Quality growth stocks have taken a back seat this year as the post-pandemic value recovery has captured the imagination of investors.

One trust to have suffered from this rotation is Finsbury Growth & Income, run by FE fundinfo Alpha Manager Nick Train, which has slipped from a premium rating to a share price discount.

Known for his buy-and-hold approach, Train invests in companies with competitive advantages that can withstand disruption and will continue to be market leaders for decades. While this has been a winning long-term strategy, more recently investors have started to cool on the portfolio.

Shares in the £1.9bn trust now sit on a 5% discount to its net asset value (NAV), the widest level for 18 months. Apart from a temporary Covid-related discount in March last year, the shares have not been this out of favour since the financial crisis.

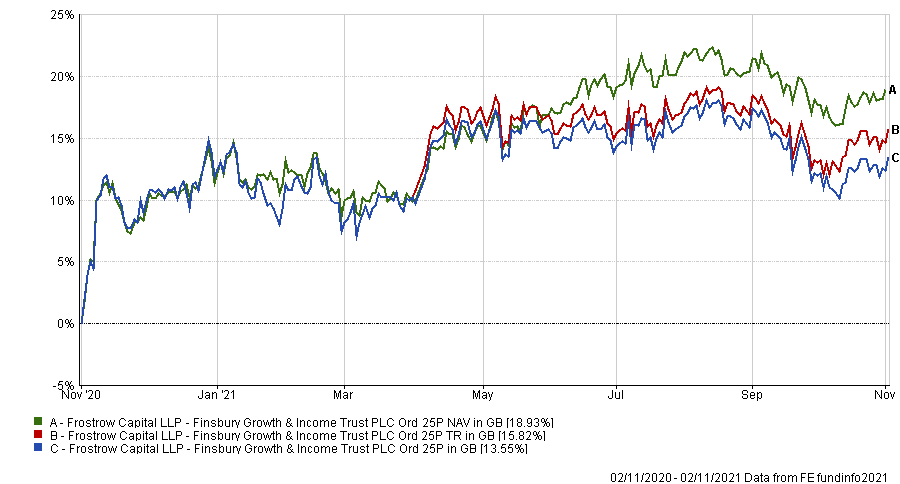

Yet the underlying performance of the trust has been positive. Over the past year it has made investors a total return of 15.8%, yet the NAV has risen 18.9% while the share price has only gained 13.6%.

Performance of the trust on a total return, NAV and share price basis over 1yr

Source: FE Analytics

Mick Gilligan, head of managed portfolio services at Killik & Co, said: “The derating in the shares may be justified by concerns of a rotation away from quality growth stocks towards out-of-favour value stocks.”

However, he said that anyone with a long-term view who is willing to add the trust to their portfolio should be buoyed by the ongoing support from the board to buy back stock around current levels, helping to ensure the discount does not drift much wider than 5%.

So far this year the board of the investment trust has bought back £4.4m worth of shares.

Chris Salih, investment trust analyst at FundCalibre, said investors should consider buying the trust if they have no exposure to it, while those that already own it should hold tight.

“If you like Nick Train and his style of investing – picking a handful of quality companies and keeping hold of them for the very long term as their growth compounds – then now is the time to buy,” he said.

“If you already hold the trust, then I wouldn't worry too much about the discount. With a concentrated portfolio, there is always the chance of underperformance if a couple of stocks struggle for a period, as has been the case recently. But if you've invested for the long term in this trust, the impact should be brief.”

Analysts at Winterflood Securities agreed. In a report from earlier this week, the team, headed by Simon Elliott, announced it was to be included in its list of recommended trusts.

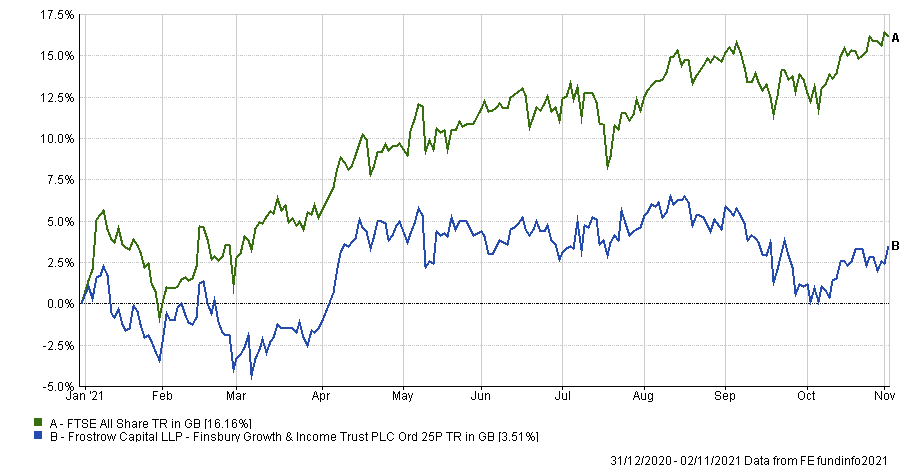

This is despite the tricky year it is having so far: the portfolio has made just 3.5% in 2021, while the FTSE All Share is up 16.2%.

Performance of trust vs FTSE All Share in 2021

Source: FE Analytics

Again, however, much of this has been due to the weakened share price. On a NAV basis, the trust is up 6.9%. Assuming the trust cannot make up this lost ground in the final two months of 2021, it will be only the fifth calendar year out of 21 that it has failed to beat the FTSE All Share.

“We continue to regard Nick Train’s unchanged investment approach highly, with his emphasis on quality growth compounders. Given that the fund has traded at a small premium to NAV for the vast majority of the last 10 years, we see the current discount level as an attractive value opportunity,” Elliott said.