The freezing of the Russian central bank’s foreign currency reserves held by Western financial institutions could be accelerating a shift towards a new gold-based global monetary system, according to some fund managers.

Gold has long been the go-to instrument for investors seeking a safe haven, usually to protect the value of their investments against inflation or geopolitical risk – both of which seem to be growing in relevance today.

However, Russia’s invasion of Ukraine and the ensuing sanctions imposed by Western nations has set in motion something that Jupiter Asset Management’s Ned Naylor-Leyland thinks was largely inevitable – the upheaval of the role of the US dollar as the main currency of trade in the global economy.

The manager of the Jupiter Gold and Silver fund believes that the freezing of Russia’s US dollar reserves will spur central banks throughout the world to re-evaluate their own foreign reserves.

He said: “One has to remember where we've come from: which is gold settling international trade until 1971 when the Americans changed the rules. So yes, we're returning to the old rule where if you've got surpluses, you're not going to want to hold US dollars in my opinion.

“When you go freezing other countries reserves – especially when you think the amount that the Chinese have – this is a very, very important moment in the structure of markets.”

Ian Williams, manager of the WS Charteris Global Macro fund, expects there to be a “massive switch” by central banks around the world from foreign currency reserves into gold.

“It’s the beginning of the end of the dollar as the world’s reserve currency,” he said. “Would you put your money into a bank if you thought they could confiscate it?

“The Chinese have a trillion dollars of US treasury bills. They are looking at this thinking ‘Well if we have a pop at Taiwan in the next two or three years, that’s going to potentially happen to our trillion dollars’

“What would you do? You’d switch the trillion dollars into gold and ship the gold back to China.”

He said that eventually the Chinese renminbi could emerge as the world’s new reserve currency, backed by gold or at least semi-convertible to gold.

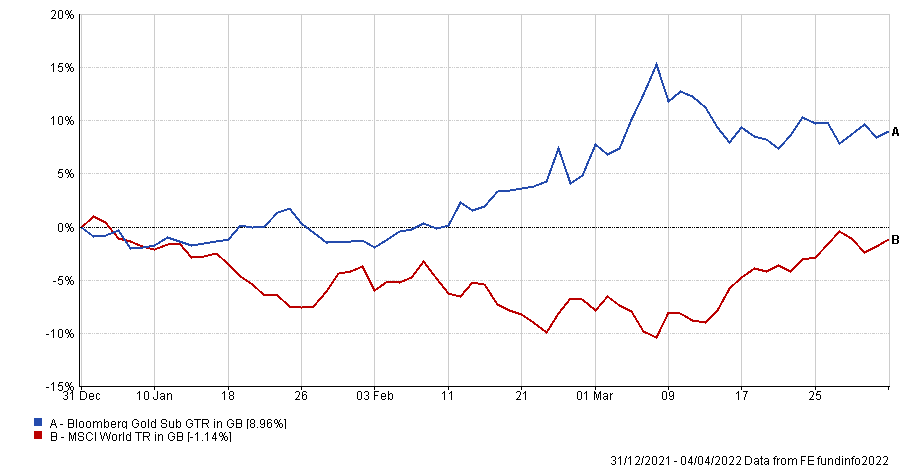

Year-to-date, the Bloomberg Gold Sub index is up 9%, while over the same period global equities have endured notable volatility, declining as much as 10% at one point.

Performance of gold & global equities year-to-date

Source: FE Analytics

However, since the invasion of Ukraine, there has also been a spike in the price of various crucial commodities, such as wheat and nickel.

Naylor-Leyland suggested that the shortages and price spikes in commodities could have ripple effects for the financial system that is not yet fully priced in by the markets.

“The phenomenon of raw materials protectionism and hoarding just wasn't on the radar for a long, long time,” he said.

“Now it's on the radar, but I do think the market is struggling still to digest this and understand it properly – when it does, you're probably going to see a pretty ugly outcome because you would expect there to be sort of a combination of a scramble and speculative scramble at the same time.”

He expects that gold will eventually be chosen as the desired asset for central banks because of its apolitical nature: “The fact that it doesn’t have a sovereign sat on top of it.”

According to him, markets could already be undergoing “a monetary regime change” where gold will eventually reassert itself as “the primary monetary mechanism”.

During this regime change, he expects gold mining equities will be the primary instrument for financial markets to gain exposure.

“When we've been in this post-Bretton Woods system for 50 years, gold miners have been really disappointing investments,” he said. “The reason really is to do with the financial architecture.

“What I mean is that when the government issued pure confidence-based monetary system is functioning and people are willing to play the game, then financials operate in a way that gold miners used to operate.

“Gold miners pre-1971 were very high dividend paying, core parts of people portfolios – they were financials: they were mining money and paying big dividends.

“So there's no reason to expect that wouldn't be the case in the future, in fact, that would be my expectation, because that's as I see it a more normal scenario than highly leveraged financials performing that role.”

However, Williams is more bullish on commodities in general than gold specifically. He said: “Gold, like all commodities, is in a long-term bull market. These commodities trade in rotation. They don’t all go up at the same time.

“It's inevitable at some stage that gold will go through $2,000 an ounce, and then probably make some progress up to $2,600 or maybe even $3,000. It's just got to take its turn in the queue.”

As such, while Williams’ global macro fund does have large positions in gold and silver equities, it also has large stakes in the copper miner Antofagasta and the diversified miner BHP Group.