Baillie Gifford, Allianz and Marlborough were the fund groups that produced top-returning UK equity funds with low-costs, according to data from FE Analytics.

A half of a percentage point difference between the cost of two funds may not seem like a significant amount to pay for double-digit returning active funds, but over the long-run it can make a big difference to total returns.

This explains why some investors opt for passive strategies with the lowest ongoing charges, which over time, can compound to large savings.

But for those who prefer active funds, there have been a handful of active strategies that offer top-ranked returns at a low cost relative to their peers.

In a continuation of Trustnet’s series looking at the best low-cost funds across the Investment Association’s sectors, we looked at the UK equity sectors to find out which funds over the past five years have delivered top-quartile returns and top-ranked low ongoing charges figures (OCFs). Previously we looked at the cheapest global funds.

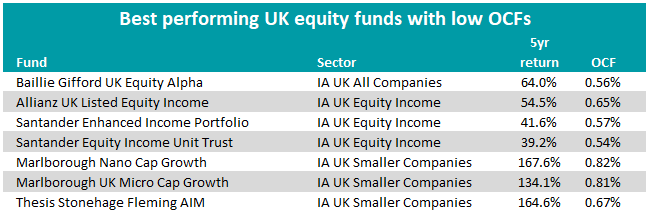

Of the 692 funds with a five-year track record across the IA UK All Companies sector, UK Equity Income sector and UK Smaller Companies sector – only seven achieved the best returns and lowest costs relative to their peer group.

Please note that the OCF figures were based off the main driver share class in FE Analytics and charges may vary depending on the share class available.

Out of the 258 funds in the IA UK All Companies sector, only one fund has delivered returns at the top of their peer group and at the lowest cost: the Baillie Gifford UK Equity Alpha fund. It had a five-year return of 64% and an OCF of 0.56%.

Managed by Gerard Callahan and Milena Mileva, this fund invests in UK-listed companies that can grow their profits and cashflows faster than the market average.

It follows Baillie Gifford’s long-run, benchmark agnostic approach to investing and holds in its top-10 both large- and mid-cap stocks.

When it comes to the IA UK Equity Income sector, there were only three funds out of 87 that managed to deliver both top-ranked returns and low costs.

One was the Allianz UK Listed Equity Income fund, which had a five-year return of 54.5% and an OCF of 0.65%.

Run by Simon Gergel – who also runs the Merchants Trust – alongside Richard Knight, the managers look for high dividend paying stocks in the UK.

Some of its biggest holdings include well-known FTSE 100 giants such as Imperial Brands, British American Tobacco and Royal Dutch Shell.

The Santander Enhanced Income Portfolio and the Santander Equity Income Unit Trust were the two other low-cost, top performers in the IA UK Equity Income sector.

Both are managed by Robert McElvanney, who focuses on quality, momentum and value stocks in the UK with attractive dividend prospects.

The funds typically have a bias towards medium-sized companies, although they still have top-10 holdings in several FTSE 100 firms such as Unilever, Rio Tinto and Legal & General.

Turning to the IA UK Smaller Companies universe, out of 50 funds, only three strategies stood out with top-ranked returns and low costs.

Marlborough had two funds that achieved the rare feat: Marlborough Nano Cap Growth and Marlborough UK Micro Cap Growth.

Both managed by Guy Feld and Eustace Santa Barbara, they both invest with the premise that smaller companies will outperform their larger counterparts over the long term.

Indeed the five year returns of 167% and 137% respectively far outpace the return of most large-cap UK equity funds.

The Micro Cap Growth fund invests in UK-listed small-caps that are less than £250m in market capitalisation with strong growth potential, while the Nano Cap Growth fund invests in UK-listed small-caps that are less than £100m at the time of investment.

The final fund that featured in the table was the Thesis Stonehage Fleming AIM fund, which returned 164.6% and had an OCF of 0.67% over the past five years.

Previously known as the TM Cavendish AIM fund, this fund is run by Paul Mumford and Nick Burchett, who invest mainly in stocks listed on the UK Alternative Investment Market (‘AIM’).

Like many other small-cap focused funds, it has benefited from increased M&A activity in the UK market, where private equity buyers have been making above-market bids for UK-listed small-cap stocks.