Japan has been one of the most marmite markets over the past two years, topping the charts in 2020 only to fall back this year.

The Nikkei 225 index of Japan’s largest companies made an impressive 17.5% return last year, beating the wider global MSCI World index and the US’s S&P 500 index. But this year it has fallen 1.4% at a time when the US market has made 30.7% and global stocks are up 24.5%.

After such a dismal year, investors may believe they can pick up some cheap bargains, but reviewing the IT Japan and IT Japanese Smaller Companies sectors, there are few that are on bigger discounts than usual. However, there are also few that are extremely expensive either.

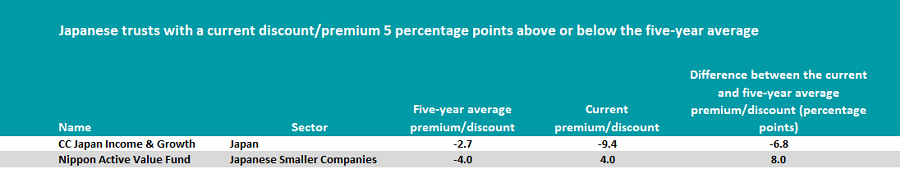

In this series, Trustnet looks at which investment trusts had diverged at least 5 percentage points off their five-year average premium/discount. Where a trust did not have a five-year track record, the data was from its launch date.

A share price premium or discount can be a big point of focus for investors. When people sell out of a trust in large waves this can cause the share price to drop, even if the underlying holdings keep their value, creating a share price discount. If this is coupled with those underlying stocks falling, those remaining in the trust can end up with two sets of losses.

This also works the other way: if more people buy the trust’s shares, they could be more expensive than the total value of the underlying holdings, placing the investment company on a premium.

Having looked at the UK and Global sectors, where there were several trusts that deviated from their long-term average, when Trustnet looked at the North America sector there were relatively few cheap or expensive trusts.

Japanese trusts are in the latter camp with their North American peers. Data provided by QuotedData revealed just two trusts met the criteria: CC Japan Income & Growth and Nippon Active Value.

Japanese stocks have learned the lessons of the past, when a deep recession in the 90s caused a stock market collapse that took more than two decades to recover from. Regulation has forced companies to shore up their balance sheets, keeping more cash behind for shocks such as the pandemic last year.

However, the market has struggled this year, although it has been much less volatile than other areas. Indeed, over the past 12 months, the IT Japan and IT Japanese Smaller Companies ranked low on volatility.

This may explain why just two trusts out of the IT Japan and IT Japanese Smaller Companies sectors combined were on a much wider premium/discount today than they have been historically.

The CC Japan Income & Growth (CCJI) trust is a member of the IT Japan sector and is currently on a 9.4% discount, which is 6.8 percentage points wider than it was historically (2.7%).

It is the only equity income strategy in the sector and its manager, Richard Aston, strikes a balance between holding quality growth names and creating an attractive level of income. This means the trust tends to hold more cyclical stocks than growth companies, which has hurt the trusts’ performance long-term when value was out of favour with the market.

As a result it has made the second-worst returns over five years (44.5%). But in the past 12 months, when value has dominated markets the trust’s returns have rallied and it performed second-best overall, up 8.5%.

Kepler analysts were positive on the trust despite the poor track record. They said that although Aston’s valuation and high-yield sensitive approach has prevented him from capitalising on the technology and e-commerce rally that followed the initial outbreak of the pandemic “we believe his current portfolio may be well positioned to benefit from the post-pandemic recovery”.

They added that for investors looking to invest in Japanese large-caps without compromising on yield “they may find this to be the only effective option, given its unique status as the sole equity income strategy in the sector”.

This means the trust could offer “compelling diversification” from their other income streams.

The other trust identified was the Nippon Active Value trust, a member of the IT Japanese Smaller Companies sector. It is currently on a 4% premium, a jump of 8 percentage points from its historic 4% discount.

The trust was only launched in early 2020, meaning it does not have a full five-year track record and the historic average was generated from the data since it launched.

Since then though it has performed well making the sector’s best returns – 32.4% over one year. A lot of this could be down to the trust’s value style, which has often led markets since the Covid vaccines were announced in late 2020.

When the trust initially launched it failed to meet its £200m targeting, hitting £103m. Today the trust size is £153.7m.