Biotech is one of the few high-growth areas of the market that currently looks attractively valued, according to Marek Poszepczynski, co-manager of the International Biotechnology Trust, after a correction across small- and mid-cap companies within the sector.

Earlier this year, Paul Major and Brett Darke of the BB Healthcare Trust asked, “Why aren’t more analysts brave enough to call the top [of the biotech market]?”, citing excessive valuations that bore little relation to reality and imaginative attempts by the sell side to justify these prices.

However, a 26.6% fall in the S&P Biotechnology Select Industry index since its February peak this year has once again made it compelling from a valuation perspective, according to Poszepczynski.

Performance of index in 2021

Source: FE Analytics

“The equal-weighted index just skyrocketed through the [US] election, everything went its way, and in fact it peaked,” he said.

“At that time, we thought it was too toppy. But then you started to see inflation taper tantrums and stocks have come down around 30 to 35%, while some companies have lost more than 50%.”

However, the Nasdaq Biotechnology Index, which is market-cap weighted, did not follow the same path, suggesting that the large caps didn't follow the same trajectory as their small-cap peers, he added.

Daniel Koller, who works alongside Major and Darke on the BB Healthcare Trust, shied away from making broad-brush statements about valuations like his colleagues and peers.

For example, the manager said it was impossible to compare cash-generative large caps such as Amgen or Gilead with loss-making start-ups, some of which may not even have a drug in trials yet.

However, he agreed with Poszepczynski about the divergence between small and large caps.

“One clear outlier has been large-cap biotech, which in general has done well – everything is up 10, 20 or 30% on a year-to-date basis,” he said.

“You have genetic-medicine companies that are up even triple-digit percentages and you obviously have coronavirus-related companies.”

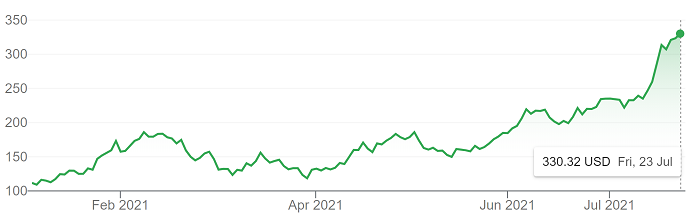

As an example, Koller pointed to his trust’s biggest holding Moderna, which he said had “the ultimate run-up in the last couple of days” with its inclusion in the S&P 500. The stock is up almost 200% this year.

Performance of stock in 2021

Source: Google Finance

On the other hand, oncology specialists, platform companies, those with single assets and businesses with cardiovascular and psycho-neuro drugs have struggled, even if they are very successful.

“Many of the names are actually down double digits on a year-to-date basis, and some are even down 60 to 70%, often for the wrong reasons or no reasons, besides not being in the hot seat right now towards Wall Street's attention. That, we think, offers interesting opportunities for the course to come.”

More important than looking at which parts of the market appear to be over or undervalued, according to Koller, is sticking to your process and refusing to get carried away.

He said this was especially important in biotech, where there are many hot areas, such as genetic medicines, where the entire sector can rally on positive clinical data for a single drug.

At this point, the manager likes to take a step back, asking whether these firms are financial viable, how the drugs may be priced if they do get to market, and questioning the market size.

He added: “We try to flip this around from a fundamental perspective and think not just of the disruption potential, but as well from a more individual, realistic point of view in terms of, what else do they have in the pipeline? How long does it take to get to market? What is their cost of capital and their DCF [discounted cash flow] valuation?

“There are certain areas where a lot of capital has flocked to and other areas where we have seen the absolute opposite: profit-taking to valuation levels that we absolutely can't understand anymore.”

Yet just because valuations are now more reasonable in small- and mid-cap biotech, this doesn’t necessarily make them good investments. Poszepczynski noted a spike in inflation was the main headwind that caused the sector to fall this year, adding that if this proves to be more persistent than expected, it will continue to drag down this area of the market.

“Small and mid caps all have profits 10 years down the line, whereas all the costs are near term,” he explained.

“People tend to move towards the large caps that have cash-flow generation now, so that is something that one needs to take into consideration.”

Yet he said the lower-growth profile of these cash-rich large caps may mean they aim to take advantage of the cheaper valuations in the small- and mid-cap space through increased merger and acquisition (M&A) activity. This could provide a major boost to the lower end of the market, with the average holding in his trust that has been taken private sold on a 70% premium to the share price at the time the bid was announced.

“We have seen a lot of activity in the private space, in terms of venture capital funding and early-stage funding, but not so much M&A in the public space. That might come through later this year, or maybe next,” he finished.

Data from FE Analytics shows the BB Healthcare Trust has made 122.2% since launch in December 2016, compared with gains of 75% from the IT Biotechnology & Healthcare sector. The International Biotechnology Trust made 63.9% over the same period.

Performance of trusts vs sector since Dec 2016

Source: FE Analytics

BB Healthcare Trust has ongoing charges of 1.1% and is on a premium of 1% compared with 0.8% and 1.1% from its one- and three-year averages.

The International Biotechnology Trust has ongoing charges of 1.3% and is on a discount of 3.1% compared with a premium of 0.2% and a discount of 0.9% over one and three years.