This year will be remembered as one of phenomenal growth. Recovering from the Covid pandemic, markets developed markets have risen as vaccine rollouts breathed an air of calm into the markets.

Although next year looks to be more frenetic, below experts reflect on 2021 and tell Trustnet about their favourite funds of the past 12 months.

Schroder Global Recovery

Starting with the global portfolios, Schroder Global Recovery is a name that has summarised the driving force in markets this year: recovery.

Rory Maguire, managing director of Fundhouse, picked the £1bn fund because, although value investing had struggled prior to this year, the managers have resolutely stuck to their process “and this commitment to their philosophy paid off handsomely this year”.

Indeed the fund made 23.5% total return in the past 12 months, ranking in the top quartile of the IA Global sector. This was a positive shift, having underperformed over the long-term, making 39.7% over five years.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

AVI Global Trust

James Carthew, head of investment companies QuotedData, picked the AVI Global Trust, which was the second best IT Global trust not only this year, but over three and five years as well, only beaten by Scottish Mortgage. But it is available on a much wider discount (8.5%), making it very appealing to investors.

Carthew said that the trust holds a mix of “great family controlled businesses” and has wide regional exposure, almost equally split between North America, Europe and Japan.

“AVI has been vocal, where it needs to, about what needs to be done to unlock value for investors. It believes that there is a lot more to go for in 2022,” Carthew said.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

JOHCM UK Dynamic

Next are the more regional options and the first fund is JOHCM UK Dynamic, another portfolio whose performance was hurt by value’s unpopularity over much of the past decade, but saw a resurgence in 2021.

Gill Hutchison research director and co-founder of The Adviser Centre, said that 2020 could be described as the fund’s “annus horribilis”, but in 2021 it had a “renaissance in performance”, moving to top-quartile returns (22.8%).

“All credit goes to the manager, Alex Savvides, for persisting with his long-term investment philosophy,” Hutchison said.

Savvides’ stock picking process is comprised of four key tenets: to profit from extremes; that companies are dynamic not static; to employ strict investment disciplines; and build a margin of safety – all at a low valuation.

Fidelity Special Situations

Jason Hollands, managing director of Bestinvest, picked Fidelity Special Situations, another value fund. “I was flagging this fund back in autumn 2020,” Hollands said.

FE fundinfo Alpha Manager, Alex Wright, invests across the all-cap space, but with a bias to mid- and small-caps, which means the fund can be more volatile than its IA UK All Companies peers.

It has made 22.1% this year and 186.1% over 10 years, a top-quartile return.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Tellworth UK Smaller Companies

The final UK fund was Tellworth UK Smaller Companies, a small-cap fund run by Tellworth founder and Alpha Manager, Paul Marriage and Alpha Manager, John Warren.

Adrian Lowcock, independent commentator, said it was his pick because Marriage and Warren “have a lot of passion and interest in the sector”, which has helped the fund generate decent returns this year.

He noted that “the latter half has been more disappointing” due to macroeconomic factors, but the fund has still made 32.2% overall, the eighth-best in the IA UK Smaller Companies sector in 2021.

Since it launched in 2017 it has made 57.2%, ahead of the sector average (49.7%). It is not heavily weighted to one style, differentiating it from the other UK funds listed.

European Opportunities Trust

The European Opportunities Trust was Fairview Consulting director Ben Yearsley’s favourite fund of the year because of the manager’s ability to overcome a crisis.

The fund had a “disastrous” 2020 Yearsley said, after its biggest holding, Wirecard, was embroiled in a series of accounting scandals that ended with it going bust and put the trust on a major discount of 11.8%.

“It would have been easy for Alexander Darwall to change tack or style in the face of such a disaster, but he stuck to his guns and although the share price hasn’t reached pre-Covid levels yet, it has bounced back strongly,” Yearsley said.

The trust’s performance has lagged its IT European peers, ranking second-worst over five years (62.1%) and third worst over 10 years (277.1%). In 2021 it made 11.2%, behind the sector and benchmark (14.5% each).

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Magna New Frontiers

Moving out of developed markets and Sam Buckingham, investment analyst at Kingswood Group, chose the Magna New Frontiers fund, which he said struggled with “undeserved underperformance” in 2020.

Since then it has rebuilt those losses, spurred on by the vaccine rally from October 2020. In the past 12 months it made 57.9% total returns.

“But the valuation discount remains substantial whilst the earnings outlook for the fund remains strong,” Buckingham said.

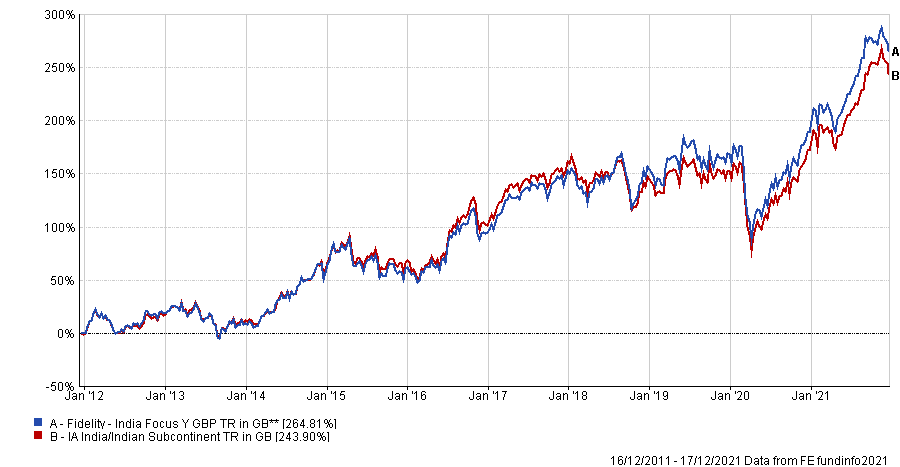

Fidelity India Focus

Ryan Hughes, head of active portfolios at AJ Bell, was extremely bullish on India coming into 2021 and said it is a region that will continue to deliver next year.

He picked the £1.7bn Fidelity India Focus, the biggest fund in the IA India/Indian Subcontinent sector.

“We added Fidelity India Focus to our portfolios to capitalise on this and bring diversification away from China and it’s worked out very well,” he said.

Over 10 years it has made 264.8% total returns, higher than the sector average (243.9%). This year it made 21.2%, just behind the sector average (22.4%).

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Taylor Maritime Investment

Darius McDermott, managing director of FundCalibre, said: “My favourite fund this year? That’s easy: Taylor Maritime Investment.”

“I’m geekily fond of this trust,” McDermott said, which acquires vessels, primarily container ships. “Not the big container ones that get stuck in the Suez Canal, but ‘handy-sized’ ones,” he added.

“I also like it because it’s something we couldn’t have owned before. Now it’s possible and our clients can benefit,” he said, having added it to the VT Chelsea Managed Funds.

The trust only launched in May this year, raising $253.7m (£191.9m) at its initial public offering (IPO) “and has had a flying start since”, McDermott said, “and looks even more positive for next year.” It has made 37.3% since launch, ahead of the average IT Leasing trust (10%).

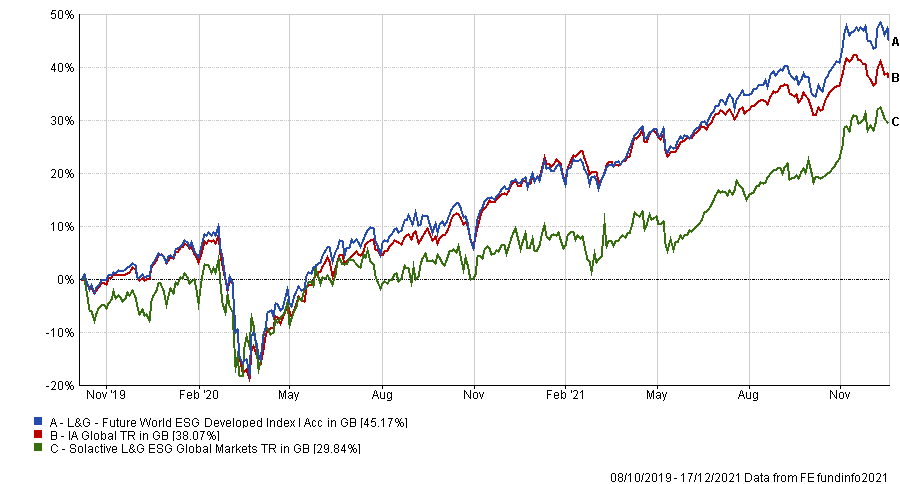

L&G Future World ESG Developed Index

Active funds were not the most impressive options for some experts. Emma Wall, head of investment analysis at Hargreaves Lansdown, picked the L&G Future World ESG Developed Index as her 2021 favourite.

The fund tracks the Solactive L&G ESG Developed Markets index but increases investments in companies that score well on a variety of ESG criteria – from the level of carbon emissions generated, to the number of women on the board and the quality of disclosure on executive pay. It also reduces exposure to companies that score poorly on these measures and excludes classic ESG ‘sin stocks’.

“Not only has performance been strong but the philosophy and process behind the fund is one I believe in,” Wall said. Since it launched it has made 45.2%, ahead of the IA Global sector (38.1%) and the index (29.8%) and in 2021 has made 21.6%, ahead of the IA Global sector.

Performance of fund vs sector and index since launch

Source: FE Analytics

Lyxor Robotics & AI UCITS ETF

Lastly, Andy Merricks, commentator and fund manager at 8AM Global, picked the thematic Lyxor Robotics & AI UCITS ETF, which plays into the long-term theme of robotics and artificial intelligence (AI), something Merricks said was only “strengthened by the pandemic”.

The ETF tracks the MSCI ACWI IMI Robotics & AI ESG, which follows the performance of companies associated with the increased adoption and utilization of AI, robots and automation while excluding those involved in certain controversial businesses or with relatively low on ESG.

Since it launched in 2018 it has made 87.8% total returns and this year it has made 13.5%, beating the sector’s average (6.6%).

| Fund/Trust | Sector | Fund Size(m) | Fund Manager(s) | Yield | OCF | IT Net Gearing | IT Pub. NAV Discount |

| Devon Equity Management European Opportunities Trust | IT Europe | £844.30 | Alexander Darwall | 0.25% | 0.99% | 6.60% | -13.70% |

| Fidelity India Focus | IA India/Indian Subcontinent | £1,698.90 | Amit Goel | 1.08% | |||

| Fidelity Special Situations | IA UK All Companies | £3,055.30 | Alex Wright, Jonathan Winton | 0.90% | |||

| Fiera Capital Europe Magna New Frontiers | IA Specialist | £455.10 | Stefan Bottcher, Dominic Bokor-Ingram | 2.45% | |||

| L&G Future World ESG Developed Index | IA Global | £876.80 | Index Fund Management Team | 1.10% | 0.25% | ||

| Lyxor MSCI Robotics & AI ESG Filtered UCITS ETF | Gbl ETF Equity - Tech Media & Telec | £268.80 | 0.40% | ||||

| Taylor Maritime Investment | IT Leasing | £302.30 | Taylor Maritime | 1.30% | 1.20% | 0.00% | 5.77% |

| TM Tellworth UK Smaller Companies | IA UK Smaller Companies | £472.90 | Paul Marriage, John Warren | 1.08% |