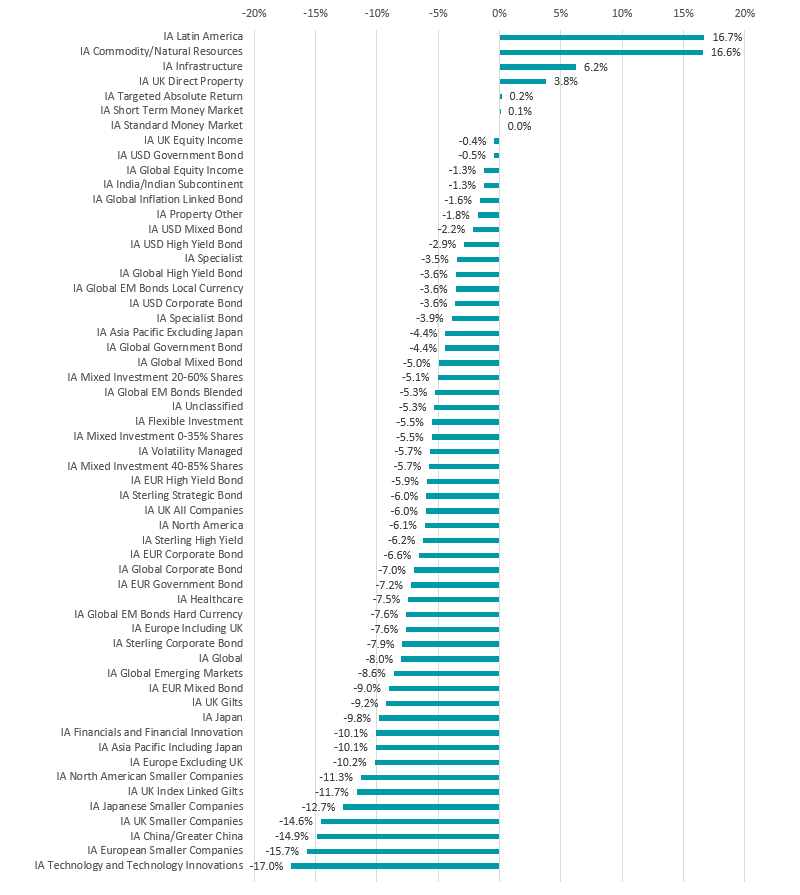

Investors in most fund sectors are sitting on losses for 2022 so far, FE fundinfo data shows, with just a handful eking out positive returns as the war in Ukraine, inflation and interest rate hikes hammer sentiment.

Just six of the 57 Investment Association sectors were in the black during the first four months of the year, led by an average total return of 16.7% from IA Latin America funds.

Latin American equities are enjoying somewhat of a bull run thanks to the region's status as an exporter of several key commodities, which have spiked in price as the conflict between Russia and Ukraine added to global supply bottlenecks.

Reflecting this, the average fund in the IA Commodity/Natural Resources sector is up 16.6% for 2022 so far. The other sectors in positive territory are some way behind this: IA Infrastructure is up 6.2%, IA UK Direct Property 3.8%, IA Targeted Absolute Return 0.2% and IA Short Term Money Market 0.1%.

Source: FE Analytics

At the same time, the majority of Investment Association peer groups are nursing losses, as shown in the chart above.

The average loss of 17% in the IA Technology and Technology Innovations sector is an amped-up version of what’s happening in the rest of the market. Growth stocks are tumbling as central banks attempt to curb soaring inflation with higher rates, which tends to make their future earnings look less attractive to investors.

This is a stark reversal of the market backdrop of the past decade and, when combined with the war in Ukraine and the risk of stagflation, is causing heightened volatility.

George Lagarias, chief economist at Mazars, said: "Since the beginning of the year, equity and bond markets have been in disarray. For asset allocators, it marks by far the worst beginning of the year in this century. Performance is three-quarters of the way to catching 2008, in just four months.

"We are in a market dominated by risks and in desperate search of a guiding theme that will replace the ‘Fed put’. This will not be easy. In the past 14 years, markets have been guided by a single, government-sponsored theme. Even before the global financial crisis, Alan Greenspan happily assumed the mantle of ‘the market-friendly’ Fed.

“Reversion back to a pre-Fed put market will take time. Failure to find a new guiding doctrine could see further and significant devaluation of risk assets.”

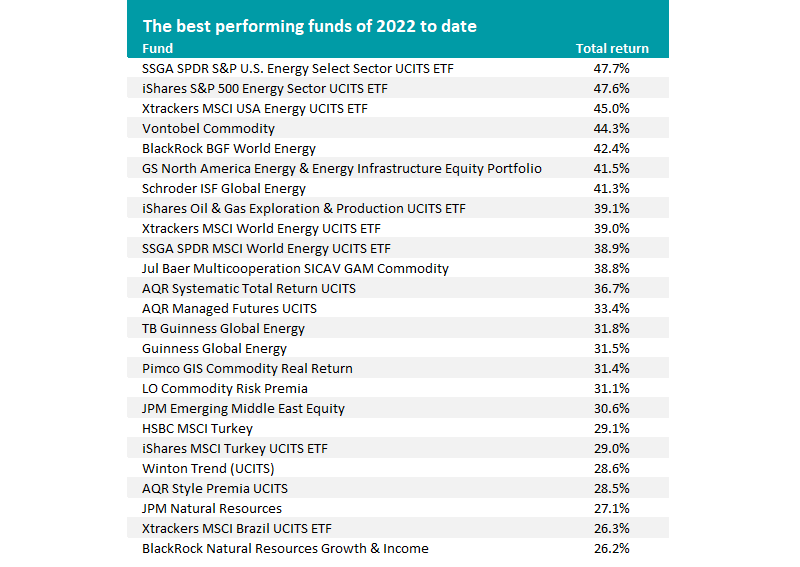

When it comes to individual funds, the list of the year’s best performers is dominated by those that invest in energy stocks. While commodity prices in general are on the up, the likes of oil and gas have rocketed as the West seeks to reduce its reliance on Russia’s energy exports.

Source: FE Analytics

SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF made a total return of 47.7% in the opening four months of 2022, while another six funds are up more than 40%.

A few funds on the list are not energy or commodity specialists.

AQR Systematic Total Return UCITS, for example, is a diversified absolute return fund offering exposure to “traditional asset classes, alternative risk premia and differentiated alpha sources”; two other funds run by AQR Capital Management, which applies academic thinking in economics, behavioral finance, data and technology to investing.

Two Turkish equity trackers (HSBC MSCI Turkey and iShares MSCI Turkey UCITS ETF) and one active Middle East fund (JPM Emerging Middle East Equity) are among the year’s best performers.

Xtrackers MSCI Brazil UCITS ETF has just made it into the top 25, but other IA Latin America funds aren’t far behind, reflecting the sector’s strong run this year.

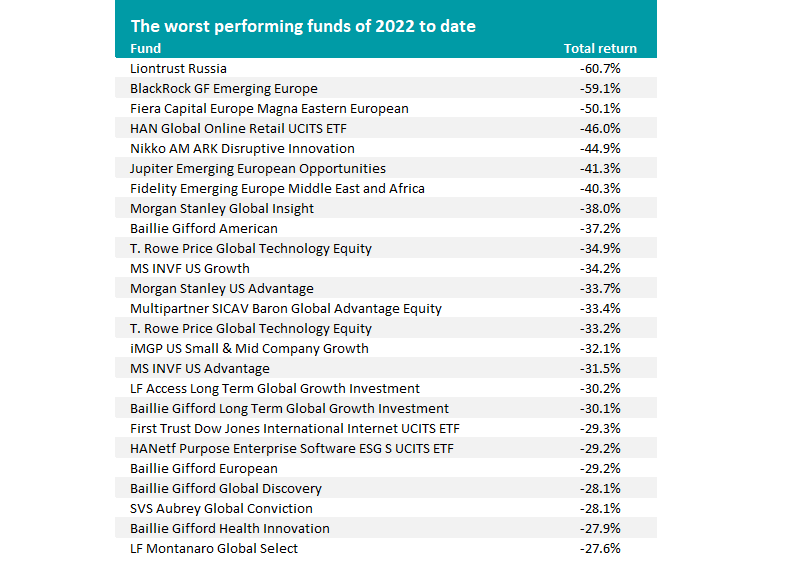

Source: FE Analytics

At the bottom of the table, however, is Liontrust Russia and several other funds with heavy exposure to the country. Russia has been sanctioned heavily for its attack on Ukraine and the value of Russian stocks have been written off by many investors.

Funds that have enjoyed several years of strong returns because of their bias to the growth style are also taking heavy losses this year as growth comes under pressure. Nikko AM ARK Disruptive Innovation, Baillie Gifford American and T. Rowe Price Global Technology Equity are three examples of this.