Fundsmith Equity has bought into online retailer Amazon for the first time, FE fundinfo Alpha Manager Terry Smith revealed in its latest monthly factsheet.

He has also sold out of InterContinental Hotels Group, the UK-listed hotel chain. After a sharp 45% fall last March shares have recovered 86.9% since and are back to their pre-pandemic level of £51.48 per share. Over 12 months the shares have made 30.9%.

Conversely, Amazon’s shares were fairly resilient during the pandemic but have been stagnant in 2021. Last year they rose 73.7% as the pandemic forced people indoors, placing a greater reliance on online retailers such as Amazon to buy items online.

This year has been more muted however, as the firm has been hit by global supply chain issues, as well as the resurgence of unloved pandemic losers, such as retailers, oil stocks and travel and leisure firms, which have drawn investors’ attention away from the big tech names.

Overall, Amazon’s share price is up just 5.8% year-to-date. This compares with a 23.7% rise for the Nasdaq 100 and a 23.6% gain for the S&P 500.

Smith has bought into the company after an inauspicious set of quarterly results for Amazon. Last week the company revealed revenues topped $110bn (£80.4bn) in the most recent quarter, a rise of 15%, but failed to meet market expectations. Operating profits were 21% down compared with the previous year at $4.9bn.

Higher costs associated with the Christmas period and supply chain disruption also meant that in the short-term the company could come under pressure, experts warned.

It was the first quarterly earnings update for new chief executive Andy Jassy, with analysts mixed on the performance, but the overall message from commentators was that the firm had enough cash piled up in reserve to deal with issues and it was willing to spend to grow where opportunities arose.

This has been a key part of Smith’s process for more than a decade – buying companies that are fast-growing but are also high-quality, resilient to shocks and that are good value compared with their peers.

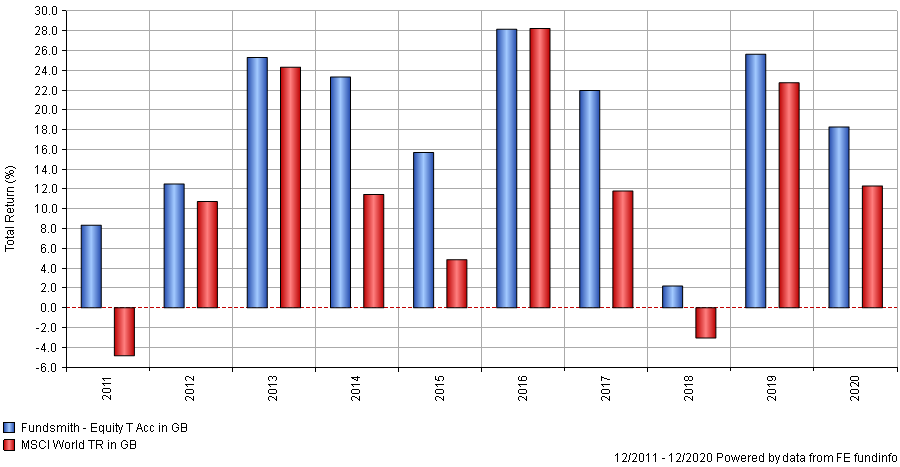

The fund manager has an enviable track record using this approach, beating the MSCI World index in nine out of the past 10 years. The only exception was in 2016, when the fund was just 0.08 percentage points behind the index.

Total return of fund vs MSCI World index each year for 10yrs

Source: FE Analytics

This year the fund has some catching up to do. It has made investors 15.4% in 2021 so far, 3.1 percentage points below the index.

Earlier this year, the manager pointed out that investors could have made good gains from investing in “value” names – cheap, unloved stocks – which have done well this year.

“In such a situation our fund is always likely to underperform for a period, after all the companies we invest in mostly have little or nothing to recover from,” he said.

However, if returns were evaluated from the start of the pandemic – including both the market falls last year and the recovery in 2021 – his fund has outperformed significantly.

“There are several lessons to be learnt from this, not the least of which is that no amount of recovery or low valuation will turn a poor business into a good one and quality is the main determinant of long-term performance,” he said.