Nick Train has warned investors in the Finsbury Growth & Income Trust that he doesn’t know whether he can repeat his outperformance of the past two decades – but said he is confident somebody “is going to make a lot of money investing in unloved UK companies” over the next few years.

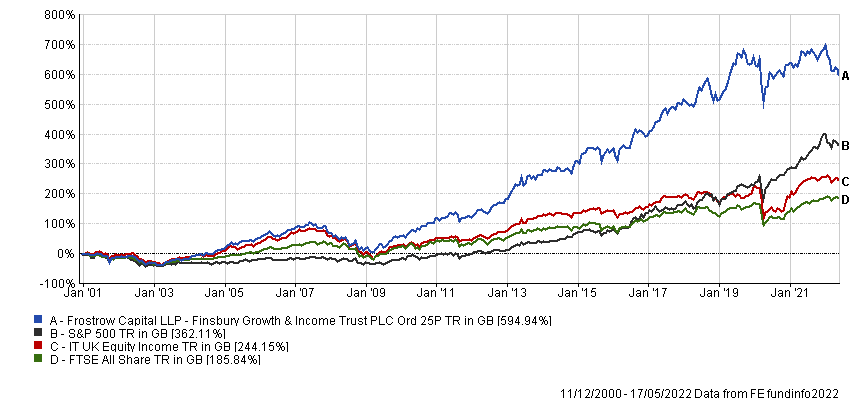

Train pointed to a graph showing that since the market peaked in the dotcom bubble at the turn of the millennium, the FTSE All Share index is up just 27.1% in share price terms, while other markets such as the US have surged ahead.

Performance of indices (price only) since 2000 peak

Source: FE Analytics

As a career UK equity investor, the manager said that you could reasonably expect him to use this graph as evidence that the FTSE All Share was “cheap as chips”, making it highly likely to be the best-performing developed market for the foreseeable future.

“I don't know that, of course, so it would be imprudent of me to imply it,” he said. “But I would like to stick my neck out a little and say that after this long period of disaffection – with global asset allocators reducing their exposure to the UK and private clients throwing in the towel on their own home market – it would be a surprise if there weren't some mis-pricings in the UK stock market.”

Pointing to the performance of Finsbury Growth & Income, which has even beaten the S&P 500 since Train took charge in December 2000, he said: “I really don't know whether we could do it again. But what I do think is that somebody is going to make a lot of money over the next few years investing in unloved UK companies, and I sincerely hope that we own enough of them in this strategy to participate.”

Performance of trust vs sector and indices under manager

Source: FE Analytics

Of course, it would be overly simplistic to claim that a market is likely to contain undervalued companies just because it has done poorly. Yet Train pointed out many of the “exceptional” businesses in his portfolio are trading at much lower valuations than their international equivalents.

For example, he noted that investment house Schroders was trading at 0.9% of assets under management, compared with 1.9% from US competitor T. Rowe Price.

“It's a different market, maybe a different business dynamic, but let me remind you Schroders’ assets under management have been compounding at 10% per annum over the last five years,” the manager said.

“This is a business that is actually making progress.”

Meanwhile, he pointed out enterprise resource planning software provider Sage is trading on an enterprise-value-to-revenue multiple of less than half that of US peer Intuit, and less than a third that of New Zealand’s Xero.

“Sage is a business that is making progress – it needed to,” Train added. “Sage is not yet in the same league as Intuit or Xero, but it's actually getting closer to those businesses than the extraordinary valuation disparity implies.”

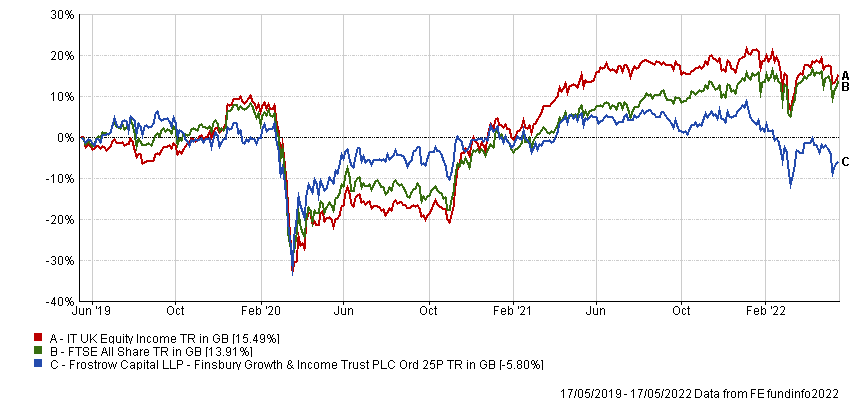

Finsbury Growth & Income has suffered a rare period of underperformance over the past three years, losing 5.8%, compared with gains of 15.5% from the IT UK Equity Income sector and 13.9% from the FTSE All Share.

Performance of trust vs sector and index over 3yrs

Source: FE Analytics

Yet Train is not unduly worried, saying his focus on companies that deliver a high return on equity has driven his outperformance in the past and should continue to do so in the coming years.

The average return on capital for holdings in Finsbury Growth & Income is just above 15%, but with “the judicious use of leverage”, they have been able to enhance their return on equity to just under 30%.

This compares with a figure of about 14% for the FTSE All Share.

“Now in the short term, there is little or no correlation between such strong returns on capital and equity and the performance of share prices,” Train continued.

“I know that very painfully, personally, because the highest return-on-capital business we own in the portfolio, at 50%, is Hargreaves Lansdown, which has had a diabolical share price over the last couple of years.

“So in the short term, there is little or no correlation, but over time there really should be a convergence between sustained high internal rates of return from corporations and ultimately the returns they're able to deliver to their owners. That's got to be the basis of our conviction.”

Finsbury Growth & Income has ongoing charges of 0.62% and is trading at a discount of 8.7%.