Jupiter European is the most consistent IA Europe ex UK fund of the past decade, beating the most common benchmark in the sector – the MSCI Europe index – in nine of the past 10 calendar years, and its peer group average in eight.

State Street Europe ex UK Screened (ex Controversies and CW [controversial weapons]) beat the index in the same number of years, but only beat its average peer in four of these.

Of the 90 funds in the sector with a track record long enough to be included in the study, another nine beat the index in eight of the past 10 calendar years.

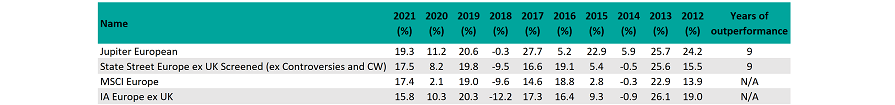

Performance of funds vs sector and index

Source: FE Analytics

Jupiter European is managed by Mark Heslop and Mark Nichols, who aim to invest in cash-generative businesses with clear barriers to entry, visible growth opportunities and attractive industry structures. When they find such businesses, they will hold them for the long term.

The managers said they would focus on four key themes in 2022 and the years ahead: emissions, digitalisation, ageing populations and productivity.

“The most important considerations when selecting companies in which to invest can be extremely varied from one opportunity to the next,” they explained.

“They are not captured in a view of near-term interest rate policy or ongoing geopolitical shenanigans. Rather, we focus our thoughts on how the economic landscape might change over the next five, 10 or even 20 years.

“Among the important questions we are seeking answers to are: which companies are best placed to access the structural growth trends we identify, and which can do so without sacrificing price?”

Much of Jupiter European’s outperformance came under former manager Alexander Darwall, who left to set up Devon Equity Management in 2019. However, the new managers got their first major call right, selling out of Wirecard, one of the largest holdings in the fund, for an average price of €130 a share.

In 2020, the payments processor announced €1.9bn was missing from its accounts, and it was declared insolvent. That year, Darwall’s European Opportunities Trust – which had 17% in the stock at one point – lost 9.2%, while Jupiter European made 11.2%.

In a recent note to investors, Heslop and Nichols said: “Our holdings continue to ride their way through this extraordinary period, and overall we have been impressed by the way their operations have held up.

“We continue to focus on businesses that have the potential to consistently create significant value for shareholders over the long term regardless of short-term headwinds.”

Jupiter European made 335.1% over the 10-year period in question, compared with 199.4% from its sector and 151.9% from the MSCI Europe index.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

State Street Europe ex UK Screened (ex Controversies and CW) is a passive fund that aims to replicate the performance of the FTSE Developed Europe ex UK ex Controversies ex CW index.

The index includes a negative screen that excludes securities from the index based on two criteria: controversial weapons (including chemical and biological weapons, cluster munitions and anti-personnel landmines), and controversies as defined by the 10 principles of the UN Global Compact.

Many studies have indicated that companies that place an emphasis on environmental, social and governance (ESG) factors tend to outperform those that don’t.

However, while the FTSE Developed Europe ex UK ex Controversies ex CW beat the FTSE Developed Europe ex UK index over the period in question, the outperformance was relatively slight – about 7.5 percentage points over the decade. The outperformance of the FTSE Developed Europe ex UK index over the MSCI Europe was much larger, at more than 30 percentage points.

The FTSE index tracks a higher number of companies – 469 compared with 347 from its MSCI counterpart. The difference comes from companies further down the market-cap spectrum, which tend to deliver higher returns over the long term.

Therefore, it is possible to conclude the presence of the State Street fund on the list owes more to the fact it follows a higher-growth index than its ethical screening process.

State Street Europe ex UK Screened (ex Controversies and CW) made 191.5% over the 10-year period in question.

| Name | Fund size (£m) | OCF (%) |

| Jupiter European | 3942.1 | 0.99 |

| State Street Europe ex UK Screened (ex Controversies and CW) | 4208 | 0.25 |