The quality-growth companies that investors have relied upon for the past decade are going to be under pressure from inflation if they can’t pass higher prices on to consumers, Man GLG’s Rory Powe has warned.

The manager of the £1.6bn Man GLG Continental European Growth fund said he was more concerned for the profit margins of companies, than rising inflation, as passing on price rises to consumers is likely to be a challenging task.

He said: “Whether it's port congestion on the west coast of the US, higher freight charges or higher packaging costs because raw material prices have gone up – all of these things are going to potentially put downward pressure on margins.

“This is unless companies can pass them on to their customers - and we are sceptical about a lot of companies’ ability to do that.”

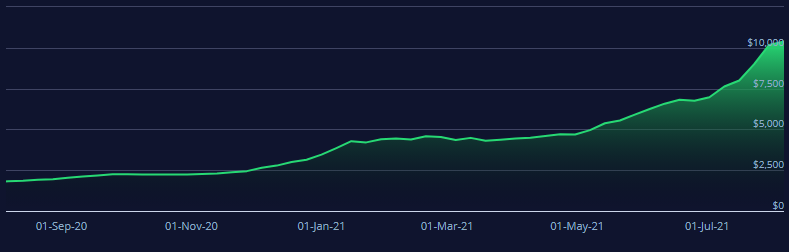

Indeed, freight costs, as represented by the Freightos Baltic Container Freight Index (FBX) have increased nearly 10-fold in the space of a year.

Source: fbx.freightos.com

Some companies with less pricing power, such as those in the low-margin consumer goods industry, were already feeling the heat of rising input costs, he said.

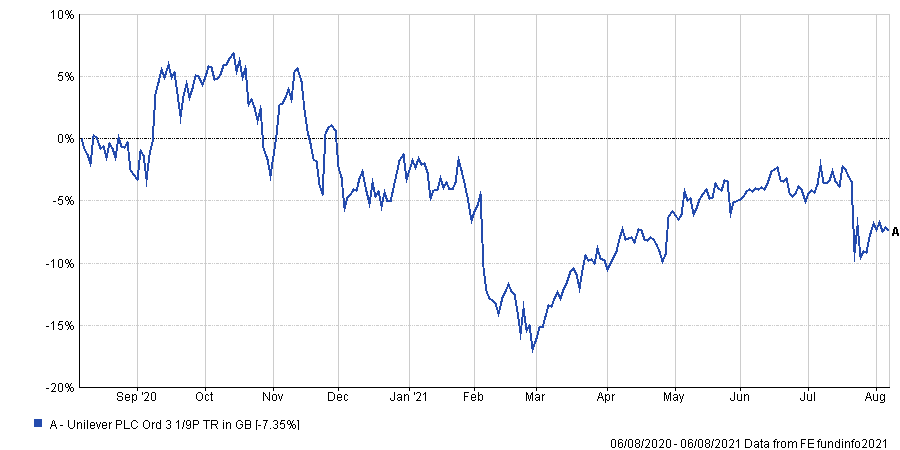

“Unilever – which is not one of our positions – talked about the margin consequences of this for them in 2021,” Powe noted.

FTSE 100 giant Unilever’s most recent results indicated that surging commodity costs had been putting pressure on its profit margins. The company’s share price has since been on a gradual decline over the past year.

Unilever share price over 1yr

Source: FE Analytics

“I think inflation is more likely to be a margin problem than an inflation problem. Right now, pricing power has become particularly important because a lot of bottlenecks have emerged due to the economic rebound,” he said.

However, even the companies with pricing power will not be able to fully pass on higher input costs – at least not immediately.

“There's usually a lag,” Powe said. “It might be up to nine months before companies have managed to compensate for higher input costs in the form of agreed higher selling prices with their customers.”

As an example, he highlighted how the Swedish security and locks conglomerate Assa Abloy, had also struggled with the margin consequences of rising input costs in 2021.

“It is confident that by 2022 it will have made that up in the form of high prices, but it won't happen overnight. That lag will act as a drag on the margin,” Powe said.

“And we would argue that Assa Abloy is a very good example of a company with pricing power. So if it is struggling at the moment to pass on higher costs - it’s not going to be good for those which lack pricing power.”

Assa Abloy share price over 1yr

Source: FE Analytics

In Powe’s view, the rising input costs underscores the importance of avoiding companies that will likely suffer from eroding margins, making pricing power especially important in today’s market.

As companies continue to grapple higher input costs and inflation, investors may also need to consider the possibility that the US Federal Reserve raises interest rates soon.

Not all companies will be as well equipped to cope with, or pass on, the increased cost of debt to consumers.

“It's not impossible the Federal Reserve raises interest rates in 2023,” Powe said. “In fact, they have kind of suggested they will do exactly that.”

This backdrop underscores the importance of sticking to companies that have the earnings and pricing power to thrive in what is going to remain a complicated and difficult market, he said.

“It's all very well getting excited about recovery but it's not easy for companies to manage a very sharp downturn and then a very sharp upturn. Both of them are difficult in different ways,” he said.

Over the past five years, Man GLG Continental European Growth has delivered a top-quartile total return of 95.3% compared to 71.4% from the FTSE World Europe ex UK index and 66.9% from the IA Europe Excluding UK sector average.

Performance of fund versus sector & benchmark over past 5yrs

Source: FE Analytics

The fund has an OCF of 0.9%