The Baillie Gifford European Growth Trust’s board has upped its maximum allocation to private companies from 10% to 20% as part of an ongoing move among the firm’s investment trusts to increase their weightings to unlisted businesses.

Baillie Gifford is becoming synonymous with private companies, with the likes of Scottish Mortgage – the UK’s largest trust – backing unquoted firms. The strategy has not been limited to the behemoth trust however, with a number of others now upping their potential weighting to unlisted stocks.

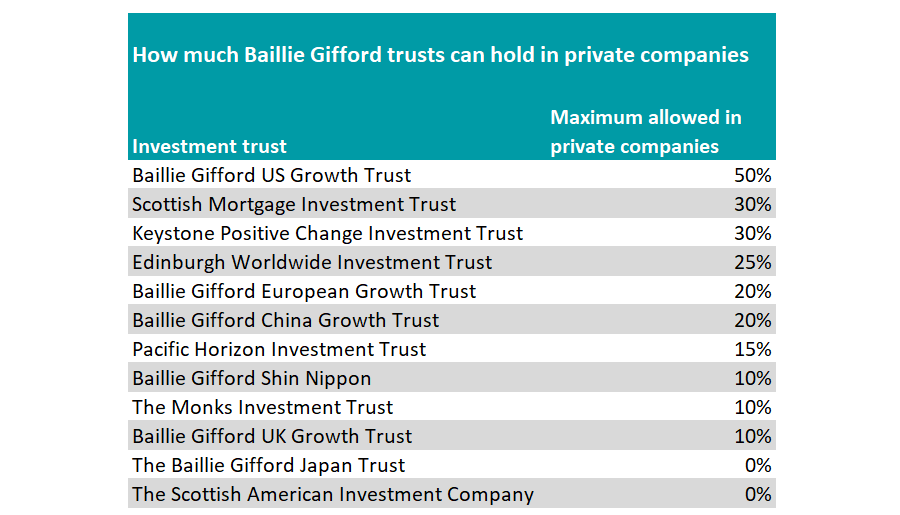

Indeed, the Baillie Gifford US Growth Trust can have up to 50% of the portfolio invested in unlisted companies, while Scottish Mortgage and Keystone Positive Change can have 30%.

Source: Baillie Gifford

The latest move to double the potential allocation in the European trust is part of a wider strategy by the firm. Indeed, other notable changes include the Baillie Gifford UK Growth Trust, which now has 10% authority, having previously not been able to invest in private equity at all.

Pacific Horizon has increased its maximum allocation from 10% to 15%, while Edinburgh Worldwide has upped its potential total from 15% to 25%.

At the European trust’s annual general meeting (AGM), co-manager Moritz Sitte said the portfolio currently had a 4.5% weighting to unlisted stocks but added that the ability to invest up to 20% in this area reflects the “terrific opportunity” in the unlisted space.

“According to this years’ State of European Tech report – which we co-sponsored – more than $100bn [£74bn] were invested in European start-ups in 2021 alone. Almost 100 new unicorns were created in Europe over the same time frame,” he said.

“The European tech ecosystem is developing at an increasing pace. Allowing us to invest more in private companies enables us to participate in this trend.”

Investing in private companies has been a hot topic in recent years as companies have not needed to list on the stock market to generate cash thanks to the accommodative monetary policies from central banks, which has left the world awash with money and allowed companies to get financing elsewhere.

Speaking in December, Scottish Mortgage co-manager Tom Slater said: “Back in 2012, it was clear that if we were going to retain access to the most exciting growth opportunities in the world, we must invest in private companies.

“Today, Baillie Gifford has about $5bn of assets invested in private companies, and around $40bn of assets invested in companies that we first invested in when they were private.”

He added that there were other reasons for firms to remain private other than no longer needing the cash, such as distancing themselves from the short-term pressures of the public markets and constant scrutiny of earnings results.

Peter Singlehurst, head of private companies at Baillie Gifford, added that it also allowed companies to stick to their “core mission” rather than forcing changes to be more accommodative to shareholders.

“As these companies stay private for longer, it means that there is a change in where value accrues. More value is accruing while companies are private, and less value is accruing while they’re public.”

This phenomenon has made it more important than ever to invest in early-stage businesses, but it also comes with its own risks.

In 2019 Woodford Investment Management was forced to suspend trading in its funds as it was no longer able to keep pace with investors withdrawals. The firm was unable to pay all of the money back to those that wished to sell as the funds were too heavily invested in these hard-to-trade unlisted companies.

However, investment trusts operate differently. Unlike open-ended funds, where the company is required to return cash to investors when they sell, closed-ended funds are traded on the stock market and therefore investors can sell their shares at any time, providing they can find a buyer. This means that the risk is lower that investors will be left with nothing.

Annabel Brodie-Smith, communications director of the Association of Investment Companies said: “Investment trusts are clearly the right vehicle to invest in unquoted companies. Their closed-ended structure is particularly suitable for hard-to-sell unquoted companies as the fund managers can take a long-term view of these investments and are never a forced seller.

“Investment trusts are also listed on the stock exchange so their shares are easily bought and sold by investors. Whereas open-ended fund managers have to manage inflows and outflows of cash into their funds and can be forced to suspend s fund if they are not able to sell assets quickly enough to meet investors’ redemptions.”