Fund managers are hoarding cash in May, a closely watched indicator of investor positioning reveals, as worries about hawkish central banks, lacklustre economic growth and the Russia/Ukraine war continue to hammer sentiment.

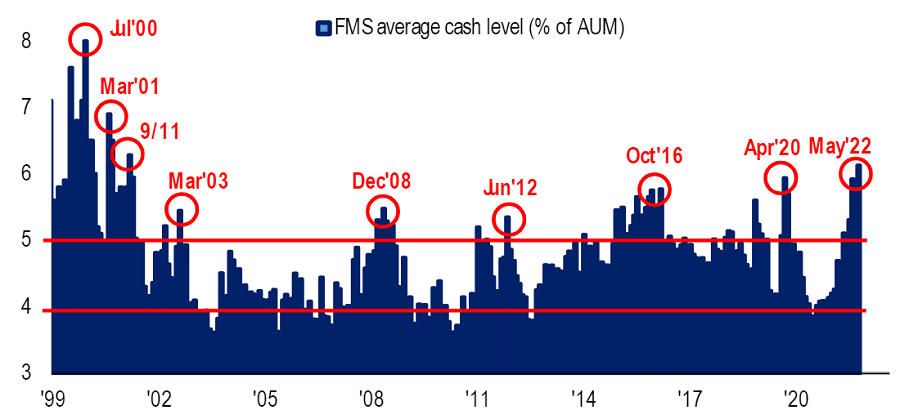

Describing the mood this month as “extremely bearish”, the Bank of America Global Fund Manager Survey found that cash levels among professional asset allocators has surged to 6.1% in recent weeks as investors dialled down risk in their portfolios.

Current cash levels rose from 5.5% in April and are now at a 20-year high – the highest since the attack on the World Trade Center in September 2001.

Average cash level of fund managers

Source: Bank of America Global Fund Manager Survey – May 2022

When asked what level of risk they are currently taking in portfolios, a net 49% said it’s lower than normal. This is a 14 percentage point change on last month, taking risk appetite to its lowest since December 2008.

The declining sentiment comes as fund managers fear a combination of factors such as rising inflation, rate hikes and the conflict in Ukraine could derail global growth.

A net 72% of managers expect the economy to weaken over the coming 12 months, which is the lowest growth expectations since the Global Fund Manager Survey was started in 1995.

Indeed, 77% of fund managers now expect ‘stagflation’ to hit the global economy – the highest reading since August 2008. Stagflation, or below-growth and above-trend inflation, is seen as the harshest of economic climates and one that would create a significant headwind for markets.

What fund managers think global economic trends will be over the next 12 months

Source: Bank of America Global Fund Manager Survey – May 2022

Just 17% think the economy is heading into ‘boom’ conditions of above-trend growth and inflation – the lowest since November 2020 and down from 30% last month. Expectations of ‘goldilocks’ conditions (above-trend growth and below-trend inflation) or a state of below-trend growth and inflation were flat at 1% each.

Concern over the health of the global economy was apparent when fund managers were asked what they see as the biggest tail risk in the market at the moment.

Some 27% cited ‘global recession’ as their main worry, an increase on the number highlighting this concern in April. This puts it in second place, down from first last month.

What fund managers consider to be the biggest tail risk

Source: Bank of America Global Fund Manager Survey – May 2022

Hawkish central banks have become the main tail risk that investors are watching as the likes of the Federal Reserve and the Bank of England push on with the rate-hiking programmes in the face of decades-high inflation.

Just over 30% said hawkish central banks is their biggest worry, while 18% opted for inflation. The Russia/Ukraine war was highlighted by just 10% while only 1% are concerned by Covid-19 – the same number as those watching the risk of an Asian currency war.

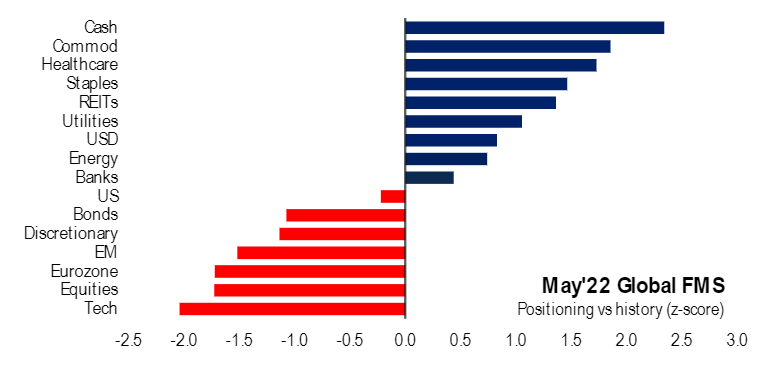

Against this backdrop, global fund managers have been trimming risk from their portfolios. The below chart shows current investor positioning versus its 10-year history.

Portfolio positioning vs history

Source: Bank of America Global Fund Manager Survey – May 2022

Investors have gone very underweight on tech stocks, which led the post-financial crisis bull market and were a persistent overweight in portfolios until rising interest rates hampered them and other growth stocks. A balance of 12% of fund managers say they are now underweight tech, which is its largest net underweight since August 2006.

The allocation to defensive sectors (utilities, consumer staples and healthcare) stands at 43%, an increase from 28% last month and the highest since the peak of the market’s pandemic worries in May 2020.

There’s a bearish mood against all equity regions but the lowest levels of sentiment were reported for European and emerging market stocks.

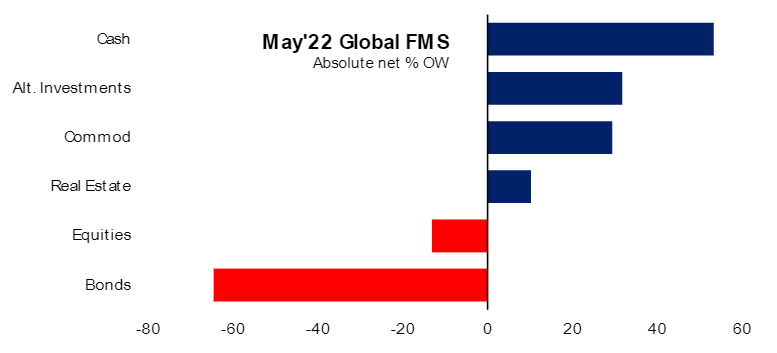

Net % overweigh to asset classes

Source: Bank of America Global Fund Manager Survey – May 2022

In terms of broader asset classes, managers are negative on bonds and equities, but bullish on cash, alternative investments, commodities and real estate.

The latest edition of the Bank of America Global Fund Manager Survey polled 288 participants with combined assets under management of $872bn between 6 and 12 May 2022.