Investors are putting more cash into sustainable funds than ever before in 2021 but savers need to be vigilant against ‘greenwashing’.

So far this year responsible investment funds have taken in £9.5bn, taking more than a quarter of total fund sales year-to-date and on pace to smash through last year’s record high of £12.4bn.

At 5.4% of the overall market, the area remains niche, but with investors now thinking ethically, the pace of growth means investors can no longer afford to ignore it, according to Laith Khalaf, head of investment analysis at AJ Bell.

He said that environmental concerns have been a big catalyst for the increased fund flows into this “long-ignored sector” as well as a heavy dose of industry marketing.

“Right now, climate change is the sizzle that is selling the environmental, social and governance (ESG) investing sausage,” he added.

This flood of new investment has made sustainability a tantalising opportunity for fund houses, which have tried to cash in by rebranding non-sustainable products as part of this theme.

Khalaf said “perhaps that’s why almost all fund groups seem to be beefing up their sustainable investment credentials, even for funds which look to be stretching quite hard for the ESG tag.”

Investors entering this space should therefore exercise extra diligence to make sure they’re not caught out by ‘greenwashing’ – the term used for funds that appear ethical, but under the surface invest in some questionable businesses.

With this in mind, Trustnet asked market commentators for sustainable fund picks that have a clear ESG process.

Ninety One Global Environment

Ryan Lightfoot-Aminoff, senior ESG research analyst at FundCalibre, chose the Ninety One Global Environment fund. It takes a “unique approach” to sustainability, he said, investing in companies that contribute to global decarbonisation.

To reach the global temperature goals of limiting a global rise in temperature to two degrees, $2.4trn (£1.8trn) needs to be spent or reallocated to climate friendly projects, according to Ninety One Global’s research. This fund aims to invest in the companies that will benefit from this spending.

The companies they invest in must make at least 50% of their revenues from three sectors, renewable energy; efficient use of resources, or electrification.

Ninety One Global Environment is a relatively new fund, launching in 2019, but its managers, Deirdre Cooper and Graeme Baker have operated in this part of the market even before they became fund managers.

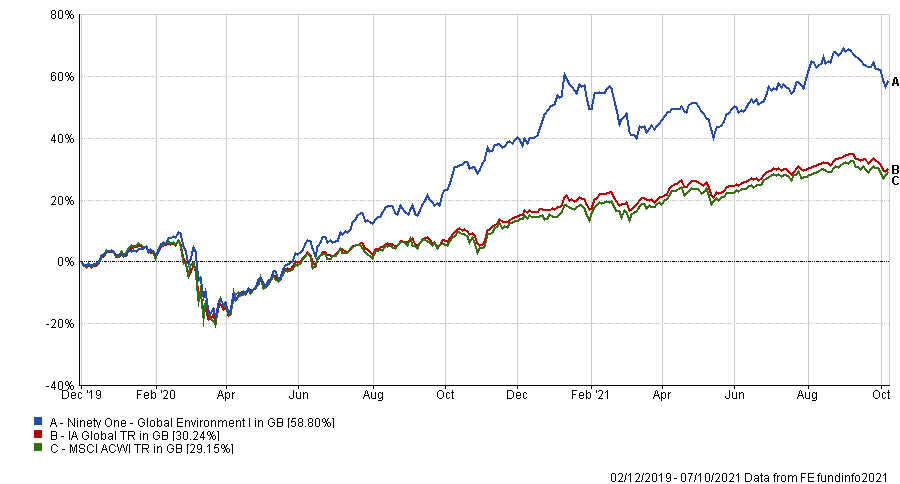

Since it launched the fund has outperformed the average IA Global fund, making 58.8%. 2020 was an especially strong year ending it as the nineteenth best performer in the sector.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

BMO Responsible Global Equity

FundCalibre’s last fund pick was BMO Responsible Global Equity, an even older fund, launched in 1987.

Originally it was a purely negatively screening fund and was the first to use this investment tool. This screen is still part of the process today, but the sustainable investment process is now more layered.

Now, it looks for opportunities within megatrends, such as ageing demographics, demands on healthcare systems, urbanisation and climate change. A final part is engagement, whereby the BMO team aim to work with the companies they invest in to improve its practices to being more ESG focused.

The latter is what “really sets this fund apart from its peers,” Lightfoot-Aminoff said.

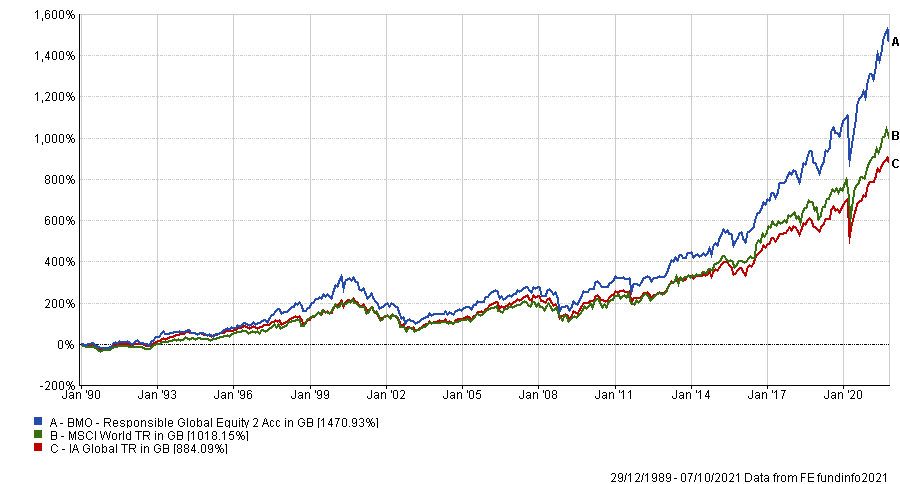

The four FE fundinfo Crown-rated fund has generated top-quartile returns over the past decade, twenty-sixth best out of almost 300 IA Global funds.

Since it launched it has made 1,470.9%, well ahead of the sector and MSCI World benchmark.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Baillie Gifford Positive Change

Next is Baillie Gifford Positive Change, chosen by both Tom Sparke, GDIM investment manager, and Patrick Thomas, head of ESG portfolio management at Canaccord Genuity Wealth Management.

Although a more recently launched fund Sparke said that the Baillie Gifford team have shown genuine commitment to “not only filtering out the ‘bad actors’ from an ESG perspective, but actively pursuing companies that have a positive net impact”.

The fund has piqued investors’ interests on two sides, appealing to those seeking out a growth bias – a style of investing Baillie Gifford has become well-known for – and garnering interest from sustainable investors.

For investors that want a close-ended option, Thomas also highlighted its sister investment trust Keystone Positive Change “due to its ability to access the unlisted space where many exciting opportunities lie.”

Over three years the Baillie Gifford Positive Change fund made the second-best returns in the IA Global sector of 131.9% Since it launched in 2017 it has made 286.2%.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Impax Environmental Markets

Last up is Impax Environmental Markets, a “brilliant compliment,” to the Baillie Gifford option, according to Thomas, which provides small-cap exposure by focusing on environmental technology and resource efficiency themes.

“Historically the investment trust has outperformed its open-ended stablemate and this would be a good choice for longer-term investors,” Thomas added.

One of three trusts in the IT Environmental sector Impax Environmental Markets has been the best performer across almost every time frame. Over 10 years it’s made a total return of 521.9%, almost double second place’s returns.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Managers Bruce Jenkyn-Jones and Jon Forster have run the fund since launch in 2002. The pair look to capitalise on the growth in markets and society for a more efficient delivery of basic services, namely energy, water and waste.

At £1.5bn the trust is running at a 3.2% premium with 1% gearing, a dividend yield of 0.47% and ongoing charges of 0.95%. It is the only fund in the sector on a premium.