The number of ISA millionaires has gone up by more than 800 in the past year, according to the three main DIY investment platforms in the UK.

AJ Bell, Interactive Investor (ii) and Hargreaves Lansdown (HL) all reported a jump in the number of ISA millionaires on their platforms in the past 12 months to the end of 2021 after a bumper year in markets.

HL reported it had 973 ISA millionaires this year, 576 more than last year (a 69% increase) while there were 983 on interactive’s platform. AJ Bell had 85 millionaires.

Sarah Coles, senior personal finance analyst at Hargreaves, said that many of the millionaires had benefited from the rises in global markets over the past 12 months, as well as a boost from another £20,000 allowance.

“But they also hold the lesser-known secret to making a fortune from ISA investments: getting rich slowly,” she said.

Indeed, the average age of an ISA millionaire across the three platforms was 71, although there were some exceptions with the youngest AJ Bell millionaire aged just 34.

Coles said that the typical path to reach a six zero sum was “consistently investing as much as possible of the annual allowance as early as possible in the tax year”, split across a “a diverse and balanced portfolio”.

Moira O’Neill, head of personal finance at ii, added that the average age of this group evidenced how “investing is a marathon, not a sprint”.

“Ask any professional athlete and they’ll tell you the key to crossing that finish line in one piece is the consistent and diligent habits they developed and stuck with in the run up to the event,” she said.

Investors should think of “short-term investment wins as a pair of shiny new running shoes – it’s lovely to have, and sometimes it helps longer-term, but it’s mainly the rest, the fuel, and the training along the way – which all adds up in the end,” she added.

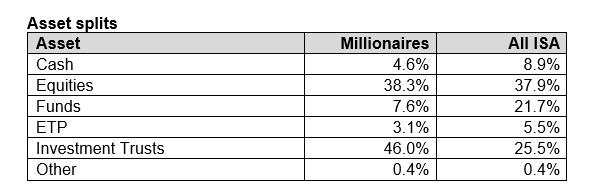

Looking at the portfolio breakdowns, most ISA millionaires’ returns come from investing in investment trusts. According to ii, they tend to focus more on closed-ended options than general investors and hold almost half as much cash, shown in the table below.

One of the most commonly held investment trusts was Alliance Trust, which was the most popular holding across all of interactive investor’s ISA millionaires, while appearing in the top 10 holdings of both Hargreaves and AJ Bell customers. It was joined by Scottish Mortgage as another widely held investment trust.

While there was a preference for closed-ended options, funds still played a role. Here, it was mainly global and income funds making up the most popular holdings, although there were some UK names, specifically IFSL Marlborough UK Micro-Cap Growth and LF Lindsell Train UK Equity.

As well as the micro-cap there were some more specialist funds on the list, such as Jupiter European and Stewart Investors Asia Pacific Leaders Sustainability, which Coles said can happen when investors have a larger portfolio.

She said: “You have more scope to add specialist funds into the mix too, which is why we see micro-caps and special situations in the top 10”.

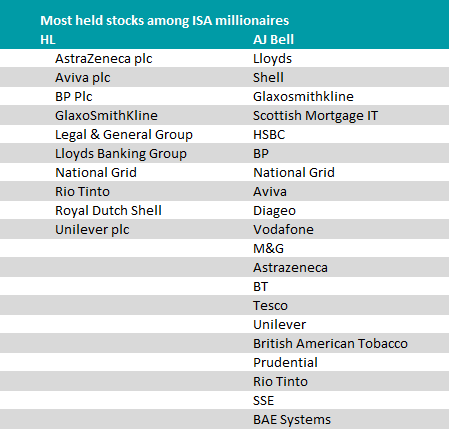

Moving onto the induvial stocks and O’Neill remarked that “top holdings were also dominated by FTSE 100 blue chips, particularly oil, pharmaceuticals, banks and telecoms – holdings that could help ISA millionaires in the race against inflation.”

A similar portfolio breakdown was found among Hargreaves Lansdown customers, with millionaires preferring the dividend-paying, large-cap end of the spectrum.

Coles said: “It means most of them aren’t speculating, they’re investing for the long term.”

Several stocks were found in at least two of the three brokers’ top 10 lists including GlaxoSmithKline, BP, AstraZeneca, National Grid and Royal Dutch Shell.

For an investor starting out today at zero, if they began investing the full £20,000 annual ISA allowance each year and had annual growth of 5%, excluding fees, it would take them 25 years to reach the £1m mark, O’Neill said.

“If your investments grew by 7% net of fees (an even taller order), you could trim three years off that period, achieving £1,048,722.82 in 22 years,” she added.