It has been a tumultuous year for the RWC Temple Bar Investment Trust after fund manager Alastair Mundy stepped down last year to pursue a career in teaching.

The board swiftly moved the mandate from Ninety One – formerly Investec – to rival asset manager RWC, with managers Nick Purves and Ian Lance taking charge, but despite a strong start, the performance has tailed off in recent months.

Indeed, last week the £721m trust dropped out of the FTSE 250 index in the latest quarterly reshuffle, after three months in which it lost investors 5.5%. It crashed out just six months after being admitted to the index in March, following a strong back end to 2020 when its value style of investing took off.

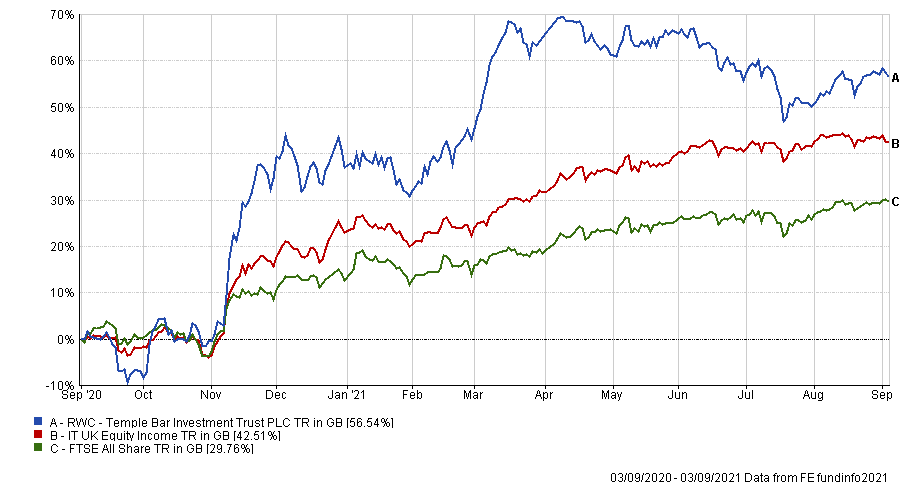

However, despite its recent poor run over the past year, the trust has made investors 56.5%, a top-quartile performance in the 23-fund strong IT UK Equity Income sector.

Total return of Temple Bar vs sector and benchmark over 1yr

Source: FE Analytics

Notable contributors over the six months to end June 2021 included value names such as Royal Mail Group, Aviva, NatWest Group and BP.

This volatile performance has been ongoing for much longer however. Temple Bar’s long-term performance has been poor – over the past decade it has made 82.8%, the second worst in the sector.

Jayna Rana, investment companies analyst at QuotedData, said much of this was due to value stocks failing to match the returns of their growth counterparts, which have dominated since the financial crisis of 2008.

Total return of Temple Bar vs sector and benchmark over 10yrs

Source: FE Analytics

Some feel that the six-month value rally reprieve at the end of 2020 and start of 2021 has now run its course and the world will return to the conditions of the past decade, but the managers disagree.

They argued that as UK stocks continue to be valued at a marked discount to world equities, this offers an opportunity at a time when interest rates are low and private equity has significant resources.

“As a result, mergers and acquisitions (M&A) activity in the UK has picked up since the start of 2021 (which has benefited a number of Temple Bar’s holdings) and the managers think that there should be plenty more to come,” Rana said.

“Short-term, the emergence of new variants remains a risk to value but, with dividends recovering and strong figures within its portfolio, investors in Temple Bar are being paid to wait. Beyond this, the value discount looks too wide and so Temple Bar appears on track to gain even more.”

Juliet Schooling Latter, research director at Chelsea Financial Services, agreed. She noted that the performance of the trust at the end of 2020 and beginning of 2021 indicated that Temple Bar could take advantage if the value rally continued.

“The trust is still operating at a near 9% discount and yields a reasonable 3.6%, so I would consider it a solid hold given just how undervalued UK equities are to their global peers relative to history. There is significant upside potential and these are two managers have the credentials to deliver on that. Just don’t expect it to be a smooth ride,” she said.

Anthony Leatham, head of investment companies research at Peel Hunt, said investors that already owned Temple Bar should hold on and give the new managers an opportunity.

He said the pair from RWC have a less extreme version of value than the former manager.

The new approach is “high conviction with low turnover targeting a ‘discount to intrinsic value’ with an emphasis on quality and ethical and sustainable factors,” he said.

He added that the “undemanding” discount and “more sustainable income growth", a consequence of the trust's rebasing of its dividend, make it an attractive option for investors that want to invest in unloved UK stocks that have “come back into fashion in a post-vaccine, post-Brexit world”