Payouts from investment trusts hit a record high in the past 12 months as alternative mandates propped up stagnating equity portfolio dividends, according to the Link Investment Trust Dividend report.

Overall, investment trust dividends rose 15.4% to a record £5.5bn in the 12 months to the end of March 2022, with portfolios that invest only in listed equities holding payouts steady at £1.85bn.

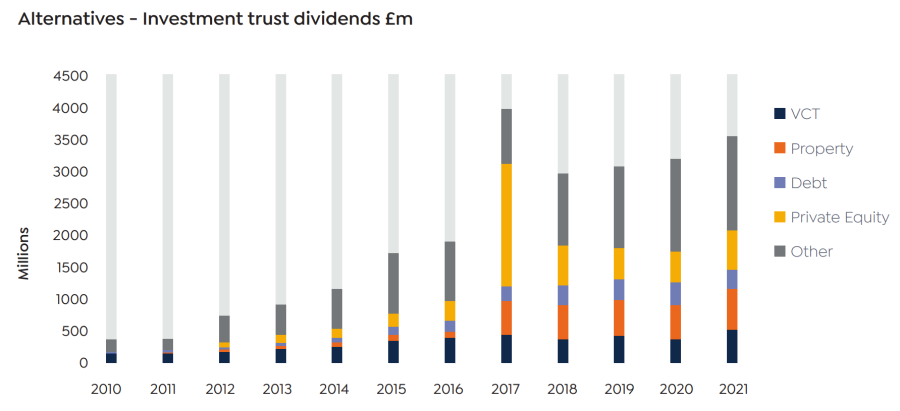

The key area of growth was among alternative investments, where dividends rose by 25.1% to £3.65bn. Venture capital trusts (VCTs), property and renewable energy trusts accounted for four-fifths of the increase.

The biggest increase came from VCTs, up by £221m, which have grown in popularity over recent years as investors have been attracted by the generous 30% tax breaks.

Source: Link Investment Trust Dividend Monitor

“A reduction in the lifetime allowance on pension funds is catching more and more savers with punitive tax on their pension pots,” the report said.

VCT dividends fell by 6.6% in 2020 owing to the “chilling effects” of the pandemic, but have more than made up for that since and have now tripled over the past 10 years.

Private equity also shone in the report, with payouts worth £576m in 2021, the largest of any category of trust thanks to the “dominant” 3i Group, which accounted for two-thirds of this.

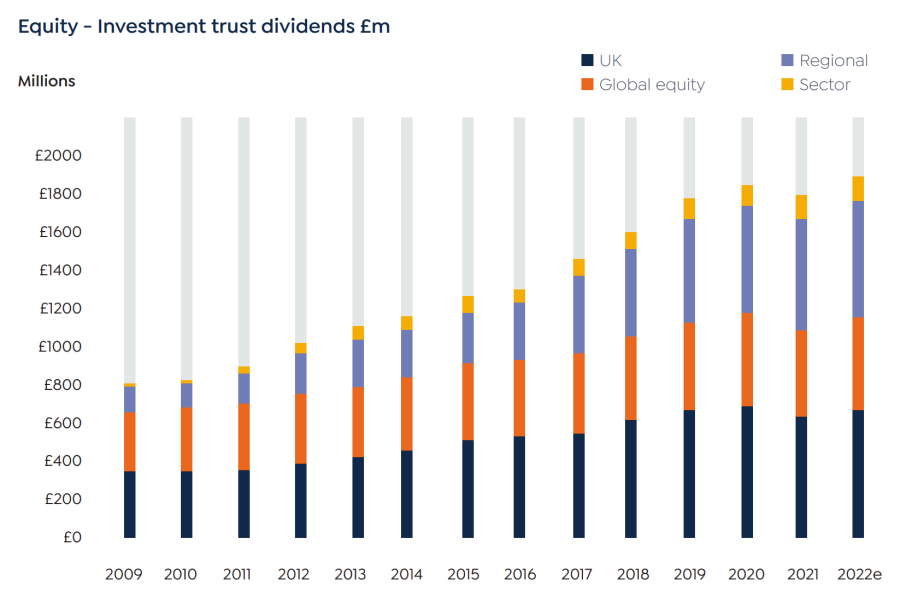

Among equity trusts, it is important to note that dividends barely fell during the pandemic and are recovering more quickly than expected, but the figures are less eye-catching than their open-ended rivals in the post-pandemic world. At their lowest point, dividends only fell 1.9% compared to the pre-Covid-19 peak.

“Having fallen so little they naturally have almost no ground to make up which explains why they appear to have lagged behind the wider market in recent months,” the report said.

Indeed, in the UK, underlying dividends paid out in the first quarter of 2022 were 4.2% higher than the previous year. They will take some time to regain pre-pandemic highs, however.

By contrast, the Janus Henderson Global Dividend Index shows that global payouts have now topped their pre-pandemic levels.

“Investment trust dividends barely fell during the pandemic and are recovering more quickly than expected,” the report said, despite the flat numbers over one year.

In the first quarter of 2022, dividends from equity trusts were 4% higher than the previous year at £437m, with the IT UK Equity Income sector leading the way.

Source: Link Investment Trust Dividend Monitor

“With a time lag, this group has echoed the cut in UK plc dividends that we have reported in the UK Dividend Monitor – down 7% in the past 12 months compared to the previous 12,” the report said.

“But the echo has been faint. If we take into account the time lags, we can see the decline has been one-third as severe.”

Global funds also paid out less over 12 months, down 1.6% as a result of the pandemic, although this was lower than their UK peers.

Emerging market trusts also paid out less than the previous year as companies cut their dividends later that their developed market peers. Here they waited until the effects of the pandemic were known before making decisions, rather than pre-emptive measures.

“These three categories together account for two-fifths of the dividends paid by investment trusts,” the report said.

Yet overall trusts have navigated the past few years well, thanks in part to their ability to preserve excess income as a revenue reserve. This allows them to pay out more when times are tougher.

“Trusts drew on their reserves through the pandemic, but they also took advantage of special rules that permit them to distribute some of their capital gains as dividends. In our last edition, we reported that reserves had fallen by one sixth. The decline in reserves has slowed markedly,” the report said.

“Since last June (based on latest available accounts) they have fallen by a further 6.8% and we judge that trusts are likely to start rebuilding reserves from here on.”