Investors fretting about how much further inflation can climb need to step back and look at the bigger picture, as the question they should be asking is, why isn’t it twice its current level?

This is according to Yannis Gidopoulos, investment analyst at Montanaro Asset Management.

The consumer prices index (CPI) rose by 2.9% in the 12 months to 20 October, according to the Office for National Statistics, and the Bank of England said this could hit 4% by the end of the year. In the US, it is 5.4%.

Meanwhile, inflation-linked bonds are implying RPI could rise to 7% in 2022. Mark Benbow of the Aegon High Yield Bond fund warned that if this came to fruition, “it will disrupt markets, households and students, who are painfully charged student loan interest on an RPI +3% basis, meaning they will be paying interest of 10%”.

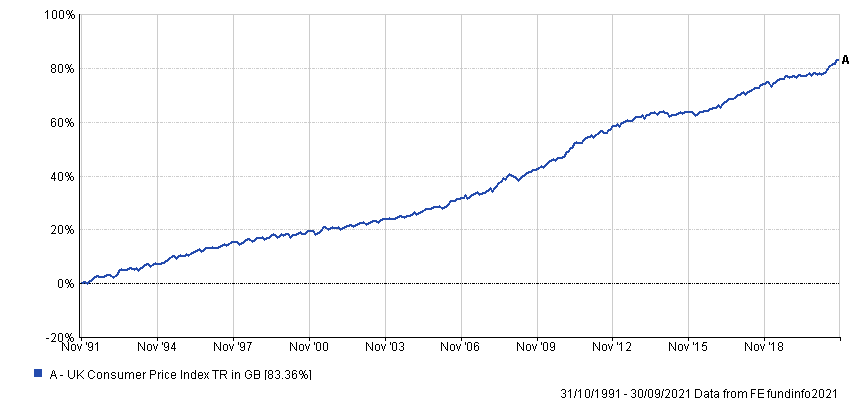

Yet Gidopoulos described this year’s increase in inflation as nothing more than a blip on its long-term downward trajectory, adding that what has interested him most about recent figures is that they aren’t higher.

Performance of index over 30yrs

Source: FE Analytics

“Those banging the inflation drum might want to consider that we are exiting the greatest overnight global supply-shock in economic history, with the most acute burst of short-term demand in the past 100 years (the savings rate got to nearly 35% last year – the highest ever), and overlayed with huge supply-chain bottlenecks,” he said.

“Surely in any other circumstances, this is a perfect storm for the most record-breaking inflation on record?”

Gidopoulos pointed out the last comparable global supply-shock followed by a demand-flush was the end of the Second World War, when inflation reached 10%.

Had the Covid crisis hit at around that time, the analyst said it would have been entirely likely that inflation would have reached a similar level when the economy re-opened.

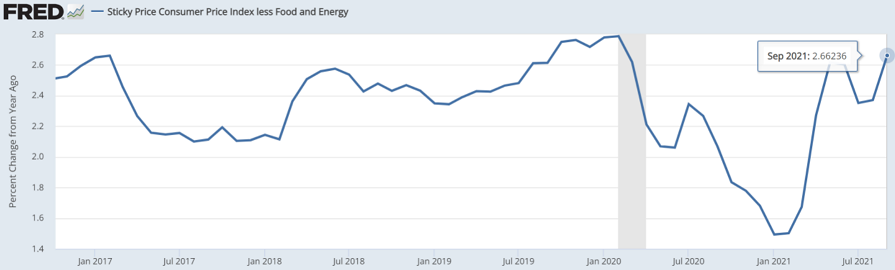

However, he pointed out that in the US, CPI minus food and energy is not even back at its pre-pandemic level. And he said the reason why this trend looks more benign than what the headlines suggest is fairly obvious.

Performance of index over 5yrs

Source: Federal Reserve Economic Data/Montanaro

“After the savings rate peaked last year, consumers went on spending binges that disproportionately went on goods over services,” he continued.

“Why? Because services were closed in lockdown. So durable and non-durable goods were the only things for people to spend on, and thanks to the maturity of the e-commerce ecosystem, they could.”

With the economy open once again, consumers are spending more of their money on services rather than goods. Gidopoulos said the issue now is that many goods-producing companies panicked as they attempted to keep on top of unprecedented demand, and extrapolated this trend into the future. This has led to overordering, “adding fuel to the fire of the chip shortage and other input-material shortages”, even though demand for goods is likely to move down to more normal levels over the next six to 12 months.

“If this happens, many companies will be left holding a glut of inventory, and it is entirely reasonable to imagine prices being cut to move some of this stock,” the analyst continued. “Somewhat contrary to the narrative, therefore, we can see cyclical deflationary pressure percolating through the economy next year.”

A major input into inflation is the price of oil, which is up 250% (in dollar terms) since the lows in April of last year when stockpiles threatened to overwhelm storage facilities.

Performance of index (in $) since 2020 low

Source: FE Analytics

Aside from the supply/demand imbalance, the spike in the price of the commodity has also been blamed on a lack of investment in infrastructure, due to a trend among asset managers to either divest from fossil fuel companies or to push them into focusing on more sustainable forms of energy.

Some fund managers, such as RWC’s Ian Lance and Nick Purves, claim this will continue to constrain supply, maintaining higher prices and creating enormous opportunities for investors willing to go against the crowd and buy into oil & gas stocks.

Yet Gidopoulos pointed out there is a major flaw in such a plan, which is that, just like inflation, oil is incontrovertibly on a downward trajectory.

“Oil’s importance in the global economy is declining so fast that even as we are seeing synchronised global economic growth, with every country coming out of a global supply shock at roughly the same time, global oil demand is still below its 2019 peak of more than 100m barrels a day,” he noted.

“If in 2021 – in spite of lockdown exits globally – we still can’t get to more than 100m barrels a day – you can see that this becomes another stranded asset in a few years. If the world coming out of lockdown couldn’t get the oil price to record highs, what can?”

Another sign of oil’s declining importance can be seen in the struggles faced by traditional car manufacturers.

While this has been partly blamed on a chip shortage, Gidopoulos pointed out this has not stopped Tesla, which – valuation arguments aside – is going from strength to strength.

Instead, he blamed it on a growing long-term structural headwind for the industry – the shift to electric vehicles – suggesting that fewer people will buy combustion engine cars in the future. He noted that this was another indicator that the oil price had peaked.

This is not to say that oil prices won’t surge in the short to medium term, with Gidopoulos adding that volatility should be expected in a “dying asset class” where capex is waning.

“But in the long term, expect the price of oil to be deflationary. The long-term prices of renewables will also be deflationary – prices of anything are set by supply and demand, and the tautological raison d’être of renewables is to have limitless supply,” he finished.