Do you prefer pop or classic rock? This is one question investors need to ask themselves when choosing which trust to invest in from the IT Royalties sector.

Hipgnosis Songs and Round Hill Music Royalty Fund are the only two trusts in the sector, both investing in songs, or rather, the associated intellectual property rights of music.

Although it is a niche asset class some managers have invested in it as a way to benefit from rising inflation.

“They won’t stop paying for their subscription, because if they do, they have no music,” he said.

Both trusts benefit from the convergence of two growing trends, one, the increasing adoption of technology and second, the widening demographics of people who stream songs.

This creates a potentially reliable stream of income, an attractive characteristic for investors.

Indeed James Carthew, head of investment companies at QuotedData, said that both of the trusts have been popular since their respective IPOs, with issues for both trusts becoming oversubscribed at launch, reflecting the popularity of this otherwise niche sector.

So which trust should investors hold?

Chris Salih, investment trust analyst at FundCalibre, said that although they are investing in the same asset, the trusts invest in different genres.

Hipgnosis Songs focuses on “newer songs”, he said, which are higher risk because you cannot know for sure which songs will become popular or whether they will be one hit wonders, petering out over the long-term.

The £1.5bn trust’s biggest allocation is pop music at 46.1%, with 8.3% in R&B, 5.5% in Dance and 4.2% in Hip Hop.

This perhaps reflects the music career of the trust’s founder, Merck Mercuriadis, who managed acts such as Beyoncé, Elton John, Mary J Blige and Guns N’ Roses to name a few.

The Round Hill portfolio on the other hand invests more in old, classic rock, which makes up 41% of its weighting. It has just 24% in pop and 13% in country music.

“Round Hill does have some newer songs as well, but the majority of the portfolio is from 1960 to 2000 with a bias towards to the 1960s,” Salih said.

“The revenues from these holdings are much more predictable and annuity-like.” This makes Round Hill the lower-risk option of the two.

For Salih his biggest concern “rightly or wrongly – is that because we believe Hipgnosis has a policy of wanting to grow aggressively, we wonder what price it is paying for its assets.”

Both trust’s invest in an artist acquiring the rights to their catalogues of music and the accompanying property rights.

Hipgnosis is invested across 138 catalogues, totalling over 64,000 songs already, investing in artists such as Shakira, Bon Jovi and Beyoncé.

In contrast Round Hill focuses on a smaller-sized catalogue, with around 100-1000 copyrights.

This aggressive push to acquire more asset combined with Hipgnosis' 3.2% premium meant that Round Hill got Salih’s vote. By comparison, the trust is on a 1.6% discount. Based on the discount and premium difference Carthew also picked the Round Hill portfolio.

It is worth noting that the Round Hill ordinary shares are on a discount but the C shares version of the trust is on a 3.6% premium.

Like Hipgnosis the Round Hill trust is run by a team of music industry veterans, who between them have worked at Atlantic Records, Sony/ATV, National Music Publishers Association and EMI Music Publishing, among others.

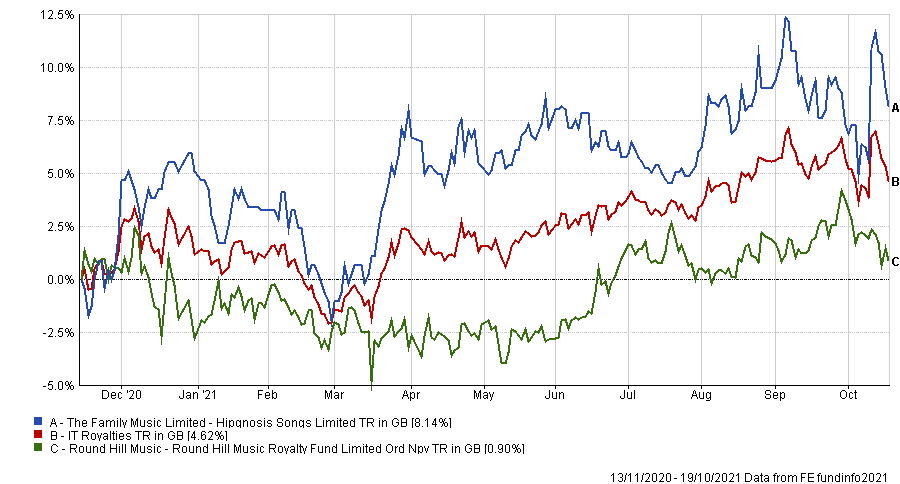

Since it launched in November last year the Round Hill trust has lagged Hipgnosis songs, making 0.9% versus 8.1%.

Trusts versus sector since Round Hill’s launch 13/11/2020

Source: FE Analytics

During 2021 so far however the rankings have reversed with Round Hill holding up the better of the two, making 3.8% versus Hipgnosis’ 2.9%.

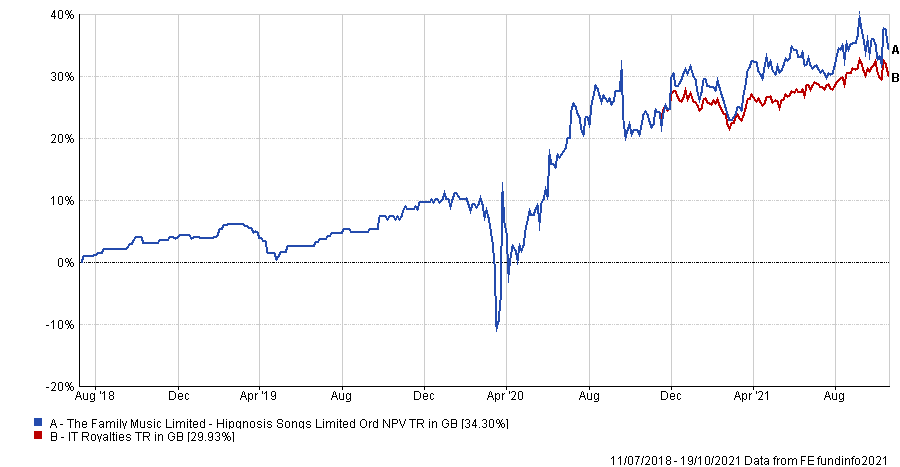

The Hipgnosis trust is the senior by two years, and since it launched has made 34.3%.

Hipgnosis Songs versus sector launch

Source: FE Analytics

Carthew pointed out that both trusts favour US dollar revenue – the region the most popular songs are in – which makes the sterling returns look more volatile than they really are.