Invesco’s global head of asset allocation Paul Jackson said that the biggest returns are earned, and the biggest losses avoided, by successfully taking out-of-consensus positions.

As a result, he has put together a document of out-of-consensus ideas for 2022 that have at least a 30% chance of occurring.

“These hypothetical predictions are our views of what could happen even if they do not necessarily form part of our central scenario,” said Jackson.

“Market sentiment is now mixed (thanks to the Fed), so our list of surprises contains something for everybody.”

1. S&P 500 closes the year lower than where it started

The S&P 500 has generated total returns of 28.1%, 17.8% and 30.7% in dollar terms in the past three years respectively. There have only been nine occasions since 1915 when real total returns have exceeded 15% for three years in a row.

These were grouped into four separate episodes, with three successive years going on to become four or even five years in three of those four episodes (1926 to 1928, 1951 to 52 and 1997 to 98).

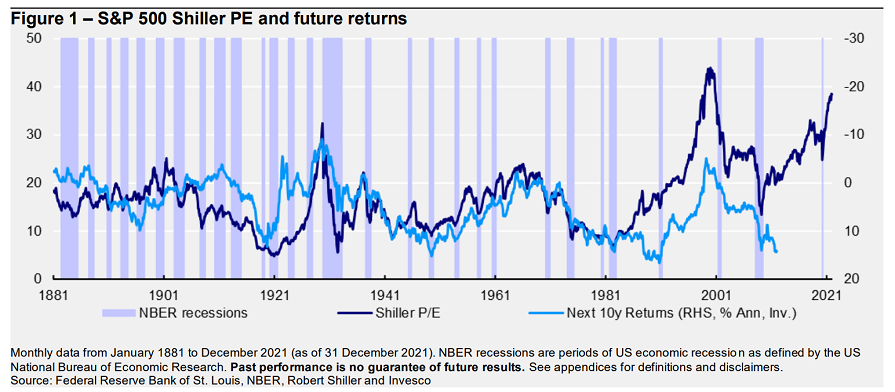

“That may give hope for 2022, but with a Shiller P/E [price-to-earnings ratio] above 38, the market has rarely been so expensive and history suggests that S&P 500 returns over the coming 10 years will be limited,” said Jackson.

“On top of which, the Fed appears more hawkish than for some time, which may bring short-term volatility.”

2. US 10-year treasury yield goes above 2.5%

With the 10-year yield currently at around 1.76%, Jackson said it was easy to see it reaching 2%, although 2.5% seemed more ambitious.

“It seems so unlikely that we think it worth considering, especially given the possible fallout,” he added, saying a combination of strong economic growth, persistent inflation, rate hikes and balance sheet shrinkage could produce this outcome.

3. Travel and leisure outperforms

Travel and leisure has been one of the sectors hardest hit by the pandemic, underperforming the Datastream World Index by 10.4 percentage points on an annualised basis over the past three years. Only energy has done worse, underperforming by 14 percentage points a year.

Yet Jackson said that if there were a silver lining to the Omicron variant, it was the weakening of the virus’s symptoms.

“This may have brought us closer to being able to live with the virus, thus enabling a return to ‘normality’,” he added. “We suspect travel & leisure would benefit enormously from that.”

4. The US Senate remains under Democrat control

Joe Biden is the least popular post-WWII president in the US at this stage of office, with the exception of Donald Trump. Meanwhile the Republican Party also has a slight lead in the polls. As a result, there is a growing likelihood the Republicans will control the US Congress after the mid-term elections on 8 November 2022.

However, Jackson pointed out the Senate elections were hard to predict, with only 34 of the 100 seats up for grabs – 20 of these are currently Republican and 14 Democrat, with five Republicans retiring compared with only one Democrat.

“The eight seats that are not considered relatively safe for the incumbent party are currently split equally between the two parties,” he said.

“With the Republicans only needing a single net gain to take control, the odds may be stacked in their favour. But a surprise is possible.”

5. Australia changes government and emissions policies

Prime minister Scott Morrison’s Conservative government has set a net-zero target for 2050, but Invesco analysis suggested this will not be achieved until 2080.

Australia has faced international criticism for its refusal to fully engage with the climate change issue and, as a large producer of coal, it has a vested interest in dragging its feet.

However, opinion polls suggested Labor will win the next election, to be held before 21 May.

“The Labor Party of Anthony Albanese has committed to a 43% cut in emissions by 2030 compared with 2005 levels, versus the 35% forecast (but not commitment) of the current government,” said Jackson.

“A change of approach and attitude could bring Australia back into the developed-world mainstream on this issue.”

6. Bitcoin falls below $30,000

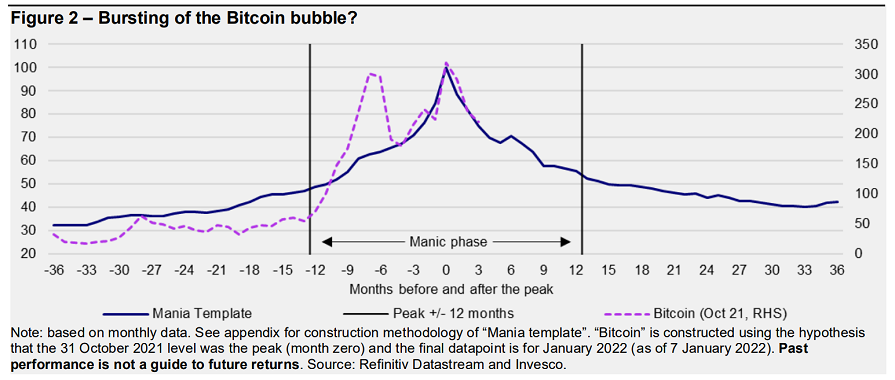

Last year, Invesco claimed Bitcoin could fall below $10,000. Instead it reached a peak of around $68,000.

Despite this mistake, Jackson warned that the mass marketing of Bitcoin reminded him of how stockbrokers behaved in the run-up to the 1929 crash.

“We know how that ended, and Bitcoin has already fallen to around $42,000, closely following the downward path of our mania template,” he said.

“That template suggests a loss of 45% in the 12 months after the peak of a financial mania. If that pattern is followed, the price of Bitcoin would fall to between $34,000 and $37,000 by the end of October.”

7. Turkey government debt outperforms

Turkey appears to be caught in an inflation/currency depreciation spiral, with the lira falling by 44% against the dollar in 2021 and inflation reaching 36% in December.

Jackson said that while these figures make it appear “uninvestable”, there was a price for everything and sometimes “the best opportunities appear in the darkest of moments”. With this in mind, he said the 8% yield on 10-year dollar-denominated Turkish government bonds looked attractive.

“That is quite a cushion, unless of course Turkey defaults,” the head of multi-asset added. “Even better, the yield on local currency 10-year government debt is 23%, compared with 1.8% in the US, which gives a nice cushion versus future currency depreciation, especially since the currency has recently weakened so much.”

8. Brazilian stocks to outperform major indices

Jackson said the “Holy Grail” for his team was a dividend yield that exceeded the P/E ratio. While these are rare, they can currently be found in Kenya, Laos, Pakistan and Russia.

“Another example is Brazil, where after a 12% index decline in 2021, the current IBOVESPA price/earnings ratio is 6.6 and the dividend yield is 8.5%,” he said.

“Having been in the bottom three equity markets for each of the past two years, we suspect 2022 could be the year of rebound, despite the possible election of a left-wing president.”

9. EU carbon goes above €100 per tonne

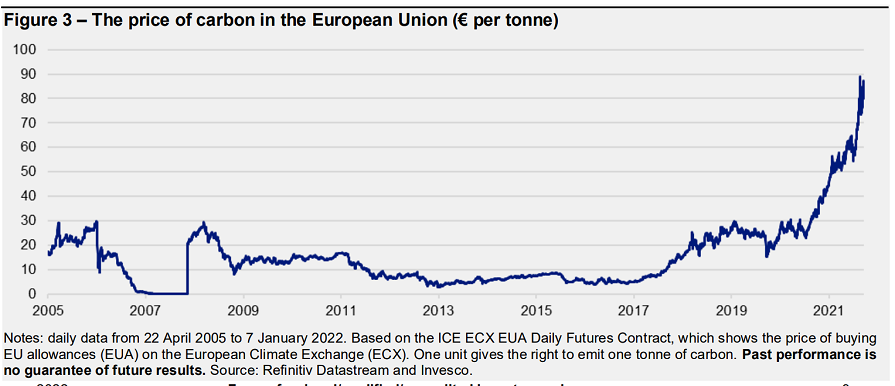

At the start of 2020, Invesco predicted EU carbon would break above €30 a tonne, and in 2021 it predicted it would go above €50. Both forecasts proved correct, and the figure now stands at €85.

Jackson noted the Stern Review of 2006 calculated the social cost of carbon to be $85 (€96) per tonne, which was likely to have increased since then.

“With the world now focused on mitigating climate change, and the global economy perhaps accelerating later in the year if the great reopening occurs, there is a good chance that EU carbon may exceed €100/t at some stage during 2022,” he said.

10. Argentina win the World Cup

While bookmakers seem to favour five-times champions Brazil and reigning champions France for this year’s World Cup, Jackson pointed out the groups haven’t been decided yet, so it is impossible the chart the path to the final.

“Armed with an incomplete information set, we suspect that Argentina and England have as good a chance as any and we are going with the former, to avoid accusations of home bias,” he finished.