Chrysalis Investments, Gresham House Strategic and Oakley Capital Investments were all more expensive than their long-run average in June, according to QuotedData.

Investment trusts can trade at a premium to net asset value (NAV) for several reasons: the region or sector may be in favour; it may be performing well or run by a popular manager; or it may have a higher than average yield.

While those trading on a premium look strong in terms of performance, if an investor pays that premium and the figure falls, they will lose money.

Just as with any other share, if you pay 100p and the price falls to 80p, you will have lost 20% of your capital.

Sometimes, if a trust pays a higher income, that can be enough to offset the capital loss. However, this is not guaranteed and there is a risk that the pay-out also falls.

Similarly, trusts on a usually very wide discount can be bid up, reducing this and making them relatively more expensive but if the move is unsustainable, they may be in danger of slipping back.

Below Trustnet highlights five investment trusts that are more expensive than usual.

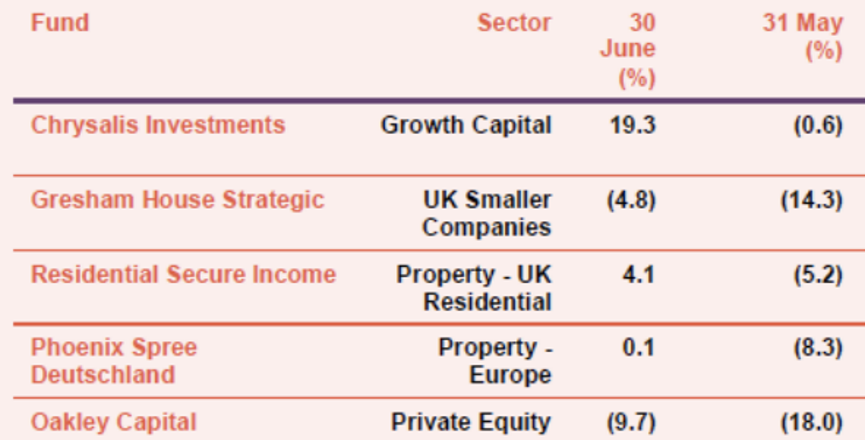

Trusts that are more expensive relative to NAV 31 May – 30 June

Source: QuotedData

First up, the £1.1bn Chrysalis Investments trust went from a 0.6% discount at the end of May to a 19.3% premium at the end of June.

QuotedData investment company analyst, Jayna Rana said that while it had announced a £75m investment in leading retirement platform Smart Pension, the price move was more reflective of hopes for an uplift in its end of June NAV.

Managed by Nick Williamson and Richard Watts, the managers have said that Chrysalis is only “scratching the surface” of the opportunities available in the late-stage private market.

The managers commented: “Our original hypothesis of a blurring of the lines between private and public markets appear to be playing out and our crossover proposition, backed by significant scale is resonating strongly with entrepreneurs.”

Since its November 2018 launch, the trust has made a total return of 140% compared to a loss of 6% for the average fund in the IT Growth Capital sector.

As of 26 July, according to the Association of Investment Companies (AIC), it is now trading at a 20.3% premium to NAV.

The Gresham House Strategic trust also became more expensive between May and June, but stayed on a discount of 4.8% to NAV, up from 14.3%.

The £54m trust invests in UK smaller public companies, applying private equity-style techniques to the portfolio.

Deputy manager, Laurence Hulse, speaking to investment research company, Edison Group, said: “We have a clearly differentiated strategy and have not wasted a crisis, having recycled sale proceeds into some exciting investment opportunities whose re-rating and profit growth potential will drive NAV growth in the coming years.”

The five FE fundinfo Crown Rated fund was a strong performer in June, returning 14%, but this has tailed off over July.

As a result, it is now trading back at a 9.9% discount to NAV at present.

While Gresham House Strategic has a private equity approach, Oakley Capital Investments – the third on the list – is a dedicated private equity trust and also became more expensive in June.

Over the month, it narrowed from an 18% discount to 9.7% off the back of strong performance.

Performance of trust vs sector YTD

Source: FE Analytics

Since the start of the year, the £537m trust has made 24.1% while the IT Private Equity sector as a whole posted a 24.2% gain.

Despite strong performance within private equity trusts, discounts tend to persist given the lengthy gaps between portfolio NAV updates and misgivings about private equity in general.

However, these shares can still perform well even if trading at a discount to NAV and can act as a useful entry point for investors bullish on the investment case of this area. Over July, the discount has widened again and now stands at 12.5%.

Finally, two trusts from property sectors complete the list. From the IT Property – UK Residential sector, the £154m Residential Secure Income trust is fourth.

Its aim is to deliver inflation-linked returns by investing in affordable shared ownership, retirement and local authority housing throughout the UK.

Speaking to Trustnet in June, manager of the Capital Gearing Trust, Chris Clothier, who holds the trust in the portfolio said: “This trust is able to secure grant funding from the government, which it in turn uses to ensure that the rental element charged to tenants is affordable and also rises in line with the retail prices index (RPI).

“Taken together, it benefits from a high-quality income stream, enabling the trust to pay a 4.8% dividend which should rise in-line with inflation.”

At the end of May, the trust was trading at a 5.2% discount, but by the end of June, it had moved to a 4.1% premium to NAV. As of 26 July, it is now at a slightly lower premium of 3.2%.

Last up, the Phoenix Spree Deutschland trust sits in the IT Property – Europe sector. Investing in the German property market, since its launch six years ago the £352m trust has made a 207.4% return, while the sector as a whole has made 94.2%.

From the end of May to the end of June, Phoenix Spree Deutschland went from a 8.1% discount to a small 0.1% premium. However, it now stands at a 2.7% premium.

From the end of December to the end of June, assets under management (AUM) of the trust increased by 2.6% - driven by, according to chairman Robert Hingley, “the combined impact of modest yield compression, supported by a decline in interest rates, and the active management of the portfolio.”

Some uncertainty remains given the introduction of rent controls in Berlin (the ‘Mietendeckel’) but according to Hingley, these measures are “unconstitutional” and he was hopeful they would be overturned.

He added: “A positive ruling on Mietendeckel has the potential to positively impact the current valuation.”

Like most trusts in property sectors, the trust is highly geared at 50%. It also has a dividend yield of 1.6%.