Investors topping up their portfolios monthly can lose out on some long-term returns compared to those who go all in on day one, but this method might have saved them some sleepless nights during the recent bouts of volatility.

Deciding how to invest is a personal choice and depends on what means you have available. Usually, the main options are either an initial lump sum or regularly drip feeding into markets.

Trustnet asked a selection of financial advisers which method they preferred and all of them said the lump sum approach, although both have their pros and cons.

Clive Hale chief strategist Albemarle Street Partners, said if he was given a lump sum today he would “put it to work in markets straight away”, on the basis that putting as much money in as soon as possible creates a longer time horizon to grow the initial investment. This only works if you have a lump sum to invest with, however, which not everyone will have.

Tracey Crookes, a chartered financial planner at Quilter Private Client Advisers, said that if investors did not have an initial bulk of cash “then drip feeding in regular contributions is the next-best alternative”, adding that “it is better to be doing something than nothing at all”.

If adding to a portfolio monthly, Gary Fawcett, senior investment manager at wealth manager Brewin Dolphin, said it was best to establish a base portfolio of funds and equally add to each holding.

“This way you reduce the risk of missing out on some areas doing well that you haven’t yet committed funds to, or the investments you have allocated to not performing as well as others, which would be a double hit,” he said.

Ultimately, it comes down to what is suitable for the individual. Fawcett said: “Some people are natural risk takers and others are more cautious.”

For the former, he said a desire “to get your money to work harder straight away is a compelling one”, especially if they need a source of income to help meet lifestyle costs.

“If that person can remain invested for the long term and doesn’t envisage needing to draw down capital in the immediate future then they can absorb fluctuations in equity markets and a lump sum strategy is likely to be appropriate,” he noted.

But for newer and less-experienced investors, building up their total over time was more palatable, removing some of the intimidation of letting go of your entire pot in one go. This can also be a less volatile way to invest, which more cautious investors may prefer.

“This is likely to give them more comfort, especially if they have no requirement for immediate income,” Fawcett said.

Crookes added that whichever method a person starts with they tend to stick to throughout their investment journey “because they are comfortable with that pattern”.

Between the two, a lump sum investment tends to reap higher rewards long-term, although both offer a decent chance at returns.

Trustnet compared the total returns from £5,000 initially invested over three, five and 10 years versus a build up to £5,000 from some of the biggest and most popular active and passive strategies. In all instances initially investing the total amount paid out more, but it was a more gut wrenching ride to get there.

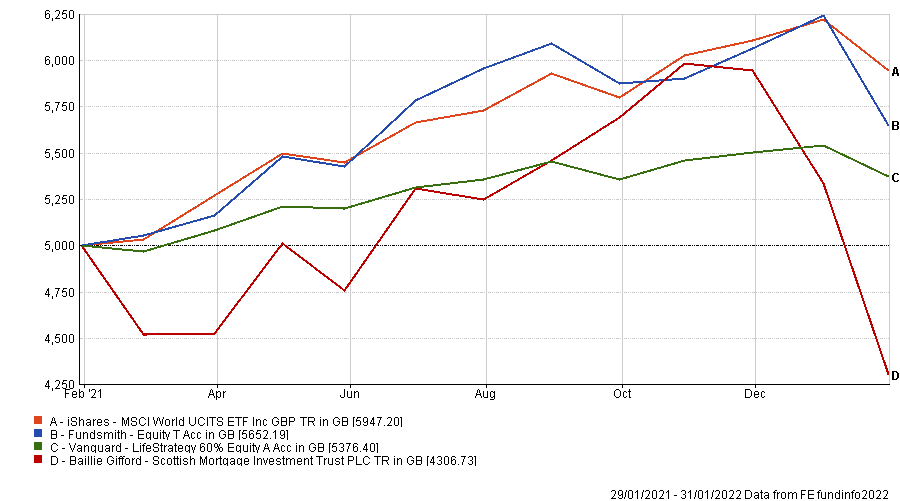

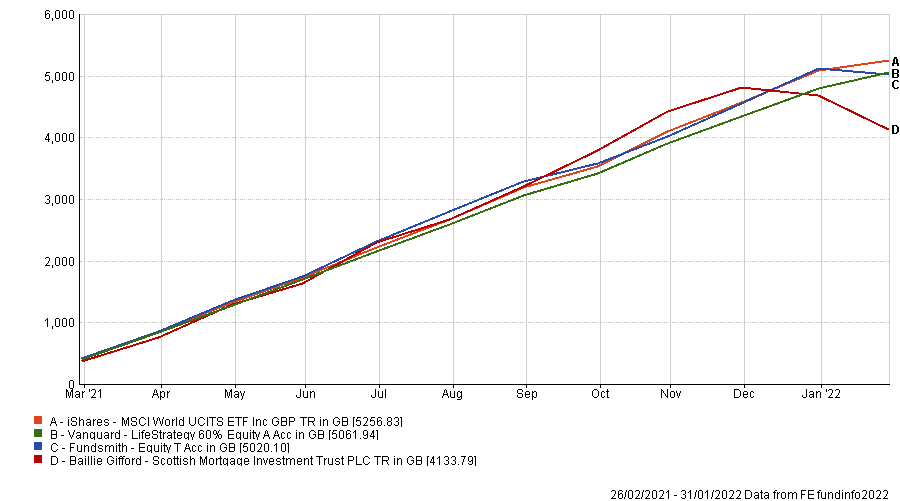

Focusing on the past 12 months, investors still would have made higher returns via an initial £5,000 investment, but it would have been a much more turbulent ride.

£5,000 lump sum returns over 1yr

Source: FE Analytics

£5,000 staggered returns over 1yr

Source: FE Analytics

These longer-term investments were generated in a steadily trending bull market which was the ideal for a lump-sum investing, according to Hale.

He said that when markets are trending upwards with low volatility “the argument for drip feeding wasn't really terribly good, because you just kept on buying units at a higher price and the whole point of dripping in is pound-cost averaging.”

He said if you were drip feeding during the 2009-2020 bull market “it was a bit of a waste of time, you might as well just shove the money in and be done with it.”

This is very different to the environment facing investors today. For the first time in years equity markets are having to process rising inflation and interest rates, which is causing some “savage” drawdowns, Hale said.

Crookes added that, at the same time, portions of the market remain very expensive, making it even harder to know where to invest.

In this environment it is understandable why investors would be more cautious about deploying all of their cash at once.

Time in markets rather than timing markets is an investment mantra all the advisers promoted, as the latter is very difficult to do. But Fawcett said that there was some truth that investing at the right time can “supercharge your long-term returns”.

He pointed out that if you had deployed all your cash when markets crashed at the end of March 2020 the returns in the following two years “would have been very good indeed and would help build a solid foundation for the future”.

“However, if you had invested just two months earlier, you would have seen a significant drop before a subsequent recovery,” he noted.

“Whilst returns would have still been very positive over the following two years, they wouldn’t have been as good as if the funds had been invested two months later.”

Fawcett said that while these were “extraordinary circumstances” it did demonstrate how initial timing could have a positive or negative impact. The very worst thing for either investor to do was panic and sell-out entirely, they all agreed.

Crookes said she has had to do a lot more “handholding” with her clients during the latest round of volatility than the Covid selloff because at the moment “investors can’t see where the growth is going to come from”.

She said that both styles of investors have been asking if they should move out to cash to try and limit losses, but she said that would be the worst thing to do.

“It's not a real loss until you actually cash out,” she said. “If they do cash out then they have definitely lost but if you stay in the market then you've got that opportunity to return.”

For either method all the advisors said investors needed to be clear on their long-term plan and stay committed to it while ensuring that they have adequate cash savings to cover emergencies and planned capital expenditure, as a safety net.