Several of the biggest names in emerging and Asian markets are charging investors more than double the stated ongoing charges figure (OCF) because of their added costs, research by Trustnet has found.

OCF is the top-line cost of investing in a fund, used to refer to the fees investors pay for the management of a fund, but not including any charges related to buying and selling stocks.

Changes to the portfolio are inevitable, hence unavoidable transaction costs otherwise known as ‘ex-ante’ charges are incurred, but some funds have additional charges equivalent or higher than the stated OCF, costing investors twice as much as advertised.

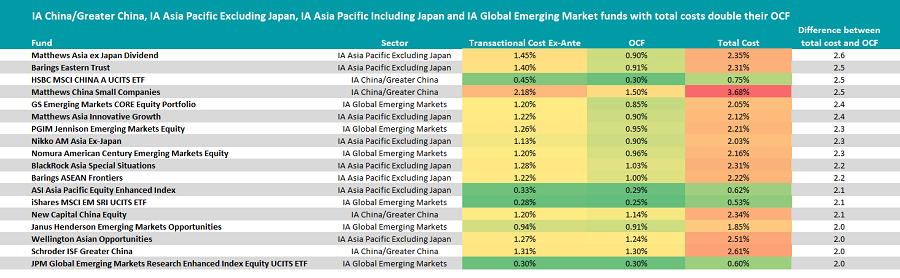

Trustnet looked at which funds in the IA China/Greater China, IA Asia Pacific Excluding Japan, IA Asia Pacific Including Japan and IA Global Emerging Markets sectors met this criteria.

The results for the sectors are shown below, which shows the transaction costs, original OCF and the total cost, as well as how many times more an investor paid overall versus the stated fees.

It is also conditionally formatted against the sector. The colours represent how expensive a fund’s cost is relative to the entire sector as higher transaction costs do not necessarily mean that a fund is expensive.

Those in green are the cheapest among their peers, while red indicates the most expensive. Orange and yellow represent the middle portion, with the former above average, while the latter is below average.

Source: FE Analytics

Emerging and Asian markets have had a busy year, recovering from the Covid pandemic and facing several macroeconomic headwinds from China’s falling valuations, caused by tough regulations on its tech sector and the ‘Evergrande Saga’.

Markets are also reacting to rising inflation and interest rates, meaning a lot of funds shifted positions. But this has not driven the ex-ante costs as high as some UK and global funds, which had funds charging more than six times the stated OCF.

This time the study found 21 funds across the four sectors met this criteria, although none were in the IA Asia Pacific Including Japan sector.

Matthews Asia ex Japan Dividend fund had the biggest difference between the stated OCF and total charges across the sectors. Its published OCF is 0.9% but its ex-ante costs were 1.45%, making the total cost 2.35%, 2.6 times higher than the OCF.

The five FE fundinfo Crown-rated fund is run by FE fundinfo Alpha Manager Yu Zhang and is one of the best performers in the IA Asia Pacific Excluding Japan sector, making the third-highest returns in the past five years (98.2%).

Square Mile Investment Consulting and Research Limited were positive on the fund, calling it a “strong option” for UK investors looking for Asian income.

Another five crown fund on the list was Barings Eastern Trust which had an OCF of 0.91% but ex-ante cost of 1.4%, pushing the total cost up to 2.31%.

The fund has generated significant outperformance long-term, making almost 240% over 10 years, the second-best returns in the sector during that time. This could make the higher cost more palatable for some investors.

These returns were generated via a bottom-up, multi-cap approach, investing in growth companies with a decent amount of liquidity.

Another big name from the sector was Wellington Asian Opportunities which had overall charges of 2.51%, double its stated OCF.

Like the other funds it has been a strong performer long-term but near term has lagged due to its growth bias, which has struggled during the recovery this year.

IA Global Emerging Markets had the most funds in the study with eight on the list. GS Emerging Markets CORE Equity Portfolio had the biggest increase between OCF and total cost in this sector, jumping 2.4 times.

PGIM Jennison Emerging Markets Equity was only just behind with total charges 2.3 times greater than the OCF.

Another five-crown fund, it owns companies that are in the early stages of accelerated growth, catalysed by a new technology or product or leadership in a niche market.

So far this has worked well for the fund, which has delivered the third-best returns over three years (128.7%). It has maintained at least a top-25% ranking in all time frames since then.

Moving onto IA China/Greater China, five funds were flagged including the sector’s best performer this year: AQR China A Equity UCITS.

The fund has made 15.3% during that time, but it was an outperformance which cost investors double the stated OCF (0.6%). It is actively managed but aims to beat the benchmark by tilting towards value and momentum.

Two funds in this sector had total charges 2.5 times bigger than their respective OCFs: HSBC MSCI China ETF and Matthews China Small Companies.

The latter had a 1.5% OCF and additional charges of 2.18% while the former was 0.3% and 0.45% respectively.

Although these funds have the same relative increase their total costs are different as one is actively managed while the other is an index tracker.

Exchange-traded fund (ETF) investors end up paying 0.75% for the HSBC MSCI China ETF while active fans paid 3.68% for Matthews China Small Companies.

Passive funds’ totals are usually ‘cheap’ relative to their active rivals but they are also unable to avoid trading and incurring higher additional costs. The other IA China/Greater China funds on the list were New Capital China Equity and Schroder ISF Greater.