There is little risk that the world is returning to the stagflationary conditions that blighted the 1970s despite the stronger-than-expected rise in inflation, strategists at BlackRock have argued.

Higher prices had been anticipated when the world opened from 2020’s Covid lockdowns as demand surged, but inflation is now stronger than originally expected because of the numerous supply bottlenecks around the globe.

In the US, for example, consumer prices inflation stands at 5.4% - a 13-year high – while the Bank of England expects it to hit 4% in the UK by the end of 2020, prompting governor Andrew Bailey to warn that the central bank might “have to act” to curb it.

Higher inflation has come at the same time as signs of muted economic growth, leading some to question whether the world is on the brink of a bout of ‘stagflation’. Characterised by weak growth and rising prices, stagflation hamstrung the global economy in the 1970s and is a difficult scenario for investors to navigate.

However, the latest note from the BlackRock Investment Institute said: “Prices have climbed around the world, with commodities prices surging and US inflation hitting a 13-year high. It’s the first time since the 1970s that a supply shock is the main culprit.

“This is where the comparison ends. There’s no risk of 1970s-style stagflation, in our view. Economic activity is increasing briskly and has room to run.”

BlackRock has “long held” the view that most investors have overlooked the risk of inflation. It warned that investors now have to accept that this is something they need to deal with for the foreseeable future as manufacturers struggle to meet demand, logistics blockages prevent goods from reaching the market and energy prices climb.

“These dynamics mark a sea change from the environment many of today’s investors know best: decades of low inflation on the back of deepening globalisation and technological advances,” the institute said.

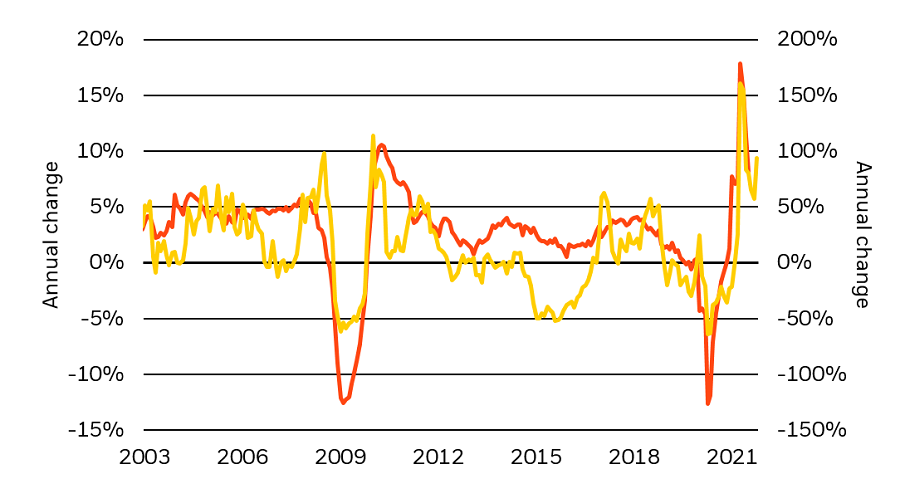

Global industrial production (IP) and Brent crude oil prices

Source: BlackRock Investment Institute, with data from BEA, Netherlands Bureau for Economic Policy Analysis, Energy Information Administration. Chart year-over-year growth in global industrial production (IP) on the left and Brent crude oil prices on the right

While many have been quick to draw comparisons with the 1970s – when an oil embargo by producers triggered a spike in oil prices – BlackRock was quick to downplay this risk.

“The growth situation today is in many ways the 1970s turned on its head,” it said. “Growth is increasing at a rapid clip, rather than stagnating, as the restart rolls on. The oil price surge is to be expected in this environment, in our view.”

One major difference with the 1970s is that the current spike in inflation is being drive by the global restart from the pandemic, rather than rising energy prices.

Another is that the global economy appears to have “room to run”, as it remains well below its long-run potential. Supply will eventually rise to meet demand, BlackRock’s strategists predicted, rather than demand falling to meet supply like in the 1970s.

A third difference with the 1970s is that higher levels of economic activity are lifting demand for oil and pushing its price higher. “Again, this is the exact opposite of the 1970s, when higher oil prices harmed economic activity,” the firm added.

That said, BlackRock believes the inflationary pressures created by the global re-opening will persist “well into 2022” – although they are likely to eventually resolve themselves.

“The risk is that markets and central banks misread the current shocks, leading to fast-rising inflation expectations or premature monetary tightening,” the BlackRock Investment Institute concluded.

“We believe central banks with credible inflation frameworks will largely look through the restart price pressures – and avoid a premature tightening that hurts growth but does nothing to address the bottlenecks. We expect this to play out differently around the world and could see central banks that worry about their handle on inflation expectations take a more hawkish approach than others.”