A balanced portfolio has classically been a 60/40 split between equities and bonds, but with yields hovering around or below zero, investors need to become more creative with their allocations.

In the latest series in which we ask fund selectors to help investors build the ideal portfolio Trustnet has already looked at the cautious and aggressive approach. This time we tackle those in the middle wanting to generate somewhat higher returns but without sky high risk.

This is the type of portfolio most investors fall into according to Clive Hale, chief strategist Albemarle Street Partners, but many will have portfolios that are unfit for purpose.

He said that the 40% allocation to bonds is no longer appropriate, for example. In the past the bond allocation was a defensive way to counter the higher risk and generally higher returns equity portion. But at present they offer very little to a portfolio overall.

Hale said investors should consider alternatives, such as infrastructure, or different types of bonds to compensate.

But before choosing what assets to hold Hale said it was crucial investors understand the full market and economic picture they are investing in, balanced or otherwise.

For example, are markets favouring growth or value or how much is inflation likely to have an impact?

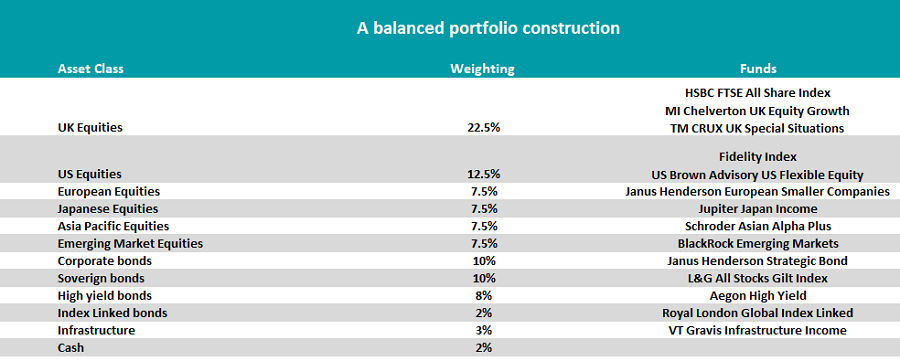

In his model portfolio, Hale adjusted the classic equity-bond split going 65% in equities, 30% in various types of bonds, 3% in infrastructure and 2% in cash. Within each section he highlighted one or more funds investors could hold.

UK Equities

Within equities Hale split the allocation across various regions, the largest in the UK (22.5%), then in descending order, US, Europe, Japan, Asia Pacific and emerging markets.

For the UK portion Hale highlighted a growth and a value fund: MI Chelverton UK Equity Growth and TM Crux UK Special Situations, as well as a passive option, HSBC FTSE All Share Index.

The former is the best performer in the IA UK All Companies sector over five years and has been among the top 10 across all, shorter time frames. Performance this year, when it held up during the recent value rotation, has been particularly impressive.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Hale said the managers James Baker and Edward Booth have a very clear and simplistic strategy, which allows it to be agile in changing markets.

The £1.8bn fund holds an FE fundinfo Crown Rating of five.

Hale advised not to be so wedded to one particular style of investment in a balanced fund, and highlighted the TM Crux UK Special Situations value fund to round out his growth choice.

Although run with a multi-cap approach the fund pays special attention to small-caps, focusing on areas that are undervalued and have growth opportunities.

Manager Richard Penny has run the fund since launch in 2018. During that time it has been in the top quartile of its IA UK All Companies sector, making 63.7%.

Performance of fund vs sector and index since launch

Source: FE Analytics

European Equites

European equites make up 7.5% of Hale’s portfolio allocation, equal to Japan, Asia Pacific and Emerging Market equities.

The Janus Henderson European Smaller Companies fund would be an ideal pick from here, he said. A blended portfolio split of 50% in growth and 50% in value results in “more of a core investment philosophy than that of the market”.

Managers Ollie Beckett and Rory Stokes break their potential stocks into four buckets, ranging from high growth to extreme value stocks, so called: Rockets, Quality Growth, Mature Companies and Turnaround Situations.

The £483.2m fund is another high performer in its sector, making the third best returns over 10 years and the best overall over five, though its performance has slipped near term to fourth quartile.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Bonds

Moving away from equities and into Hale’s bond allocation, high-yield bonds were one of four types he included, the others were corporate, sovereign and index linked.

Still using them a diversifier to equities, Hale cast his net wide across different types to find the best of a currently less-desirable asset class.

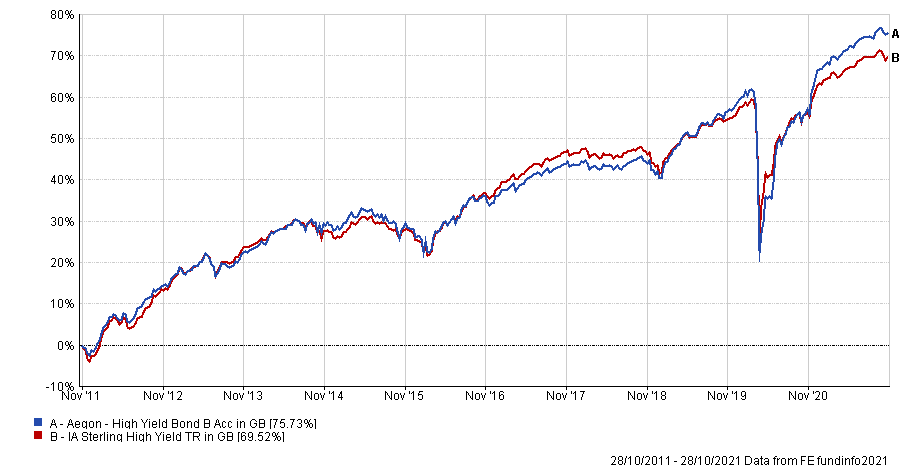

For high yield bonds he chose the Aegon High Yield Bond fund, citing its ability to hold “more challenged positions that have an opportunity for higher yields”.

The managers Mark Benbow and Thomas Hanson work with a distressed debt team who help identify where the opportunities are.

Over five years it made the fourth best overall returns in the sector over five years (30.2%) and the best over three years, up 21.2%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Infrastructure

Infrastructure was an asset Hale chose as an alternative for those unhappy with the bond yields on offer.

Like bonds, infrastructure also has little correlation to the stock market, fulfilling the role as an equities diversifier. But it has more defensive qualities due to its monopolising pricing power.

The VT Gravis UK Infrastructure Income would be an ideal pick here, providing exposure to the “growing infrastructure sector within the UK”.

Hale said it invests in real assets in highly regulated areas, or that are used by government subsidiaries, creating a dependable cash flow giving it “low volatility characteristic”.

Performance of fund vs sector and index since launch

Source: FE Analytics

Launched in 2016 it has middling returns since then, making 33.5% over five years, just under the IA Infrastructure sector returns. The £809.8m fund has a five crown rating.

|

Fund |

OCF |

|

MI Chelverton UK Equity Growth |

0.87% |

|

TM Crux UK Special Situations |

0.83% |

|

Aegon High Yield Bond |

0.6% |

|

Janus Henderson European Smaller Companies |

0.87% |

|

VT Gravis UK Infrastructure Income |

0.76% |