Baillie Gifford’s £19.4bn Scottish Mortgage Investment Trust - the largest investment trust in the world - has delivered incredible returns for investors over the past decade.

It is the top performing trust in the IT Global sector across time horizons ranging from one year to 20 years.

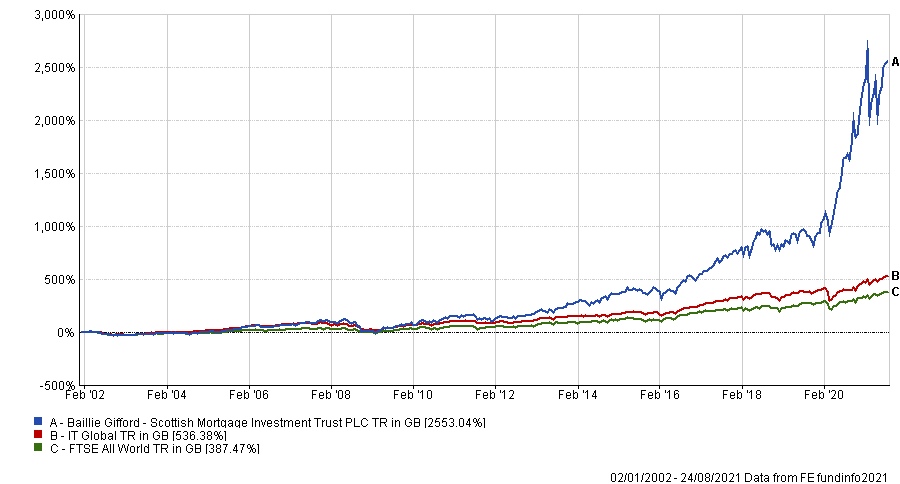

Over the past two decades – a period that encompasses both the financial crisis and the coronavirus pandemic crash - the trust has a total return of 2,553%, roughly five times that of the IT Global’s 536% return.

Performance of Scottish Mortgage vs sector over 20yrs

Source: FE Analytics

James Anderson - who has been managing the strategy since 2000 - and co-manager Tom Slater have built up a reputation of betting on wildly successful growth businesses very early.

Some of their most successful investments of the last decade include their early stakes in Amazon, Alphabet and Alibaba before they grew into the technology giants they are today.

More recently, they’ve benefited from their high conviction positions in electric vehicle manufacturer Tesla and biotechnology firm Moderna, which is widely known for its Covid-19 vaccines.

Daniel Pereira, investment research analyst at Square Mile Investment Consulting and Research, praised Scottish Mortgage’s long-term growth approach, which is designed to be unconstrained from the mainstream global equity indices “in a true Baillie Gifford manner”.

He said: “The trust invests in a concentrated number of disruptive companies but also has a tail of smaller sized earlier stage holdings, including a number of unquoted firms.”

But for investors looking for a fund with a slightly different investment approach, the analyst highlighted two quality-growth funds that would complement Scottish Mortgage well.

BNY Mellon Long Term Global Equity

The first he suggested was the £1.7bn BNY Mellon Long Term Global Equity fund, run by institutional investment firm Walter Scott & Partners.

Pereira said: “The BNY Mellon Long Term Global Equity fund also invests in global equities, is run in an unconstrained manner and focuses on growing, high-quality companies.

“However, the focus on quality alongside a strict valuation discipline means that this open-ended fund is likely to deliver a far more conservative return profile and provide some defensive stability during times of market stress.”

Indeed, the FE fundinfo four crown-rated fund ranks top-quartile within the IA Global sector for its low annualised volatility of 13.7% over the past three years.

Its top three holdings are Taiwan Semiconductor Manufacturing Company (3.2%), Japanese sensor and measurement company Keyence Corp (2.9%) and multimedia software company Adobe (2.9%).

Over the past five years, BNY Mellon Long Term Global Equity has delivered a total return of 100%, compared to 84.7% from the FTSE All World benchmark and 83.3% from the IA Global sector average. This ranks it top quartile for performance within the sector.

Performance of fund versus sector & benchmark over 5yrs

Source: FE Analytics

It has an ongoing charges figure (OCF) of 0.8%.

Stewart Investors Worldwide Sustainability

The second fund Pereira suggested was the £883m Stewart Investors Worldwide Sustainability fund, run by Nick Edgerton and FE Alpha Manager David Gait.

Pereira said this fund “also invests in high-quality and growing global equities but has a strong focus on companies with sustainable business practices”.

Members of the Stewart Investors investment team all are required to sign a ‘Hippocratic Oath’, which has a commitment to act in the interests of clients and society by not pursuing risk adjusted returns “to the extent that our actions will knowingly harm others”.

Its largest holding is a 6.2% position in NASDAQ-listed Fortinet, which sells cybersecurity software and products.

Pereira added: “Again, this open-ended fund may appeal to investors who want to invest in quality companies, but in a far more conservative manner.”

Over the past three years, the fund’s annualised volatility of 10.84% also ranks it top quartile within the IA Global sector in terms of low volatility.

Stewart Investors Worldwide Sustainability has made a total return of 82.5% over the past five years, just under the 85.4% return from the MSCI All Companies World Index and the IA Global average of 83.3%. This ranks the fund second quartile for performance, whereas over the past one year it ranks first quartile.

Performance of fund versus sector & benchmark over 5yrs

Source: FE Analytics

This fund has an OCF of 0.67%.

Edinburgh Worldwide Investment Trust

The first was the £1.3bn Edinburgh Worldwide Investment Trust, which in his opinion is an attractive vehicle that is “significantly differentiated” from other global equity funds.

Edinburgh Worldwide is managed by FE Alpha Manager Douglas Brodie, alongside Luke Ward and Svetlana Viteva.

“It typically has high exposure to the technology and healthcare industries with the emphasis being on disruptive companies driving innovation which led to many of them coming to the fore during the unprecedented period of lockdowns,” Lovett-Turner explained.

“The focus is on companies that have a proven technology which is at the start of the commercialisation stage and therefore not its potential is not appropriate priced by the market.”

He said the fund differentiates itself from its stablemates through a focus on less mature companies, usually smaller than $5bn at the time of investment – although he added that the trust can run its winners.

Its largest positions are in Tesla, followed by online real estate platform Zillow and eye surgical tools manufacturer STAAR Surgical.

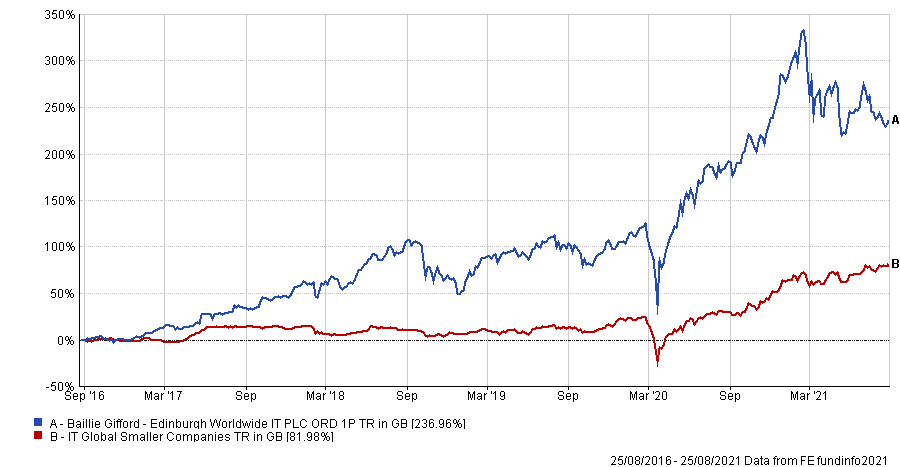

Over the past five years, the trust has generated a 237% return compared with 82% from the IT Global Smaller Companies average, ranking it in the top quartile.

Performance of trust vs sector & benchmark over 5yrs

Source: FE Analytics

It has annual charges of 0.75% and trades at a 2.2% discount to net asset value (NAV).

Mid Wynd International Investment Trust

The second trust Lovett-Turner suggested was the £480m Mid Wynd International Investment Trust. It is managed by Alex Illingworth, FE Alpha Manager Rosanna Burcheri and Simon Edelsten.

Lovett-Turner said the team’s thematic approach differentiates the trust from its peers.

“The managers, Artemis, seek to build a concentrated portfolio centred around 8-10 structural growth themes, which can generate growth independently of the wider macro-economic situations,” he explained.

“Stocks selected with exposure to these themes are typically high-quality companies with proven profitability and free cash flow generation, which are supported by strong balance sheets and protected by high barriers to entry.”

Current key themes at play in the portfolio include: online services; automation; healthcare costs; sustainable consumer, building the future, digital banking, scientific equipment; low carbon world; screen time; and energy transition materials.

Mid Wynd International has delivered a 115% return compared to 97.3% from the IT Global average, which also ranks it top quartile.

Performance of trust versus sector & benchmark over 5yrs

Source: FE Analytics

It has charges of 0.7% and trades at a 2.3% premium to NAV.

Fiera Atlas Capital Global Companies

Dan Cartridge, assistant fund manager at Hawksmoor Investment Management, prefers the $794m Fiera Atlas Capital Global Companies fund managed by “the highly regarded” Simon Steele.

He said: “It is the disciplined approach to valuation, whilst still having a strict focus on building portfolios of fast growth quality businesses, that has seen the fund complement SMT [Scottish Mortgage] well since their respective launches.”

Fiera Atlas Capital Global Companies has a strict valuation approach where it aims for 10% per annum returns over five-year rolling periods.

“They take a private equity approach to valuation where they assume conservative ‘exit’ multiples after 5 years to ensure returns are generated by the operating fundamentals of the underlying businesses, as opposed to hoping for/relying on multiple expansion for returns,” Cartridge added.

“Given the starting point for the valuations of the respective portfolios today, it is likely Fiera Atlas could enjoy a sustained period of outperformance over SMT looking ahead.”

Fiera Capital only recently hired Simon Steele’s Atlas team from AMP Capital in March 2021, so it is not yet widely available in the UK.