Only one UK equity investment trust has made a sector-topping return while taking on more risk than the market, the latest Trustnet study finds.

Dunedin Income Growth is the only top-rated trust to beat its rivals over three years, according to Trustnet data.

In our latest series, we compared investment trusts run by FE fundinfo Alpha Managers that had made top-quartile returns over the past three years and had a FE fundinfo Crown rating of four or five. Having previously looked at the global sectors, this week we cast our eye over the three UK sectors – IT UK All Companies, IT UK Equity Income and IT UK Smaller Companies.

We then used the FE fundinfo Risk Score – which measures a company’s volatility against the FTSE 100 over three years – to find the most risky trusts. Those with a score of more than 100 (the index’s score) were included.

Only Dunedin Income Growth made the grade. Managed by Alpha Manager Ben Ritchie and Georgina Cooper, the £487.5m trust has been under a recent transformation after shareholders voted to incorporate environmental, social and governance (ESG) principles into its objective.

This follows an evolution in recent years towards a greater focus on dividend growth at the expense of initial yield.

Thomas McMahon, senior investment trust analyst at Kepler Trust Intelligence, the trust was a good choice for income investors, despite the switch, which will reduce the number of high-yielding stocks it can own.

“Income investors will doubtless find the consistent track record of dividend growth and ability to support future dividends from revenue reserves reassuring, and we think that an ongoing recovery in market-wide dividends is likely to be reflected in Dunedin’s revenue account,” he said.

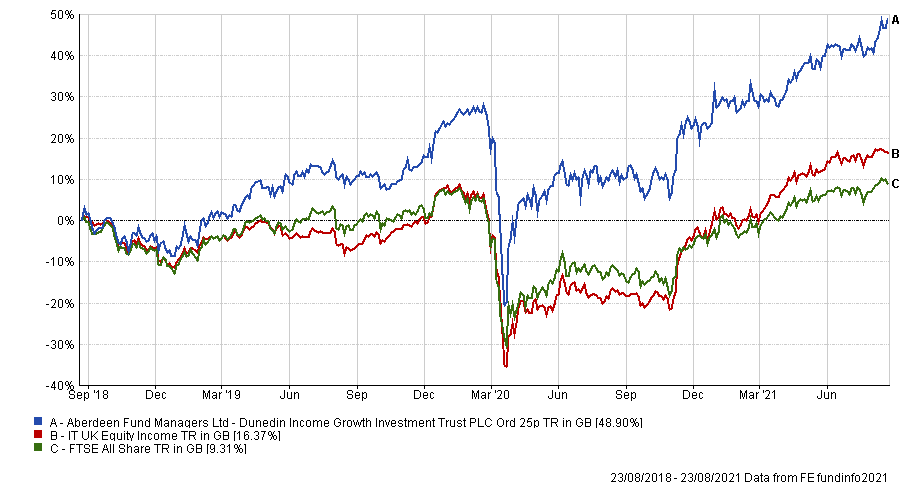

Over the past three years the trust has made a total return of 48.9% while the average IT UK Equity Income trust has made 16.4% and the FTSE All Share has returned 9.3%.

Performance of Dunedin Income Growth vs sector and benchmark over 3yrs

Source: FE Analytics

The five-crown rated portfolio had a risk score of 108, slightly ahead of the market, owing to its weighting to mid- and small-sized companies.

Although Dunedin was the only UK fund to crack the list, Finsbury Growth & Income Trust fell just shy of the criteria, with a risk score of 95 and a second-quartile return of 14.9%.

Run by Alpha Manager Nick Train since 2000, the £2bn trust invests in stocks that the manager believes will be around for the next several decades. They must also have a competitive edge, such as a strong brand that encourages customer loyalty or exclusive intellectual property.

Although in the IT UK Equity Income sector, the trust’s name gives away that it does not solely buy dividend payers as it also looks for growth stocks, meaning its 1.82% yield is a full percentage point lower than that of the market.

The trust has struggled during the market rotation this year, but Ewan Lovett-Turner, a research analyst at Numis Securities, was unconcerned.

“We do not believe investors should be overly concerned with a short period of relative underperformance, which was driven by significant market gyrations as a result of the ‘reopening trade’,” he said.

The £758m Standard Life UK Smaller Companies Trust also missed out by the narrowest of margins. The £758m trust had a risk score of 150, but its 56.2% return was in the second quartile among its IT UK Smaller Companies peers.

Run by Alpha Manager Harry Nimmo and co-manager Abby Glennie, the four-crown rated investment company uses a ‘matrix’ system to pick stocks. It looks for companies with high-quality characteristics operating in growth markets and with positive business momentum.

The manager then ranks companies based on 13 factors – including quality, earnings growth, momentum and valuation, which helps to predict share price performance.

Emma Bird, research analyst at Winterflood Secturities, said: “The fund’s emphasis on companies with strong growth characteristics, coupled with a reasonably concentrated portfolio, means that performance will primarily be driven by stock selection. As a result, the fund is likely to see periods of underperformance, particularly during cyclical-driven rallies, as was the case between November 2020 and April 2021.”

However, she added that the trust has demonstrated an ability to deliver strong performance over the longer term.

“The fund’s managers are very positive on the outlook for UK smaller companies as the economy recovers from the pandemic. In addition, they expect the fund’s strategy of focusing on quality, growth and momentum to outperform for a number of years following the end of a ‘dash for trash’ that saw deep value stocks outperform in the wake of positive Covid-19 vaccinenews flow,” she said.| Trust | Sector | Crown rating | Risk score | Return over three years | Volatility over three years | OCF |

| Dunedin Income Growth Investment Trust | IT UK Equity Income | 5 | 108 | 48.9% | 16.3% | 0.49% |

| Finsbury Growth & Income Trust | IT UK Equity Income | 5 | 95 | 14.9% | 13.9% | 0.14% |

| Standard Life UK Smaller Companies Trust | IT UK Smaller Companies | 4 | 150 | 56.2% | 23.9% | 0.39% |