Investors should use any further sell-offs in technology stocks as a buying opportunity, according to Walter Price, manager of the £1.4bn Allianz Technology Trust, who adds this is traditionally the best time of year to enter the sector.

The trust was running a 4% cash balance going into September and Price said he will be looking to deploy some of that money into discounted technology companies if he sees further falls.

“The fall [autumn] is a great time to buy tech stocks,” he said. “Seasonally, the third quarter is usually not very exciting because there are a lot of vacations and it's really hard for companies to exceed expectations.

“Then from a customer standpoint, they start thinking about what they're going to do the next year and so there's a little bit of a slowdown in decision making.”

He pointed to a drop in online spending as one example of this: “In the second quarter, people went back to stores and e-commerce slowed down, but e-commerce advertising was up 60%.

“E-commerce advertising was up strongly, but companies stopped getting the returns and the click-throughs. So they cut back their spending money in August.

“So as we think about the reporting season in September, we're going to hear about slowdowns in advertising.”

This is one reason why he has cut back his position in Alphabet, the parent company of Google, which has been a strong performer this year on the back of online advertising sales. However, it is still the trust’s largest position.

One area that Price is confident will continue to see strong growth going forwards is cybersecurity, where he has an overweight position in CrowdStrike – a company that sells cloud and endpoint security, threat intelligence, and cyberattack response services.

“The government has just started to focus on setting standards for cyber. We've had hundreds of companies that have shut down or had to pay ransomware,” Price said.

“Insurance companies are coming back and saying: ‘Look, if you want us to write you a policy on business-interruption insurance, you're going to have to change what you have installed to meet these government advisory standards.’

“So that's a great bet.”

When it comes to CrowdStrike in particular, Price said the lack of qualified cybersecurity workers is another tailwind – pointing out how there are only 1.5 million people employed in the cybersecurity industry in the US, compared with 3 million job openings.

He said: “CrowdStrike offers two versions of the product: you can buy the software, which goes on your mobile or PC, or you can buy a service that involves remediation and prevention if you're attacked.

“CrowdStrike says: ‘Okay, we'll sell you the product, or for five times as much, we’ll sell you the service.

“Amazon picked the service because it has 1,000 people doing cybersecurity, but really needs 2,000 people and it solves its problem and labour shortage.

“When it does the math, the cost of a cybersecurity person is $200,000 a year, and the cost of the service spread across a million employees means it is actually cheaper for it to buy than the product."

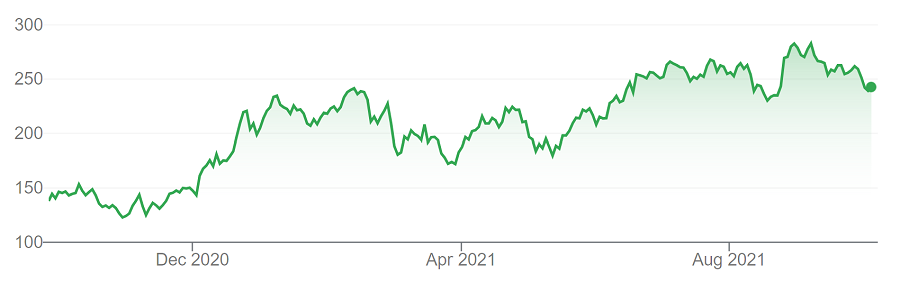

Crowdstrike Holdings share price performance over 1 year

Source: Google Finance

Looking ahead more generally, Price said the global economy will slow down next year.

There is also a fear of an increase in inflation and interest rates, but his view is that both will be “lower for longer”.

“Interest rates can't go up very much more without choking off the recovery,” he said. “Therefore, interest rates will rebound to a more normal level, but the normal level is not 3%, it is more like 2% or 2.25%.”

And despite the recent pullback in growth stocks following the rise in bond yields, Price said such an increase in rates will not be too damaging.

“I mean 7% GDP growth in 2021 – that is something we haven’t seen in a long time,” he added. “So 2022 is going to be a slower year.

“There's this adjustment process that takes place in September and October in tech stocks, but it's also a great buying opportunity, in my view.

“I feel very good about the outlook, even though interest rates are going to slow down the economy and the economy is going to be slower – I think people are going to realise that tech is a pretty good place to be in 2022.”

Performance of the trust over the past five years

-1.png)

Source: FE Analytics

Allianz Technology Trust trades at a 7.9% discount to net-asset-value (NAV) and has an OCF of 0.8%.