If inflation remains sticky, interest rates are set to rise and the past decade-long trend of declining long-term interest rates reverses permanently, is Fundsmith Equity still a good option for investors?

Terry Smith himself warned in early January that if inflation ramps up equity markets would be in for “an uncomfortably bumpy ride”.

Since then, global equities have continued a major decline driven by rising fears of persistently higher inflation and the withdrawal of central bank monetary support. Amidst the volatility, growth equities have been hit much harder than the wider equity market.

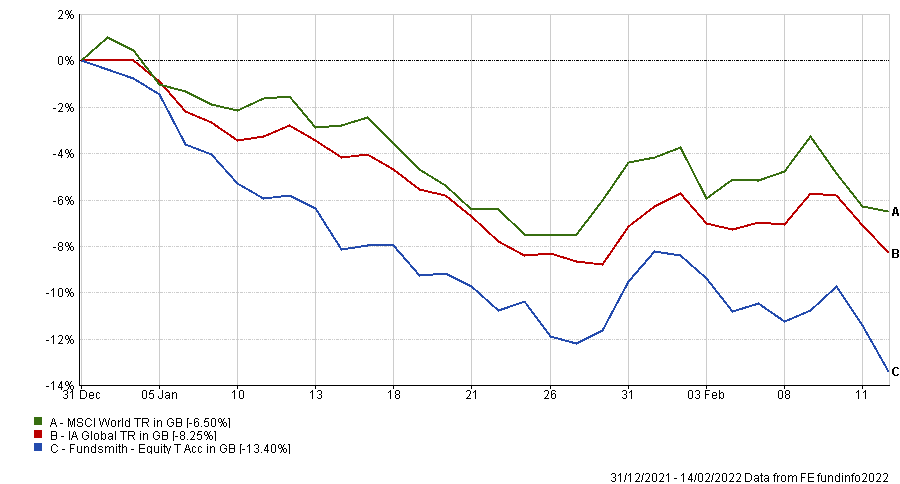

Year-to-date, Terry Smith’s quality-growth orientated fund has fallen by twice the amount of the MSCI World index.

Performance of Fundsmith Equity and global equities year-to-date

Source: FE Analytics

This more challenging macroeconomic backdrop was also the reason why Fundsmith Equity, among many others, was downgraded from five-crowns to four crowns in the latest FE fundinfo Crown Rating rebalance.

Many of Smith’s holdings have suffered from a valuation correction in recent weeks. This is because quality-growth stocks are perceived by the market as ‘bond proxies’ or long-duration assets, making their valuations more susceptible to rises in long-term interest rates.

But investors chose Terry Smith’s fund for his ability to pick stocks at good prices, not his ability to time investments around macroeconomic changes.

However not all the recent declines in Fundsmith’s portfolio have been driven by macroeconomic factors. Two of his investments (Facebook & PayPal) have suffered from major share price declines because of poor results in recent weeks.

Two weeks ago, Meta Platforms (formerly known as Facebook) suffered from a 25% drop in a single day after it warned of weaker-than-expected revenue and declining user growth. Meanwhile PayPal fell by roughly 25% on the day it reported a disappointing revenue and profit outlook for 2022, citing the impact of higher inflation on consumer spending.

These stocks – which are no longer among the fund’s top 10 holdings – have not been the only moves however, with Smith buying tech giants Amazon and Alphabet in recent months for the first time in the portfolio’s history, with two other deals yet to be named.

Given this potentially difficult macroeconomic backdrop, two recent unfortunate stock-specific blips and four new portfolio additions, Trustnet asked experts whether they would buy, hold or sell the quality-growth giant.

Nick Wood, head of investment fund research at Quilter Cheviot said that in the very immediate term, Fundsmith isn’t necessarily best placed to benefit from rising rates or an inflationary environment.

He said: “In this economic environment, areas that the fund tends to avoid such as banks and/or energy and miners have done relatively well.”

However, in the longer-term, Wood said Fundsmith holds companies that should have pricing power and withstand the buffers of inflation.

Rob Morgan, chief analyst at Charles Stanley, also warned that it is inevitable that there are periods where Fundsmith performs poorly versus the market when value outperforms.

“Pressure on long-duration assets acts as a headwind in the short term, but in the long term the successful growth of companies in the portfolio and their resilience in terms of pricing power will be a bigger factor,” he said.

Morgan noted the stock picking ability of the manager is what will ultimately matter and is what investors should focus on.

“We think Terry Smith is an excellent manager in that regard, and would look past the small number of recent ‘problem’ investments such as Meta and Paypal,” he said. “The investment approach is clear and disciplined and it is a convenient way to allocate to companies with quality characteristics.”

Despite this, he still only rates the fund as a ‘hold’ rather than ‘buy’, due to the fund’s size and subsequent inability to invest in small and mid-cap opportunities.

“We would also caution that investors should never have too much exposure to a single manager,” he added.

When it comes to the new additions of Alphabet and Amazon, Wood said they do not represent any fundamental change in process: “They may represent a change in emphasis, but it is not out of kilter with Terry Smith’s process.

“Smith has always been focused on buying good companies, not overpaying and holding for the long term. The additions fit the criteria broadly as they are strong cash flow generators, with solid pricing power and hard to replicate business models.”

Although Terry Smith is known for emphasising the low turnover levels of the fund as being a key benefit of his strategy, Wood said the new additions “don’t really represent abnormally elevated levels of activity”.

Indeed, relative to the 26 portfolio holdings, two additions to the fund is still a low number and Wood said that taking advantage of market volatility to invest at the right price is “precisely what should be expected of an actively managed fund”.

However, he warned that the new holdings should prompt investors to consider their own asset mix, as they might be holding the same stocks in other funds.

He also noted that Smith may not run the fund forever and investors should consider researching the wider investment team now to be comfortable that the fund will be capably managed in the long run.

“An issue to bear in mind is whether investors are buying the fund for Terry Smith or for the broader team,” Wood said. “Smith may well be managing in five years’ time, but he will step away one day.”

Tracy Zhao, senior fund analyst, interactive investor however, suggested that the current market sell-off could provide an opportunity for long-term investors to take advantage of.

She said: “In the short term, there will be volatility for holding the portfolio, mainly due to the rising interest rate which negatively impacted the valuation for long duration stocks.

“The US bond market has indicated the possibility of five 25 basis point hikes by the Fed, and the stock market has been reacting to the movement in the bond market.

“However, market consensus is that the long-term inflation level will be at a sustained level. The equity market may have overpriced the hikes for long duration stocks.”

Zhao also pointed to the fact that there is some diversification from any sell-off in technology stocks in the fund despite its concentrated approach.

Over half of the fund is invested in sectors that are deemed to be defensive, i.e, consumer staples (31%) and healthcare (20%), whereas technology stocks, of which the fund has recently increased its exposure, make up only 28% of the portfolio.

Zhao added: “The fund invests in high-quality businesses and these tend to manoeuvre better in an inflationary environment.”

She pointed to the fund’s return on capital employed of 28% and operating margin of 26%, compared to the S&P 500’s 16% and 17% figures respectively, as markers of this quality approach.