It has been more than two years since Schroders took charge of the trust formerly known as Woodford Patient Capital, but there has been little sign of a turnaround in performance.

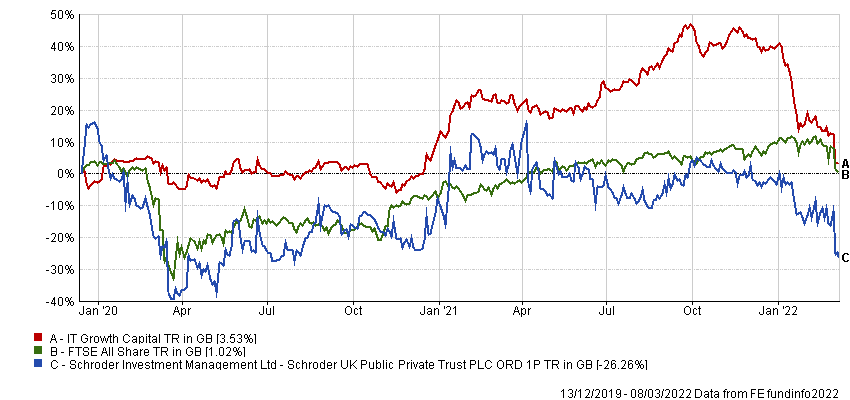

The Schroder UK Public Private Trust has fallen 26.3% since Ben Wicks and Tim Creed became managers in December 2019, and even further in NAV terms. The FTSE All Share is broadly flat over this time.

Performance of trust vs sector and index under managers

Source: FE Analytics

While its discount stands at a hefty 35.9%, it would be difficult to argue the trust represents anything more than a hopeful punt.

Instead, investors may be better off considering Schroders’ other public/private trust – Schroder British Opportunities.

The trust was launched in December 2020 to offer fresh capital to small and medium businesses that struggled to find funding during the pandemic.

It targets two types of business: high-growth companies set to benefit from the change in corporate and consumer behaviour after Covid-19; and mispriced-growth companies which, despite their struggles, offer products and services with long-term structural growth drivers.

Yet while it invests in both public and private businesses, Paul Lamacroft, senior investment director at Schroders, stressed it is a completely different proposition from the Schroder UK Public Private Trust.

“There is no crossover in holdings – absolutely none,” he said.

“This one is focused further up the business lifecycle curve: growth and buying opportunities in mature businesses that are much closer to profitability, if they’re not there already, and not those in need of multiple different funding rounds to get them through to that profitable position.”

Much has been made recently about the number of companies choosing to wait for longer before their initial public offering (IPO). Baillie Gifford recently increased the limits it could hold in unquoted assets across its investment trusts – Baillie Gifford European Growth Trust is the latest, with its board voting to raise its unquoted ceiling from 10 to 20%. Scottish Mortgage increased its limit from 25 to 30% in 2020.

Speaking in December, its co-manager Tom Slater said: “Back in 2012, it was clear that if we were going to retain access to the most exciting growth opportunities in the world, we must invest in private companies.”

However, Lamacroft said the opportunity to buy in ahead of an initial public offering (IPO) was not the only reason to invest in private companies.

“We only see about 5 to 10% of private equity deals actually going on to IPO,” he explained. “By restricting yourself purely to IPO opportunities in private equity, you are really restricting the size of the market you've got to invest into.

“Private businesses could potentially be sold on to another private equity fund, in a trade sale or at IPO.”

While Lamacroft concentrates on private companies, his colleague, UK small- and mid-cap analyst Uzo Ekwue, focuses on listed stocks.

Lamacroft said it helps to have this split, as analysing an unlisted growth company can require a different set of skills compared with a mispriced listed one.

“Profitability isn't the only metric, you can measure them in terms of the future growth rate in revenues,” he continued.

“You have to extrapolate further into the future. You're looking to see what can be achieved through cost of acquisitions and lifetime values of the different customers that are being acquired.

“There's quite an art around arriving at the valuation. It's a fairly long-winded and in-depth process, and it goes through a huge amount of interrogation from our investment committee.”

At the other end of the scale, Ekwue said there is no strict rule about when to sell a stock – it is just a case of waiting until the valuation doesn't make sense anymore.

“We never want to hold businesses that look expensive, but it's not as if we have to sell out if they cross from the FTSE 250 to the FTSE 100,” she said.

“For instance, even though we have a £50m to £2bn target range, we bought Watches of Switzerland for just under £2bn, but we continue to hold it.”

Before Russia’s invasion of Ukraine, the main topic on investors’ minds this year was the switch from growth to value stocks – or long to short duration assets.

With this in mind, many investors may be reluctant to invest in a trust with exposure to companies that are still unprofitable, even if those held by Schroder British Opportunities are at a more mature stage than those held in Schroder UK Public Private.

Lamacroft argued that while there were question marks in terms of inflation and growth rates, “if we are seeing businesses that are valued appropriately, growing at a good rate and have the strength to be leaders in their space, we would feel very comfortable continuing to make these sorts of investments”.

Ekwue added: “We are minded that we don't want to increase the portfolio turnover too much.

“This is a growth fund for someone with a longer-term investment horizon. This isn't a fund where we change the style in line with what’s going on with the macro.”

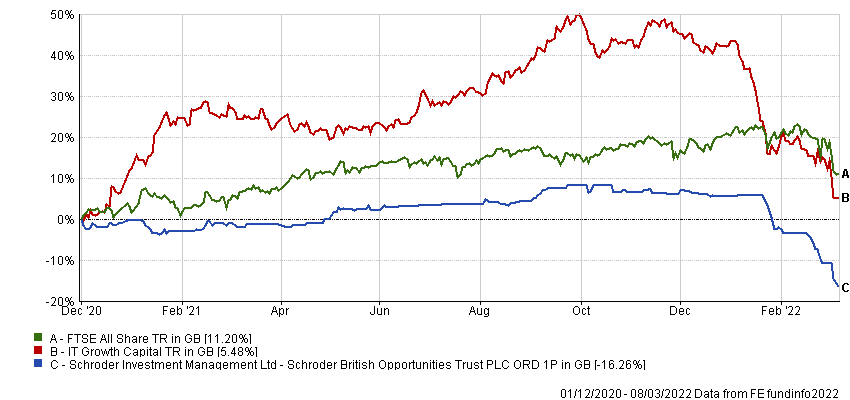

Data from FE Analytics shows Schroder British Opportunities is down 16.3% since launch, compared with gains of 5.5% from its IT Growth Capital sector and 11.2% from the FTSE All Share.

Performance of trust vs sector and index since launch

Source: FE Analytics

The trust is on a discount of 11.6% and has ongoing charges of 1.4%. It does not use gearing.

There is a performance fee of 15% on the private side of the portfolio if it outperforms by more than 10% in a financial year.