused on finding quality companies with growth that is more sustained than it is cyclical.

Its largest holdings include US technology giants Microsoft and Alphabet as well as Taiwan Semiconductor Manufacturing Company (TSMC) - the world’s largest chipmaker – all of which have proven to be consistent long-term performers. It has an ongoing charges figure (OCF) of 0.91%.

The £26.6bn Fundsmith Equity fund, run by FE fundinfo Alpha Manager Terry Smith, also featured in the table with a return of 130.7% over the period – making it the highest returning strategy.

Terry Smith’s well-known quality growth approach of buying good companies without overpaying, and then to simply ‘do nothing’ – has paid off for investors over the past five years.

Some of its largest holdings that demonstrate this include Microsoft, Danish pharmaceutical firm Novo Nordisk and French global personal cosmetics company L'Oréal.

The buy-and-hold strategy has enabled the fund to deliver top-quartile returns with a low volatility of 12.1%. It also has one of the higher Sharpe Ratio’s in the table of 1.4. It has an OCF of 1.06%.

The £115m Legg Mason Martin Currie Global Long Term Unconstrained fund was another notable fund that featured. It is run by FE fundinfo Alpha Manager Zehrid Osmani alongside Yulia Hofstede.

Despite being the smallest fund in the table, it delivered 124.5% return over the period with an annualised volatility of 11.6%.

The managers take a long-term growth approach to investing, focusing on investing in companies with a high excess return on capital.

Microsoft and TSMC also both feature in the top-10 holdings of this fund, alongside some highly rated growth companies such as the semiconductor firm NVIDIA, and the biotechnology company Illumina. It has an OCF of 1.23%.

Another notable fund that featured was the £7.4bn Wellington Global Quality Growth fund, which had top-ranked returns of 120.3% over the past five years.

Whilst it still has top-ranked low volatility of 12.3%, this was the highest figure among the funds in the table.

Run by FE fundinfo Alpha Manager John A Boselli, the portfolio’s investment strategy focuses on investing in high-quality growth companies that are trading at a discount to the market.

Like the majority of the other funds that featured, the fund’s largest holdings include the likes of Microsoft, Alphabet and TSMC.

However, through its big positions in other US blue-chip stocks such as Amazon, JPMorgan and UnitedHealth, it has a one of the highest exposures (69.2%) to North American equities compared to the other featured funds. It has an OCF of 1.04% and is currently no longer open to new investors.

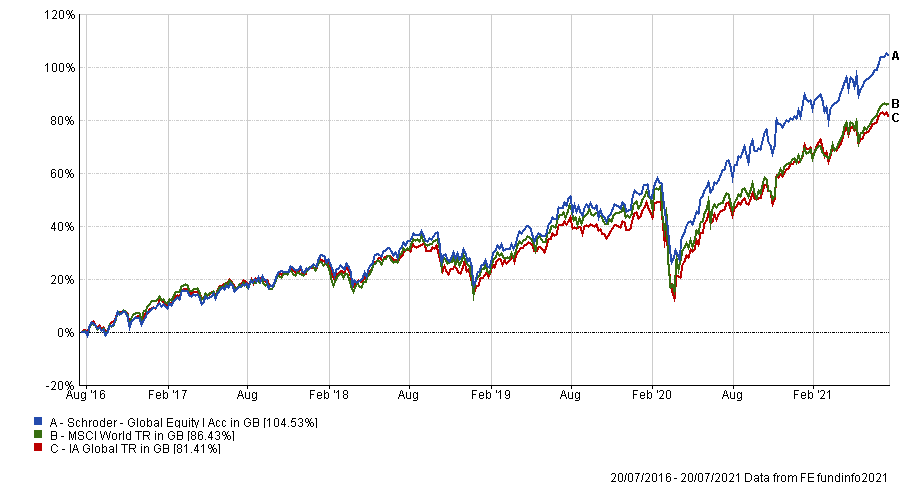

The £1bn Schroder Global Equity fund, run by FE fundinfo Alpha Manager Alex Tedder, also cracked the list after it delivered returns of 114.8% and an annualised volatility of 11.8%.

With an OCF of 0.52%, it was also the most affordable fund among those listed and ranked top quartile for low fees versus all its peers in the global sector.

Its investment strategy focuses on identifying companies with a ‘positive growth gap’ where their future earnings growth is above market expectations on a three-to-five year time horizon.

Like many of the other top-performing funds, it has its biggest positions in Alphabet, Microsoft and Amazon. Dutch semiconductor equipment manufacturer ASML is also in its top-10 holdings.