High-risk investors should put all of their money in the stock market, ideally with a strong weighting to value companies, according to Kelly Prior, investment manager in the multi-manager people team at BMO Global Asset Management.

In the latest series in which we ask fund selectors to help investors build portfolios, here we tackle those with a penchant for risk. Trustnet previously looked at the ideal portfolio construction for cautious investors, which featured a blend of asset classes.

Although the wild ride of the past 18 months may have put some off investing, for others, it has been a chance to make good gains. Indeed, since the start of 2020, investors would have been better off riding the stock market wobbles, or could have made even bigger profits by buying during the March lows.

In 2021, the main call to get right has been to invest in value companies – those that are cheap but that can rebound. As vaccines have given a path out of the pandemic, stocks in sectors such as travel, leisure and retail have blossomed.

Prior said after years in the doldrums the value recovery has helped investors that were willing to take the chance on this style of investing and encouraged them to keep with it.

“An aggressive portfolio is one that nails its sail to the mast and is unwavering in its commitment to a process and way of investing and although market levels are at heady hights, this masks an opportunity set that has sat latent, awaiting a change of economic scenarios to bloom – value,” she said.

Prior noted there is a whole generation of investors that have never experienced inflation and rising interest rates, a reality they could soon face.

She said: “The winds of change are blowing and it may be time to ride the resulting wave. Bonds offer little in this scenario, with no need for ‘insurance’ even the binary nature of returns, particularly at the moment.”

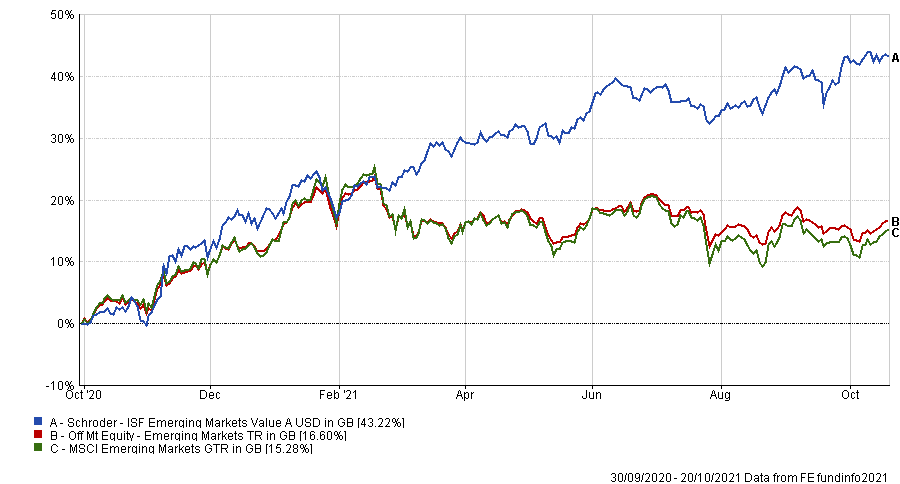

For her model aggressive portfolio Prior suggested four equity funds, all with a value bias. The largest position was to the RWC UK Equity Income at 30%.

RWC UK Equity Income

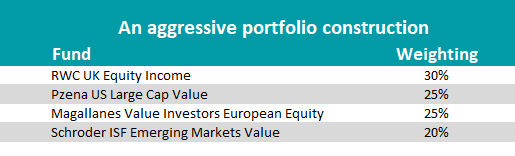

The UK stock market is synonymous with value investing, as it is made up of banks, miners and oil giants. The RWC UK Equity Income fund is a relatively new addition, Prior said, having launched in 2018.

Although a newer fund it, runs a replica of the investment mandate used by managers Ian Lance and Nick Purves for more than a decade, which is rooted in value investing.

The pair also run the Temple Bar investment trust, taking over from Alastair Mundy earlier this year.

“Regular rotation between sectors ensures the team avoid investment traps often associated with traditional deep-value investing,” Prior said.

Some of its biggest stocks include Royal Mail, NatWest Group, BP, Marks & Spencer and Royal Dutch Shell, giants of the UK equity space.

Over one year the fund has been the 12th best performer in the IA UK Equity Income sector, making 47.1%, reflecting the value rally. Since launch it has made 11%, just behind the FTSE All Share but still ahead of the sector average.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Pzena US Large Cap Value

Next is Pzena US Large Cap Value, an Irish-domiciled fund run by its namesake Richard S Pzena, Benjamin Silver and John Flynn.

Pzena, the manager, is “synonymous with value investing,” Prior said, whose previous business, Bernstein, was financed by “famous value hedge fund manager Joel Greenblatt”.

“The team are looking for good business’ with temporary problems and an eye on the long-term prize. Patience is arguably their biggest fund management tool,” Prior said.

US large-caps are a somewhat ironic part of the market to hunt out value options, having become home the of some of the world’s biggest growth companies the past decade.

Names the fund holds include sensor developers Halliburton, automotive electrical and interiors firm Lear Corporation and financial services company Wells Fargo.

Since it launched in 2012 it has beaten the average fund in its sector but has lagged the Russell 1000 Value index. Prior gave the $14.3m (£10.5m) fund a 25% weighting of the overall portfolio.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Magallanes Value Investors European Equity

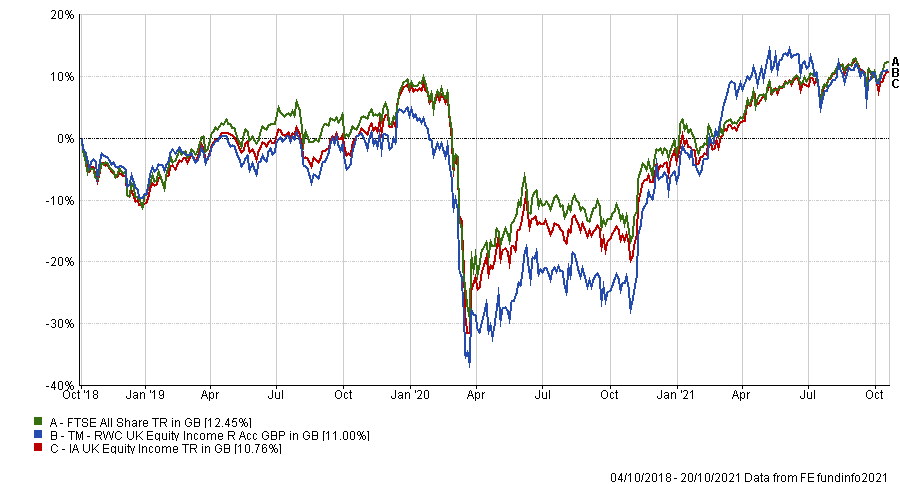

Next is the Magallanes Value Investors European Equity fund, which Prior also gave a 25% weighting to in the portfolio.

Regarding the investment process she said that 95% of the team is deployed in stock research “with an owner investor mentality looking for high quality and low leverage.”

This has created a concentrated portfolio of 30 names, mainly invested in industrials and the Netherlands. The majority of the fund is in mega-cap stocks, over £5bn in market cap, a 66.2% allocation.

From when it launched in 2016 it has returned 86.5%, outperforming the MSCI Europe index and Off Mt Equity – Europe ex UK sector.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Schroder ISF Emerging Markets Value

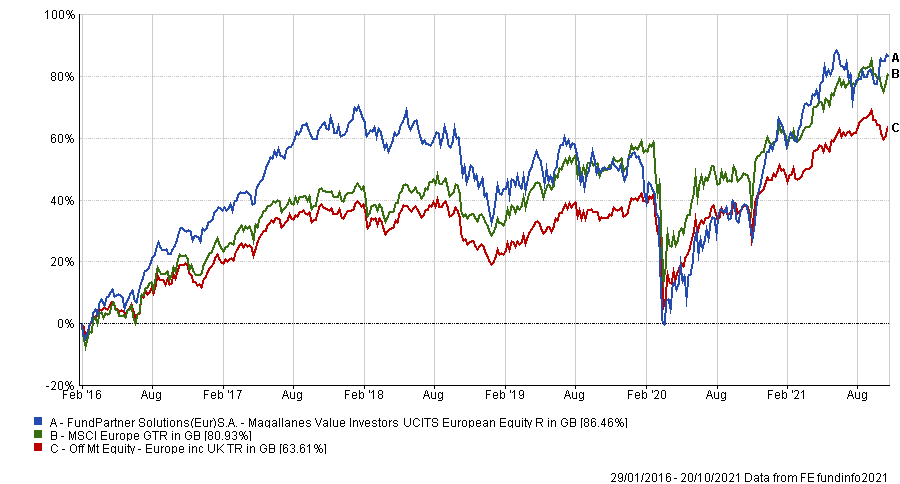

Last up is Schroder ISF Emerging Markets Value, which Prior assigned a 20% weighting. As a fund house Schroders Asset Management have been long-term investors in value.

Prior said: “They have been banging the drum on the global opportunity in mis-priced securities for some time, so it was a natural progression for them to launch a bespoke Emerging Markets (EM) product as part of this.”

Emerging markets are usually seen as one of the risker regions for investment as the fate of the sector is largely determined by China which dominates the MSCI Emerging Market index, accounting for almost 44%.

Prior said that unlike most emerging market funds, which invest in a number of names, the $45.7m fund invests in a “lean” 40 stocks.

Run by Juan Torres and Vera German, it has held up well since it launched just over a year ago, performing 8th best out of 529 funds in the IA Global Emerging Markets sector over the past 12 months.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

|

Fund |

OCF |

|

RWC UK Equity Income |

0.8% |

|

Pzena US Large Cap Value |

0.6% |

|

Magallanes Value Investors European Equity |

1.97% |

|

Schroder ISF Emerging Markets Value |

1.86% |