Fund pickers were mixed on whether to back fallen giant MI Somerset Emerging Markets Dividend Growth which has seen a positive change in its performance after years of disappointment.

The MI Somerset Emerging Markets Dividend Growth fund was previously run by Edward Lam and Edward Robertson – the latter is still managing the fund now – from its launch in 2010. Initially the fund enjoyed several years of outperformance as the investment process steered it away from certain countries, such as China and growth areas like technology.

At the time it was hailed as a ‘rising star’ in the emerging market space, recommended by fund pickers for its wide regional diversification benefits and praised for its on valuation-driven, income approach.

But as markets changed – China dominated the emerging markets while technology stocks took the lead globally – this style bias caused the fund to underperform, which investors punished it heavily for by withdrawing their money.

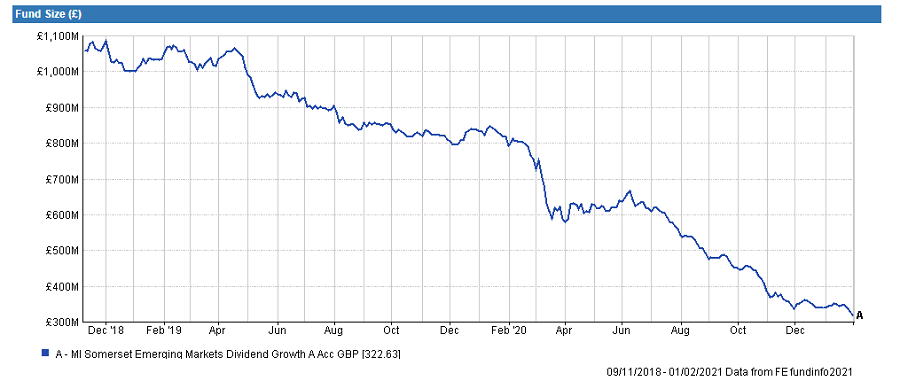

Looking at the historical breakdown of the fund, three years ago it held £1.1bn in assets under management. After all of the selling, today has just over £300m left.

Source: FE Analytics

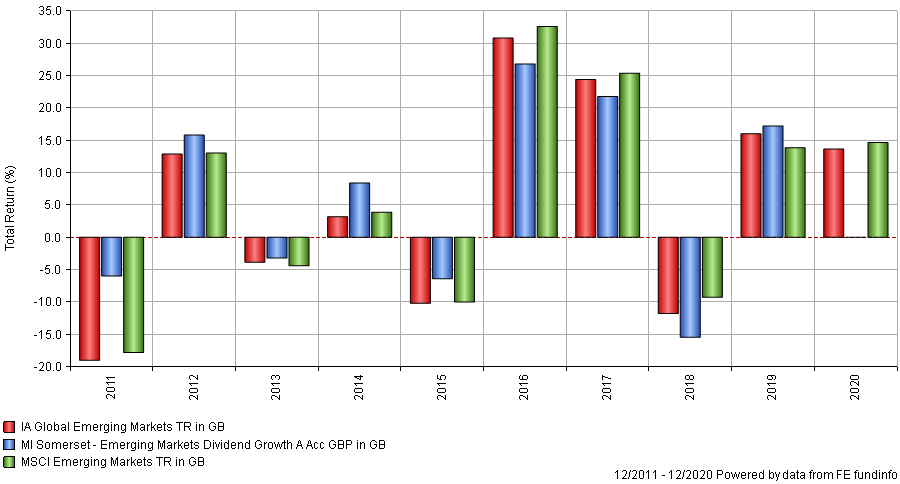

Much of this has been due to the poor recent performance. Over 10 years the fund sat in the third quartile, returning 87%, but over five years it was the 95th worst fund in the sector, out of 110 peers.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

This year things have changed. Near-term performance has shifted positively as new managers Mark Williams and Kumar Pandit steadied the ship.

The pair took charge a year ago, taking over from Lam, and since then the fund’s performance has pivoted. It has been the fifth-best overall in the sector over one year.

Performance of fund vs sector and benchmark over 1yr

Source: FE Analytics

The turnaround in performance cannot be put down to just the new managers though. Adrian Lowcock, independent market commentator, said some of this performance was “fortunate timing”, as the team took over in November 2020, just as the vaccines arrived and the value rally began.

This benefited the fund’s exposure to more cyclical sectors like financials, consumer products and industrials, which all recovered strongly.

Lowcock was bullish on the new fund and managers however, noting that the new team’s focus on fundamental stock selection rather than just low valuations was a key difference.

“An increased emphasis on the portfolio construction and reducing risk had initially good results,” he said, making the fund a buy candidate.

But not everyone was so optimistic. Sam Buckingham, investment analyst at Kingswood Group, said he remained cautious about investing into any fund where the managers had only been in charge for a short period of time.

Williams does have prior managerial experience, having run the MI Somerset Asia Income fund since launch in 2012 but Pandit has no prior managerial experience.

Buckingham said that the MI Somerset Emerging Markets Dividend Growth fund is still likely to undergo some transition as the new managers settle in and make it their own.

Indeed some changes are already apparent with the managers increasing exposure to both China and the growthier sectors, such as tech, since taking over. Those historical underweights that have played a big part in the fund’s performance may not even be a long-term characteristic of the fund anymore.

The analyst pointed out that a lot of the recent outperformance could be attributed to this historical underweight the fund has had in China, a region which has struggled the past 12 months due to increased regulation on its tech stocks and slowed growth coming out of the Covid pandemic.

“I am not sure it is fair to give the new managers all the credit,” Buckingham said.

Ryan Hughes, head of active portfolios at AJ Bell expressed similar hesitation, echoing that the recent change in performance could be down to the pivot from growth to value in markets more than the new managers themselves.

“As ever this shows just why it’s so important to understand the style biases of fund managers,” he said. The fund is currently not on AJ Bell’s Buy List.