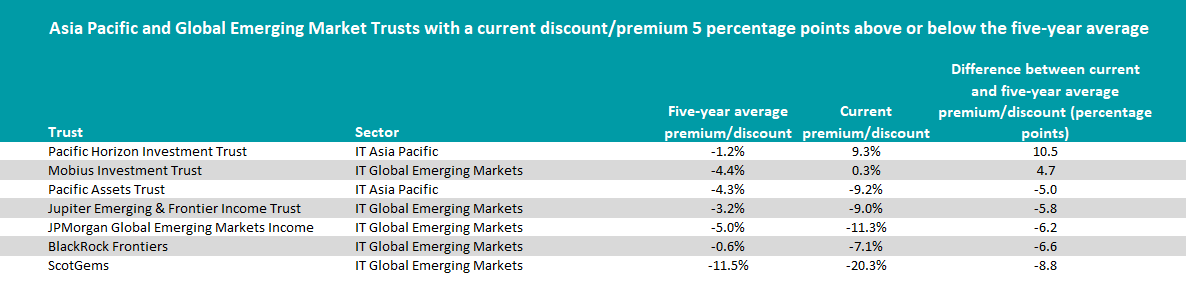

There were several bargains to be had among IT Asia Pacific and IT Global Emerging Market trusts, with many moving to a much wider discount that its five-year average.

The Asia Pacific and Emerging Market sectors struggled in 2021, ranking in the bottom half of all regional sectors for the year. The exception was IT Asia Pacific Smaller Companies which ranked in the top half of the table.

The sectors were hit by a rally in Indian equities, which had an incredibly strong year, and a drag from China’s underperformance, a big influence on the sectors’ returns as China is the dominant market in the region.

Following an overall lacklustre year of returns, investors may expect to pick up some trusts at a bigger discount from these sectors.

Data provided by QuotedData showed that there were seven trusts collectively that met this criteria, with five coming from the IT Global Emerging Markets sector.

Source: QuotedData

Looking at this sector first, there were four trusts which had much wider discounts: Jupiter Emerging & Frontier Income Trust, JPMorgan Global Emerging Markets Income, BlackRock Frontiers and ScotGems.

ScotGems had the biggest differentiation from its five-year average, widening its discount by 8.8 percentage points.

Since its inception in 2017 the trust’s performance has struggled, ranking as the worst performer over three years (losing 24.6%).

Kepler analysts said that the manager’s cautious approach combined with strict quality and valuation criteria had not been the ideal strategy, but said that the team’s keen focus on capital protection could become more appealing as “we finally appear to be reaching the end of the global economic expansion after the financial crisis”.

The JPMorgan Global Emerging Markets Income trust also had its discount broaden, moving from 5% to 11.3%. This is despite beating the benchmark and sector average across most time frames.

Its limited exposure to e-commerce companies has muted the trust’s returns in recent years, Kepler analysts said, given how much of a rally that theme has had during Covid. But its underweight to China had a bigger, positive impact on returns last year.

Overall, Kepler analysts said that it offered an “attractive diversification” for income investors, offering both geographic and sector variation.

Winterflood analysts added that although the trust appeared pretty cheap versus its peers it still offered value to investors.

There was only one trust that was on a discount or premium that was more than 5 percentage points above its long-term average: Mobius Investment Trust.

Long-term the trust has been running on a 4.4% discount but it rerated up to a slight premium of 0.3%, the only trust in the sector currently on a premium.

Part of this rerating may be down to its stellar outperformance, coming through as the best performing trust in the sector over the past year (35.6%) and also over three years (58.4%), the sector average was 5.5% and 22% respectively.

This was down to managers’ Mark Mobius and Carlos Hardenberg regional allocation, being overweight India and underweight China – an unusual make up for an emerging market focused portfolio as China is such a dominant market.

It was the right combination for 2021 when Indian equities soared and China slumped and this allocation was present across the sectors’ winners last year.

On the trust’s re-rating, Kepler analysts said that it had created an opportunity for the board to growth the trust through new issuance, which should decrease the fee burden, as well as diversify the concentrated shareholder base.

Moving onto the Asia Pacific sectors and the only names to come from the IT Asia Pacific sector were Pacific Horizon Investment Trust and Pacific Assets Trust.

Baillie Gifford’s Pacific Horizon Investment Trust has been an incredibly strong performer, consistently ranking either first or second best across most time frames. Over 10 years it made the sector’s best returns (510.1%).

As a result the trust has moved up from its five-year average 1.2% discount to a 9.3% premium, making it the only trust in the sector not on a discount.

Alpha Manager Roderick Snell’s follow’s Ballie Gifford’s style of seeking out exponential growth in just a handful of companies, several of which are Indian equities. From the top 10 alone there was car manufacturer Tata Motors, Indian mining company Vedanta and logistics and e-commerce firm Delhivery.

The other trust flagged was Pacific Assets Trust, which has gone in the opposite direction, moving from a 4.3% discount to a 9.2% discount.

The trust had a strong year in 2021, ending the year just behind the Baillie Gifford trust overall (15.1%), due to its high allocation to India.

However it has not consistently outperformed to this level, yo-yoing between bottom and second quartile over the long-term, making the lowest returns over five years (60.5%) but ranking third over 10 years (273.3%).

JPMorgan Asia Growth and Income was just outside of the criteria, with a narrower discount of 4.7 percentage points, but is worth highlighting as it is the IT Asia Pacific Income sector’s best-performing trust over 10 years (218.5%).

Kepler’s analysts said it could be a core holding for both income and growth investors and on its current discount this could be a decent entry point to the trust, but noted that investors should be wary of some forthcoming volatility from its China allocation.

This is the final instalment of a series in which Trustnet looked at investment trusts that have diverged at least 5 percentage points from their five-year average premium/discount. Previously we have looked at the UK, Global, North American, European and Japanese sectors.

A share price premium or discount can be an important factor for investors. When people sell out of a trust in large groups this can cause the share price to drop, even when the underlying holdings keep their value, creating a share price discount. If this is coupled with those underlying stocks falling, those remaining in the trust can end up with two sets of losses.

This also works the other way: if more people buy the trust’s shares, they could be more expensive than the total value of the underlying holdings, placing the investment company on a premium. However, past performance should not be used as a guide to future returns.

| Trust | Sector | Fund Size(m) | Fund Manager | Yield | OCF | IT Net Gearing | IT Pub. NAV Discount |

| Baillie Gifford Pacific Horizon Investment Trust | IT Asia Pacific | £802 | Roderick Snell | 0 | 0.78% | 5.51 | 7.11% |

| Pacific Assets Trust | IT Asia Pacific | £442.70 | David Gait, Douglas Ledingham | 0.66 | 1.13% | 0 | -7.33% |

| BlackRock Frontiers Investment Trust | IT Global Emerging Markets | £240.40 | Samuel Vecht, Emily Fletcher | 4 | 1.36% | 2.87 | -7.80% |

| JPMorgan Global Emerging Markets Income Trust | IT Global Emerging Markets | £428 | Omar Negyal, Jeffrey Roskell, Isaac Thong | 2.92 | 1.11% | 5.35 | -9.32% |

| Jupiter Emerging & Frontier Income Trust | IT Global Emerging Markets | £91 | Ross Teverson, Charles Sunnucks | 4.34 | 1.35% | 9.97 | -7.59% |

| Mobius Investment Trust | IT Global Emerging Markets | £167.10 | Frostrow Capital LLP | 0 | 1.50% | 0 | 0.18% |

| Scotgems | IT Global Emerging Markets | £37.70 | Tom Prew, Chris Grey | 0 | 1.35% | 0 | -25.27% |