Growth has been the dominant investment style in recent years as historically low interest rates and new rounds of quantitative easing have supported growth companies. But MI Chelverton’s James Baker thinks that the style could struggle next year.

Baker’s £1bn MI Chelverton UK Equity Growth fund was one of the best performing funds in the IA UK All Companies sector last year, outperforming the peer group with a total return of 15.93 per cent.

Indeed, heading into 2020 with “quite a lot of cash” was a major benefit when the market went into an “indiscriminate freefall” mid-March, said Baker.

He said the managers realised some companies wouldn’t be as negatively affected by the pandemic, especially tech names as people adapted to working from home and carrying out business online, healthcare and assets which were “less corelated to the economy”.

“So, we were upping our exposure in technology,” Baker said. “And last year technology was our second main contributor in [performance] so that worked out quite well.”

But coming into 2021, it looks like interest in more cyclical assets of the UK market is returning, according to Baker, a shift which won’t benefit growth strategies.

“I’d say towards the end of [last] year and talking about how we are positioned going forwards, I think what we [were] probably seeing with the announcements [of] a vaccine and a Brexit trade deal a return to interest in more economically cyclical assets,” the manager said.

“So, as a growth fund I think we’re going to find it a little bit harder to outperform the market as we did last year.

“I’m not saying we’re going to underperform, but the outperformance may be more difficult to come by in the short term, as it’s [a] more cyclical assets rally.”

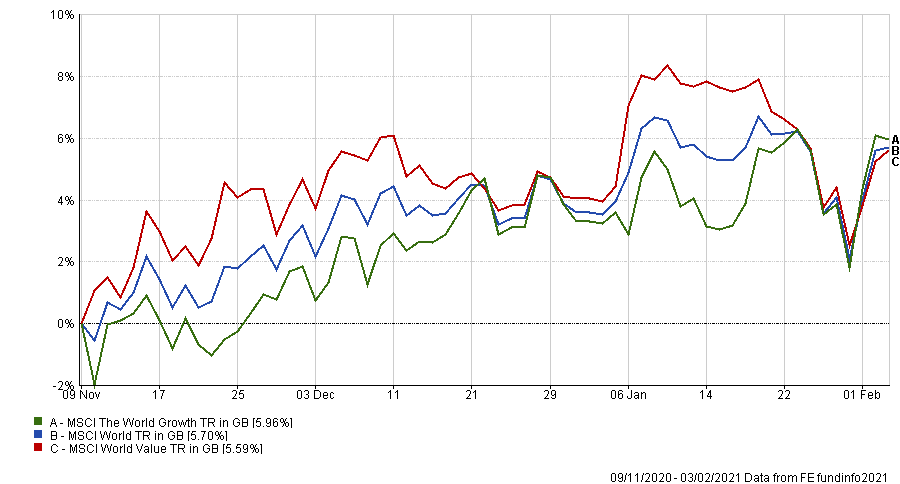

Following the announcement of the first Covid-19 vaccine, value stocks saw a significant rally, one of the first in a long time for the style.

Performance of indices since Pfizer vaccine announced (9/11/2020)

Source: FE Analytics

Further vaccine approvals brought much more positive news and, for the first time in months, there was an indication of a return to pre-Covid life. And this further boosted value stocks.

As market leadership shifted, Baker positioned his MI Chelverton UK Equity Growth fund to make sure it wasn’t left being by any cyclical rally.

One of the things he did was to reduce the fund’s tech exposure down from 20 per cent to 16 per cent during the past three to four months.

“We have scaled down our tech exposure because these stocks became the ‘go to’ place for fund managers and investors,” he said. “And some of these stocks have been getting very expensive in our mind.”

He said there had also been some changes to the fund’s healthcare portfolio, although this was restricted to names in the portfolio rather than any change in allocation, focusing instead on companies which may have struggled during the pandemic, but should continue performing once it is over.

“We’ve been turning to some of the companies that have done poorly through Covid-19 because their businesses are more dependent on elective surgery,” he explained.

“A company that we’ve liked for years called Advanced Medical Solutions,” Baker said, which makes wound dressings, focusing on post-op care products.

“We’ve never owned it because it’s always been so expensive, but this period has given us an opportunity to get a holding in Advance Medical Solutions at what we think is a more attractive valuation.

Another area where Baker hasn’t decreased exposure was construction, somewhere he’s been adding to since 2019.

“Our feeling was that in any kind of recovery the government has a number of levers to pull. Obviously, the fiscal spend is a big lever for governments pull, so we wanted to have exposure to companies which would help them kind of help in that infrastructure spend,” he said.

He has been focusing on building material companies rather than actual house builders because “house builders tend to be a bit asset intensive”. Some examples were the Breedon Group and SigmaRoc, both construction materials companies.

Nevertheless, while he has been adding to his cyclical exposure and might own more value names than some of his peers, Baker said the fund remains a growth strategy.

“Cyclicals are rallying at the moment [and] we’ll capture some of that because we’ve titled the portfolio a bit, but we still are very much a growth fund,” he said. “It’s buying stocks that can consistently generate top-line growth, which are at the right side of structural change in the long term.

“That is going to be how we generate the bulk of our performance, but there’s going to be a little bit of a cyclical catch up [and] I think we’ll capture some of that.

“And hopefully, some of these growth stocks sell off at some point, [and] then we’ll be buying them back quite aggressively. And that will set us up very well for the future.”

Looking ahead and Baker said while he does expect some short-term downgrades as the UK adapts to post-Brexit life and continues through the pandemic, investors will start to feel more confident as life begins returning to normal later this year.

“The FTSE equity market is a forward-looking animal [and] I don’t think we’ll be too disrupted by any short-term bad news that we see in the first half,” he finished. “I think that people will see that as a buying opportunity.”

Baker manages the five FE fundinfo Crown-rated MI Chelverton UK Equity Growth fund alongside Edward Booth.

Performance of fund vs sector over 5yrs

Source: FE Analytics

Over the past five years, it has made a total return of 152.92 per cent, outperforming the IA UK All Companies sector (38.74 per cent). It has an ongoing charges figure (OCF) of 0.87 per cent.