The global economic cycle has already entered its mature phase, suggesting it may be time for investors to think about taking risk off the table, according to Johanna Kyrklund, global head of multi-asset investment at Schroders.

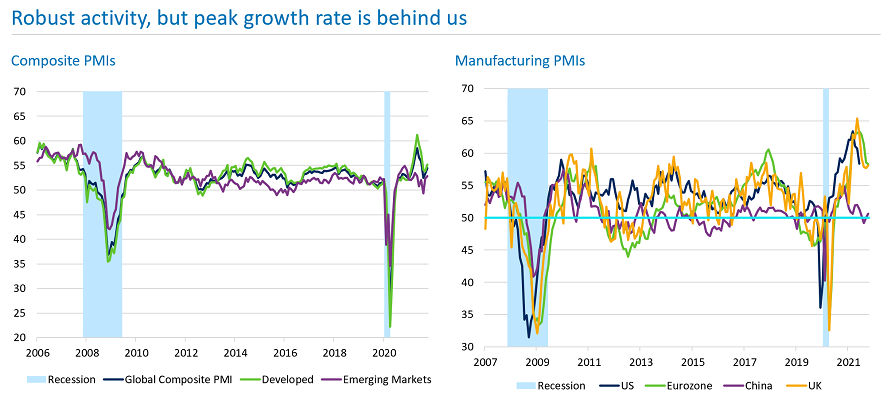

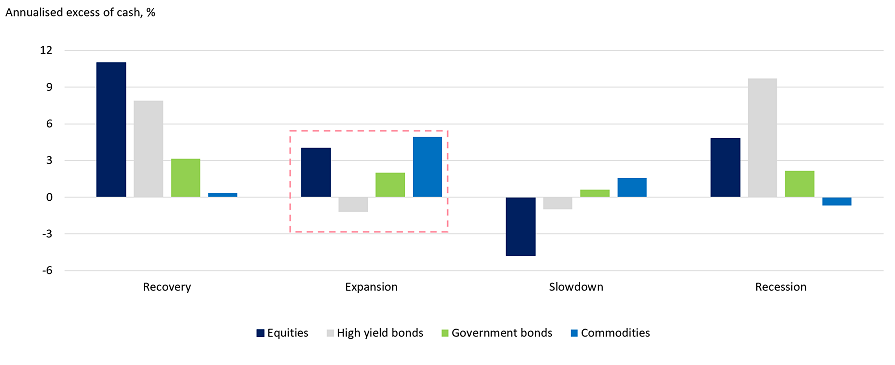

There are four stages to the economic cycle – recovery, expansion, slowdown and recession. Although it has been less than two years since the coronavirus crash of March 2020 marked the end of the previous cycle, Kyrklund said that numerous short-term indicators suggested growth momentum was peaking.

Source: Schroders

“Basically, we're seeing a maturing of the cycle,” she said. “This expansion phase is typically characterised by potential concerns about inflation and also a peaking of liquidity.

“In some senses, while the cyclical picture is still supportive of markets, it is deteriorating relative to where we were a year ago.”

Kyrklund is not the only one with this view.

Jeffrey Schulze and Josh Jamner, investment strategists at ClearBridge Investments, noted: “While many economic indicators continue to show strength, the current environment likely represents peak economic and earnings growth.

“Although some market participants appear to be worried about an impending slowdown, we continue to believe the economy is undergoing a somewhat typical handoff from the early- to mid-cycle. This period often is accompanied by choppier equity markets as investors seek to ascertain the dominant themes of the next expansion.”

Although the Omicron variant of the coronavirus has been the main topic of conversation over the past few weeks, and was blamed for the recent wobble in markets, Kyrklund said that all the economic indicators pointed towards taking a more conservative stance, irrespective of what happened with the virus.

As a result, Schroders has begun to reduce risk across its portfolios, by cutting its weighting to cyclical stocks and adding hedges by increasing exposure to duration and the US dollar. However, Kyrklund also warned that this is not the time to get too defensive.

“We still think there is a little bit more upside for equities,” she continued. “When it comes to valuations, it's really a game of a tug of war between earnings and bonds.

“Equity valuations are underpinned by the very low level of bond yields. On this measure, we're nowhere near the kind of level of overvaluation experienced in the late 1990s.

“When we look into 2022, we see some potential for [bond] yields to drift higher given how low they are. But at the same time, earnings are reasonably well supported. Again, this points to more upside for equities.”

Asset class performance by phase of the economic cycle

Source: Schroders

Although Schroders is reducing its cyclical exposure, one part of this sub-sector Kyrklund is enthusiastic about is commodities. Schroders increased its weighting to this area a year ago, which proved to be a smart move – the seven best-performing funds in the IA universe in 2021 so far are focused on oil & gas, for example, making between 48% and 71%. Despite these strong gains, Kyrklund said now is not the time to sell out of this asset class.

“We added commodities to our portfolios because we were concerned about potential inflationary risks, due to the sheer volume of money that's been thrown into the system.

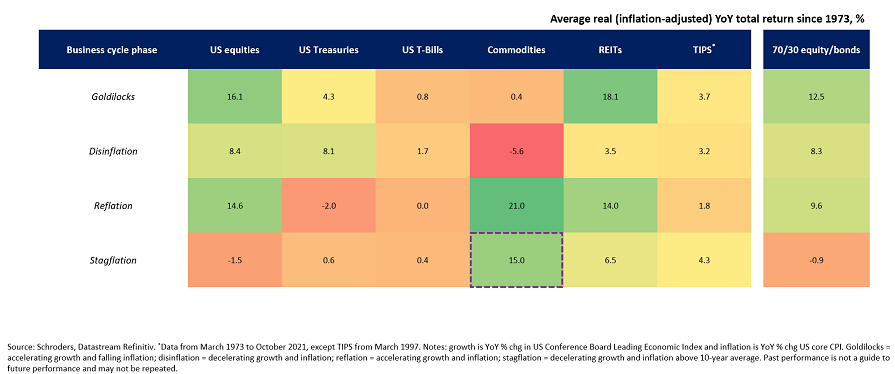

Asset class performance by inflationary scenario

“There are some stagflation risks, potentially accentuated by the Fed, and this really argues for the inclusion of commodities. We already thought central banks were behind the curve in terms of reacting to higher inflation. If they further delay tightening, this could continue to support valuations.

“Historically, it's been gold that has done very well.”

Many other investment professionals have cited commodities as an effective inflation hedge and are increasing exposure to this asset class as they anticipate a prolonged period of rising prices.

However, a paper by Wei Dai and Mamdouh Medhat, investment researchers at Dimensional, suggested investors shouldn’t worry too much about this potential headwind. It found that, with the exception of one-month T-bills, all assets have on average delivered real returns in years when inflation has been high.

“The right mix of assets for growth and hedging purposes ultimately depends on an investor’s goals and needs,” said the report, titled US Inflation and Global Asset Returns.

“The good news is that most of the global assets we study have been able to outpace US inflation over the long term. Hence, simply staying invested may by itself be an effective long-term solution to inflation concerns.”