It is little wonder that Vanguard, one of the world’s largest asset management firms, uses Baillie Gifford to run some of its active funds at the current moment in time, considering the latter’s outperformance of the past decade.

But what may come as a surprise is that the decision to bring Baillie Gifford into the fold was made in 2003, not long after the dotcom bubble burst.

Baillie Gifford’s long-term, high conviction, growth-focused investing approach was a major beneficiary of the boom in technology stocks before the crash, but it could not avoid the losses that followed.

“Anyone that was growth orientated with a penchant for technology stocks and high-growth stocks – it was a horrible time to be an investor,” said Andrew Surrey, national senior development manager at Vanguard.

“Baillie Gifford will tell you itself, it was losing a lot of clients and assets.”

Today however, Vanguard is Baillie Gifford’s biggest client.

“When we invested in 2003, if we'd filtered by performance, we wouldn't have selected Baillie Gifford,” Surrey continued. “But there are other key criteria that we believe are the drivers of future performance as opposed to past performance.”

One of these drivers is the investment process and philosophy. “The Baillie Gifford process we think is one that has an active edge,” Surrey explained.

“We think that it has got a great chance of beating the market because the process and the philosophy that is married to it – driven by the firm’s culture and the people that employ the philosophy – give it a great chance of doing what is very, very difficult to do: generating alpha against the market.”

This is one reason why Vanguard chose Baillie Gifford, alongside Wellington Management Company, to run its active Vanguard Global Equity fund.

The institutional-client-focused Wellington Management side of the fund uses a more value-driven process, but Surrey said this complements Baillie Gifford’s growth-driven approach.

He said: “Now if you get the Baillie Gifford portfolio manager and the Wellington manager in the same room and have a conversation, they see the investing world from completely different lenses.

“They have completely different ways of thinking about how to beat the market, and most of the time the strategy that will work in 2022 will be either Baillie Gifford or Wellington.

“We can't say which one it's going to be. No one can. But when you combine the two, you won't get that bump of it being one or the other – you'll get the combined effect of the two of them together.”

One other key criteria Vanguard believes drives outperformance is the quality of the management firm.

“This is absolutely critical,” Surrey said. “Baillie Gifford and Wellington are both world-class asset managers, and you won't find anyone that disagrees with that.

“They're both privately held partnerships and that enables both firms to retain and attract staff. The attraction of being a partner of either of those firms is so strong, and the culture is so healthy.”

But Vanguard doesn't use every Baillie Gifford strategy, nor does it use every Wellington one.

This is where another criteria comes in – the quality of the people. Vanguard sees it as a separate driver of outperformance, even within the firms.

“When you are the world's largest buyer of active, you get access that no one else gets,” Surrey said.

“So we can ring a firm up, whether it's an existing partner like Baillie Gifford or a firm we’re thinking of investing in, and say: ‘We want to come and spend a few days with you.’

“We want to meet everyone in the team to understand the culture, not just the portfolio manager or an investment director. We want to meet the CEO, we want to meet the compliance team, the risk team and the analysts that just joined.

“The bar is extremely high to become a client of Vanguard’s if you're an active manager.”

Vanguard uses its size and scale to then bring together what it views as the top talent, providing access for a lower fee.

For example, Baillie Gifford’s Global Alpha Growth fund has ongoing charges of 0.59%, whereas Vanguard Global Equity has an ongoing charges figure of 0.48%.

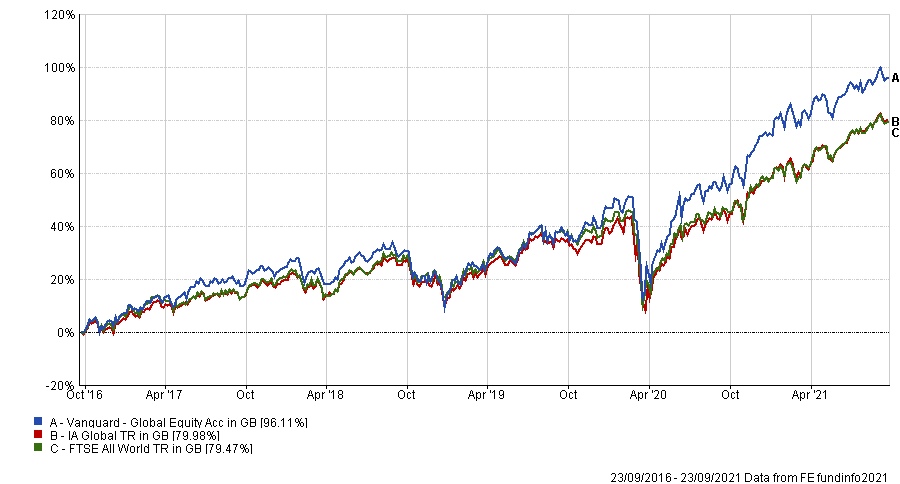

Vanguard Global Equity has managed to deliver first-quartile performance in the IA Global sector over the past five years. It has also managed to beat the FTSE All World index.

Performance of Vanguard Global Equity

Source: FE Analytics