Analysts downplaying the threat of inflation should reacquaint themselves with one of the key lessons of the 1970s: this is a “psychological phenomenon”, and the psychology hasn't taken hold yet.

This is according to , manager of the VT De Lisle America fund.

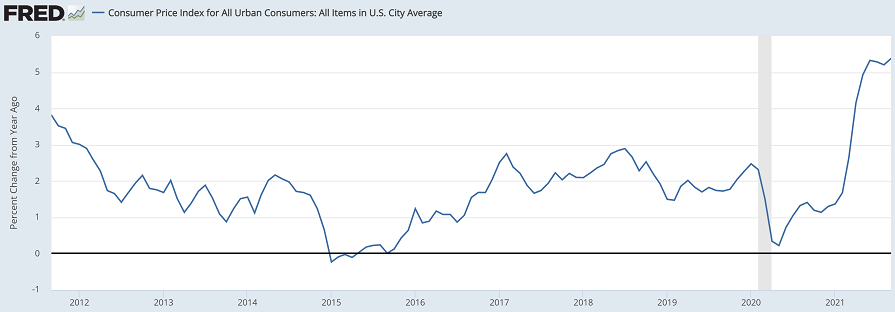

In a recent article on Trustnet, Montanaro investment analyst Yannis Gidopoulos said the real inflation headline should be: why isn’t it twice its current level? He pointed out that 5% (in the US) was not excessive, considering the perfect storm of broken supply chains and the glut of savings that has just been unleashed on the economy.

Performance of index over 10yrs

Source: Federal Reserve Economic Data/Montanaro

With this in mind, he said the recent uptick in inflation is nothing more than a blip on its long-term downward trajectory.

However, de Lisle warned that if the 1970s were anything to go by, a change in mindset among consumers will soon provide another leg-up.

“It was only last year that Boris offered the nurses a 1% pay rise and seemed to get away with it,” he said.

“You couldn't do that now. We can see the psychology and people's expectations starting to change, and that’s when it becomes embedded. Once that really takes hold, you have more of a demand pull, more of a labour issue, and people getting intransigently unwilling to take the 1%.”

The key word that has been used by the Federal Reserve to sum up the post-coronavirus rise in inflation is “transient”, which de Lisle said was originally taken at face value by the market.

However, the manager has noticed a growing realisation of what he referred to as “rolling inflation”, whereby any shortage of one commodity has a knock-on effect upon others, causing prices to spike across the board. He said the best example was the price of aluminium.

“China tried to toe the line and restrict coal mining, but aluminium – which is made by a smelting process using coke – suddenly went through the roof as the price of coal went up,” he continued.

“China said, ‘well, we can't be having that, we need the aluminium’ and started to reopen the coal fields and became an international pariah.

“It's an example of how one thing leads to another: the coal gets substituted for another energy source and the next thing you know, you've got a natural gas price rise, then that gets substituted for oil and you've got an oil price rise.”

De Lisle said that while the proliferation of renewable energy is expected to be a deflationary force in the long term, a rushed changeover is pushing up prices in the short term. He is predicting a resurgence in nuclear power to bridge the gap, pointing out France – which already derives 70% of its energy from nuclear sources – recently announced a €2bn (£1.7bn) initiative to design a new generation of small modular reactors.

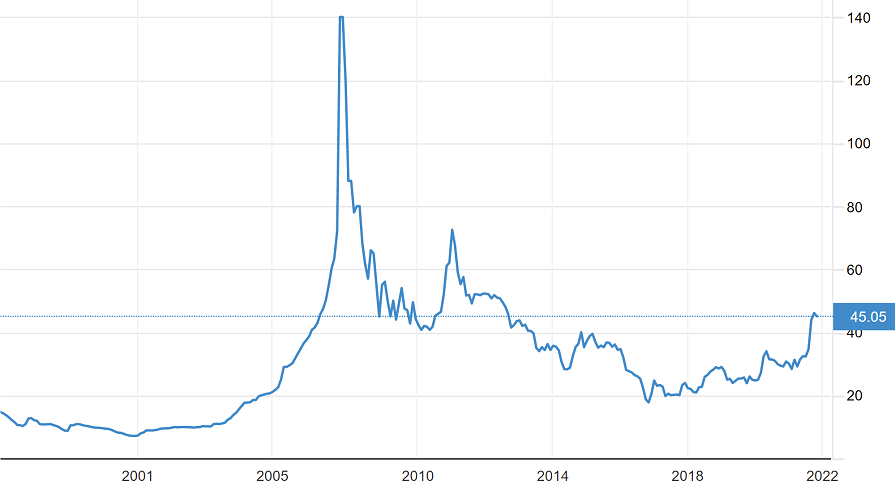

The manager is playing this theme through exposure to uranium miner Cameco.

“Nuclear utilities are contracted in to buy uranium and once you’ve got the enormous sunk cost of building your reactor, the price of uranium is absolutely marginal, so you’ll pay whatever it takes.

“Uranium has been in the doghouse for 10 years since Fukushima. [German chancellor] Angela Merkel didn't like it because of the problem of disposal, but the world is coming around to the idea that that's nothing compared with the energy problem.”

Performance of index over 25yrs

Source: Trading Economics

He added that a key turning point for the commodity was an announcement from US president Joe Biden that he was considering subsidising the nuclear industry.

“Now he doesn't have to do that,” de Lisle said. “All he said was that he wasn’t opposed. But that was taken as a stamp of approval from someone with green credentials, and that comment sent our shares up.”

Another commodity play in de Lisle’s portfolio is CF Industries. Shares rocketed when it entered a contract with the government to maintain carbon dioxide production after high natural gas prices previously caused it to shut down two of its UK sites. He also has exposure to commodity intermediaries such as scrap metal recycler Schnitzer Steel.

“Anything we can find where we think that the margins are protected so they can pass the parcel down the road when that price increase comes in,” he said.

One obvious problem with commodities is that while they offer the chance to make huge amounts of money in the boom times, you need to know when to sell out before prices crash.

Yet de Lisle said the Federal Reserve is providing major clues as to the direction of travel – and it is currently implying the boom times are here to stay.

“It all depends on how sure you are that the Fed is being honest,” he continued. “It keeps on using this word transient, but it wants to demonetise the debt: it's all rather wonderful if inflation's 5.4% and the yield on the 10-year bond is 1.5%, as it is demonetising at a rate of 4% a year.

“It’ll be very happy with that as long as it can get away with it, but it's at the point at which people say, ‘it’s not transient, it is just saying that’, that's when inflation begins to get more embedded.”

Data from FE Analytics shows VT De Lisle America has made 472.1% since launch in August 2010, compared with 467.5% from the S&P 500 and 388% from the IA North America sector.

Performance of fund vs sector and index since launch

Source: FE Analytics

The £91m fund has ongoing charges of 1.1%.