Improvements to the ways in which Japanese companies treat their shareholders have been well documented over the past decade. However, this commitment was really put to the test last year amid the outbreak of Covid.

Today, as we emerge from the pandemic, it is clear that corporate Japan has not only maintained a progressive approach to corporate governance through these tough times, but has actually been able to increase its efforts.

As a result, with dividend and share buyback growth also returning to record levels, the stage is now set for the nation to become a more attractive income investment destination in 2022 than ever before.

Dedicated focus

Japan’s efforts to shed its historical reputation of overlooking shareholders began in earnest under former prime minister, Shinzo Abe, who introduced the nation’s first corporate governance and stewardship codes back in 2014.

Though commentators still remain divided on the true degree of their effectiveness, there’s no questioning that the introduction of the codes greatly reformed markets.

By 2019, Japan was able to deliver its fifth consecutive year of world-beating dividend growth while share buybacks hit a fresh annual record before the 12-month period had even come to a close.

Given the sheer rate of improvement here (after all, the Japanese market was yielding just 1.6% back in 2013), there was one question on investor’s lips as the world locked down in early 2020: Will the corporate governance baby be thrown out with the bathwater as Japanese businesses enter crisis mode?

The answer, encouragingly, was a resounding “no”.

Japanese firms delivered new records in 2020 for both the rate at which they were unwinding cross shareholdings and the rate at which they were reducing exposure to non-core businesses.

What is more, with the Tokyo Stock Exchange’s incoming reorganisation requiring greater corporate governance oversight and a market cap of at least Y10bn (£64.8m) for a Prime Market listing, we believe that both of these trends will continue.

Alongside this, corporate Japan also appears to be positioned to emerge from the pandemic with a greater focus on shareholder returns than ever before.

Indeed, far from slowing reform, corporate Japan’s “prepare for the worst” approach to cash preservation granted many firms excellent dividend cover at a time when most of their global developed peers were suffering a “dividend bonfire”.

This, along with the government’s huge stimulus package and falling Covid cases, are reducing the need for emergency funds to be held by companies, meaning that Japanese stocks are currently sitting on excess cash levels which leaves plenty of room for further boosting shareholder returns.

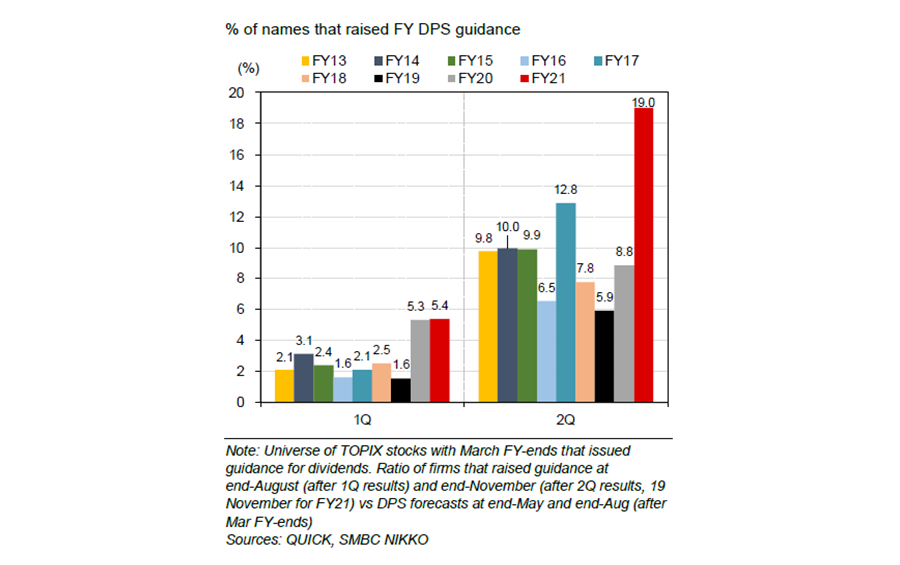

Early signs of a rapid acceleration in post-Covid shareholder returns among Japanese companies are already emerging. Not least of all, share buybacks are already sitting in line with recent highs while 19% of companies raised their dividend after Q2 – a much higher rate than in recent years.

Jump in dividend forecast hikes at 2Q results

Growing from a strong base

All-in-all, Japan has built a very strong base upon which it can continue to grow.

We have already seen that companies were able to cope with the unprecedented operational challenges of Covid without resorting to undoing years of improving corporate governance standards.

There are early signs that pre-2020 momentum has returned, and is even being exceeded, as we emerge from the worst of the pandemic.

And now, with Japan’s post-pandemic “reopening” hitting full stride, the Tokyo Stock Exchange market reorganisation on track (which will reinforce Corporate Governance and Stewardship codes) and new premier Kishida set to maintain massive fiscal and monetary support for some time, the stage is set for Japan’s pool of attractive income stocks to continue to maintain and grow shareholder returns at a faster rate than ever in 2022.

Richard Aston is portfolio manager of the CC Japan Income & Growth Trust. The views expressed above are his own and should not be taken as investment advice.