Investors worrying about an upcoming recession on the back of higher interest rates and rampant inflation should temper their fears, according to James Henderson.

The manager of the £321m Lowland Investment Company said that excess capital has flowed into speculative areas of the market such as cryptocurrencies and non-fungible tokens (NFTs), which are investments with little tangible value.

But the current bear market has caused investors to rethink this strategy, with the prices of these assets plummeting so far in 2022. Bitcoin, the leading crypto, is down two-thirds from its £49,939 peak in November 2021 to £15,842 today.

“Recessions focus people back onto a correct allocation of resources,” said Henderson.

Whether or not the economic slowdown turns into a full-blown recession remains to be seen. However, the manager said that even if it does, it should be relatively tame.

“This one will be quite flat – it won’t be too deep. I don’t think it will be that vicious. You need quite a lot of heavy leverage [for a deep recession] and it is the unwinding of the leverage that spirals it down,” Henderson noted.

“But corporate borrowing isn’t particularly high and ever since the banking crisis, the ability to mortgage up by the consumer has been pretty controlled. Getting on the ladder is too difficult rather than too easy.”

Recessions tend to be at their worst when rates of negative equity (when an asset is worth less than the remaining value of the loan taken out to buy it) spiral.

This applies to all sorts of areas where people may take out leverage, whether it is to start a new business, invest or buy a house.

While instances of negative equity may be appearing in pockets – such as in crypto where it is feared people have borrowed to invest, and in tech where non-profitable firms have taken on debt to keep themselves afloat – most areas should avoid the worst of this.

However, Henderson warned that while any recession may be relatively tame, it is unlikely to be short-lived.

“Usually in a recession there are more up-days than there are down-days, but the latter are worse. It is dull, dull, dull, pain. That’s how it feels anyway,” he said

“There isn’t a lot in the shorter term to get the economy moving forward, so it may be flat for longer than we want,” he added. However, he also said there are tailwinds that could improve the situation over the medium term, such as the move to net zero.

“There are drivers further out that suggest the economy will return to growth just to satisfy the changes needed,” said Henderson.

“You only ever know what a catalyst is after the event, so you have to move slowly in the direction because things always take longer and markets go further in both directions than you expect or is logically sensible.”

One step investors can take to help themselves is to remain disciplined and “do their buying on the red days”, when markets are down.

Henderson added that holding a diverse list of stocks and resisting the urge to become overly committed to a company are also more important during tough markets.

“When you are buying more recovery-type situations, any one of them can get into a mess in a difficult environment. So you want a bit of spread there,” he said.

This is how his portfolio is positioned, with 110 holdings in total. But Laura Foll, co-manager of the trust, admitted it had still been a tough first half of the year.

“The market performance this year has been quite unusual. It is reflecting a stagflationary scenario. Within that, the small- and medium-sized end of the market has performed very poorly relative to the large- and mega-cap end of the FTSE 100. In fact, it is only the top-20 stocks in the FTSE 100 have done well year-to-date – even the 80 beneath them have struggled,” she said.

Lowland has around 50% of its holdings in the FTSE 100, which is towards the upper end of where it has been historically.

While this has proved to be a good call, the trust has still underperformed as FTSE 100 companies account for around 80% of the FTSE All Share index.

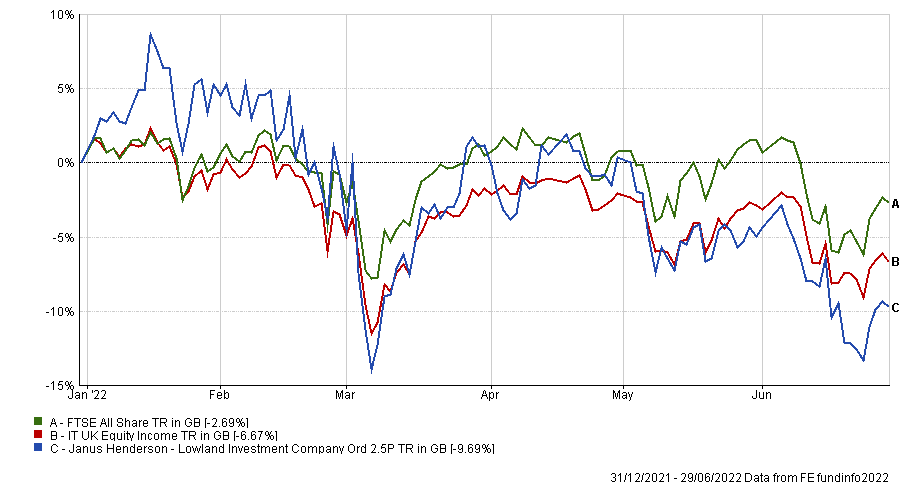

Total return of fund vs sector and benchmark in 2022 so far

Source: FE Analytics

Now the managers are deciding what to do next. Foll said that the scale of underperformance of the small- and medium-sized companies year-to-date suggests they will move the portfolio back the other way over time.

“The debate we are having is to what extent any slowdown in demand is already reflected in where valuations are,” she said. “There has to be a point where those negative expectations are already reflected in the share price.”