Some 27 UK funds have transaction costs that more than doubled the stated ongoing charges figure (OCF), research by Trustnet has found.

The OCF is the catch-all term used to define the fees that investors pay for a fund, but one area not included in this number is the charge levied for making changes to a portfolio – the transaction costs.

Investors should expect to pay something for this, as it is almost impossible for a fund to make no changes, but some may be surprised about how much extra they are paying.

As such, Trustnet looked at which funds had additional transaction costs, known as ‘ex-ante’ charges, equivalent or higher than the stated OCF – therefore at least doubling the total cost of the fund.

Having previously looked at the same phenomenon in the IA Global sector, this week we studied the three major UK equity sectors: IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies.

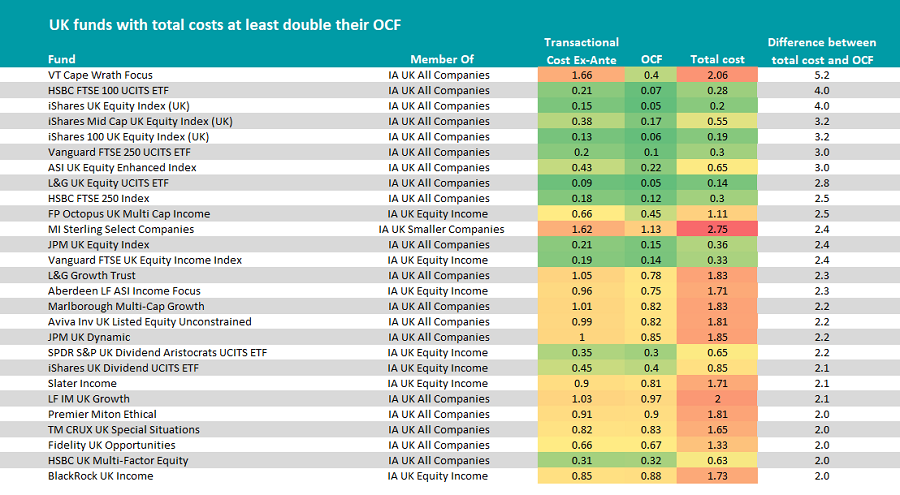

The results for the UK sectors are shown below, which shows the transaction costs, original OCF and the total cost, as well as how many times more an investor is paying overall versus the stated fees.

It is also conditionally formatted against the sector. The colours represent how expensive a fund’s cost is relative to the entire sector. Those in green are the cheapest among their peers, while red indicates the most expensive. Orange and yellow represent the middle portion, with the former above average, while the latter is below average.

Please note that the OCF figures were based off the main driver share class in FE Analytics and charges may vary depending on the share class available.

VT Cape Wrath Focus had the biggest difference between the stated OCF and total charges across the three sectors. Its published OCF is 0.4% but its ex-ante costs were 1.66%, making the total cost 2.06%, more than five times higher than the OCF.

The small £7.7m fund is a member of the IA UK All Companies sector and has been one of the best performers in the past 12 months, making the second-highest returns of 73%.

This outperformance was largely fuelled by the fund’s value bias, which has been in favour this year. It also has 55.6% invested in UK small-caps, the most profitable area of the market to have been invested in long-term, another recent Trustnet study found.

It was not the most expensive fund in the study, however, as MI Sterling Select Companies topped the list. It had a total cost of 2.75%, four times higher than the stated 1.13% OCF due to hidden fees of 1.62%. It was the only IA UK Smaller Companies fund in the study.

The portfolio was previously known as MI Discretionary and was Sterling Investments’ flagship fund, but underwent a rebrand in June last year, which involved removing the fund’s entry fee and dual pricing structure.

The fund has consistently ranked in the bottom quartile over five years, 41st out of 45 funds during that time, returning 50.6%. Over the past year, since the rebrand has taken place, it has been the worst performing fund in the entire sector.

There were several well-known names on the list, including the FE fundinfo Five Crown rated Marlborough Multi-Cap Growth fund.

Run by FE fundinfo Alpha Manager, Richard Hallett, the fund’s OCF was 0.82% but ex-ante charges of 1.01% more than doubled the total cost, pushing it up to 1.83%.

Although invested across the all-cap spectrum Hallett is a self-proclaimed fan of the mid-cap space, preferring to stay away from the more cyclically biased large-cap space.

This bias has hurt the fund’s performance in the near term as cyclical stocks have rallied during the Covid recovery, resulting in a bottom quartile 29.2% return for the fund over one year.

However, the fund’s long-term performance has been strong, suggesting the higher costs have paid off. It is the 13th-best fund in the IA UK All Companies sector over 10 years, generating 245% returns.

Two well-known IA UK Equity Income funds also made the list: FP Octopus UK Multi Cap Income and Slater Income.

FP Octopus UK Multi Cap Income did not have a particularly high overall cost at 1.11%, but this was 2.5 times higher than the stated OCF of 0.45% thanks to a 0.66% ex-ante charge.

Slater Income had a reasonably high total cost of 1.71%, with an OCF of 0.81% and transaction charges of 0.9% respectively.

However, it has been one of the best performers in the IA UK Equity Income sector – ninth best over 10 years – returning 143.1%. It has also maintained a top-quartile sector ranking over shorter periods.

Premier Miton Ethical and Fidelity UK Opportunities both hold a four Crown rating and have been high-returning funds over the long term, the former producing the ninth best returns in the IA UK All Companies sector over 10 years (263.4%) while the latter has made top-quartile returns over five years (50.8%). Both have also struggled during the recent value rally, at their growth style has waned.

Their overall costs respectively were 1.81% and 1.33%, exactly two times higher and their stated OCFs of 0.9% and 0.67%.

There were also more passive funds in the UK study than in the previous global article. In total 11 index trackers made the list, as these funds are unable to avoid trading when markets move. However, the funds’ total cost were still ‘cheap’ relative to their active rivals.

The most expensive passive was the iShares UK Dividend UCITS ETF. Its total costs were 2.1 times higher than the stated 0.4% OCF when transaction fees were added.

Other passives with relatively high total charges relative to the stated OCF were HSBC FTSE 100 UCITS ETF, iShares UK Equity Index (UK), iShares Mid Cap UK Equity Index (UK), iShares 100 UK Equity Index (UK), Vanguard FTSE 250 UCITS ETF, L&G UK Equity UCITS ETF, HSBC FTSE 250 Index, JPM UK Equity Index, Vanguard FTSE UK Equity Income Index and SSGA SPDR S&P UK Dividend Aristocrats UCITS ETF.