UK managers are unable to agree on where the best opportunities are in the market with votes of confidence all the way down the capitalisation spectrum.

Interest in the UK has made a comeback this year, with the FTSE All Share up 9% in 2025 so far while the MSCI AC World index is down 1%. However, performance has varied depending on market capitalisation.

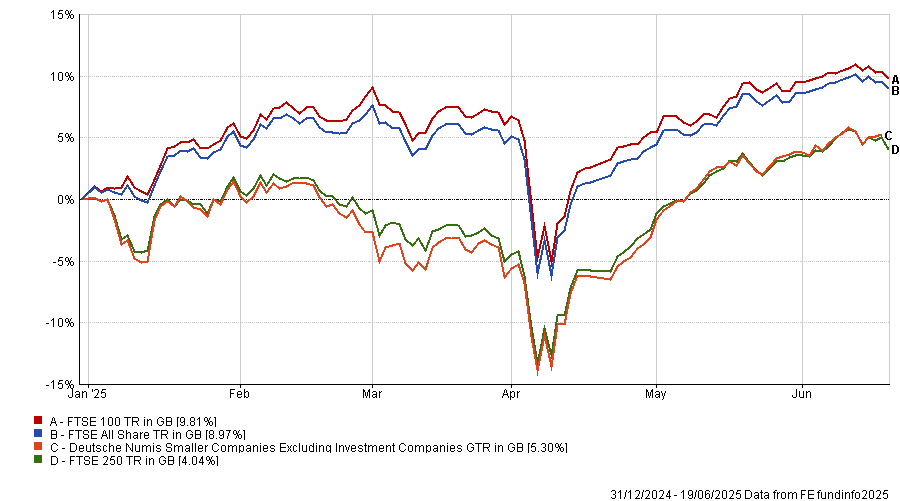

As demonstrated by the chart below, while the FTSE 100 is up 9.8% the Deutsche Numis Smaller Companies is up 5.3% and the FTSE 250 is up just 4%.

Performance of the indices year-to-date

Source: FE Analytics.

For some experts, large-caps are the clear place to be. However, for others, mid-caps and micro-caps are better plays on the domestic economy that can outperform over the long term.

Below, Trustnet asks UK managers which market capitalisation offers the most interesting opportunities.

Nick Train, manager of the Finsbury Growth and Income Trust, highlighted the FTSE 100 as his favoured market cap area, with 90% of the portfolio invested in it.

Investors are “underestimating the potential” of large-cap companies, particularly data and software businesses, such as the London Stock Exchange Group, Sage and Experian. These companies are still solid businesses that will take further market share as they expand into artificial intelligence and other analytical tools.

While share prices have been volatile recently, Train noted that all delivered positive returns over a “turbulent five years”, demonstrating the strength of these companies. Sage has even outperformed the FTSE All Share over this period, as seen in the chart below.

Total return of stocks over the past 5yrs

Source: FE Analytics.

Artemis Income’s Nick Shenton and Andy Marsh also like large-caps, but favoured the lower half of the FTSE 100.

“We think there’s a sweet spot of underappreciated businesses at the lower end of the FTSE 100, around the £8bn market-cap range,” Shenton explained. This area is full of “differentiated businesses with global scope”, which are still small enough to grow at an impressive rate.

For example, they pointed to Informa as one of the “best collections of assets in the world”, as one that still has long-term potential.

By contrast, they argued it was challenging to find businesses with the ability to scale while enjoying global leadership further down the market-cap spectrum. “There’s this misconception about the UK mid- and small-caps space that it’s some sort of El Dorado of returns, but it's not the case over time,” Shenton said.

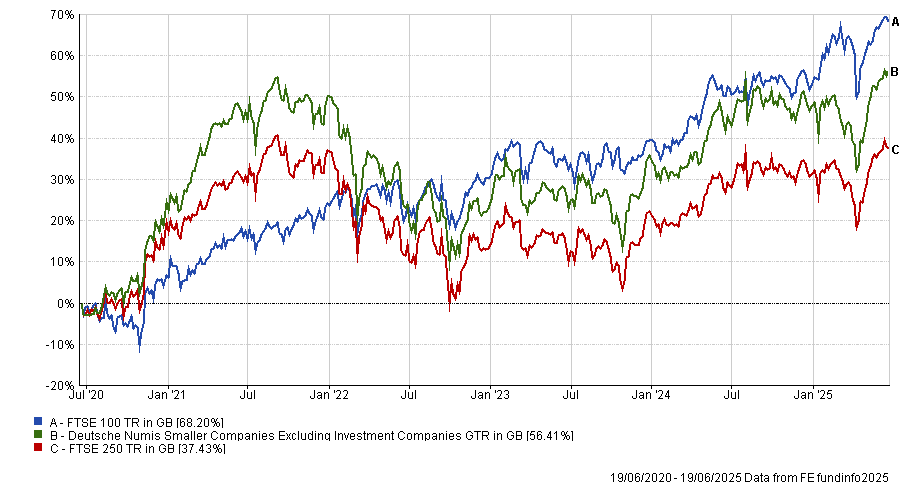

Data seems to support this, with the FTSE 100 up 68.2% over the past five years, compared to the FTSE 250 (56.4%) and Deutsche Numis Smaller Companies (37.4%) indices.

Performance of the indices over the past 5yrs

Source: FE Analytics.

However, not all experts agreed. For Alexandra Jackson, manager of the Rathbones UK Opportunities fund, mid-caps will prove themselves the best place to invest in the long term.

In contrast to the FTSE 100, Jackson argued mid-caps’ larger domestic focus is one of their biggest tailwinds. With the dollar depreciating, the sterling looks much stronger, which will “typically benefit” domestic mid-caps more than international large-caps that derive a large portion of their revenues in other currencies.

Additionally, FTSE 250 companies are expecting higher earnings growth this year than the FTSE 100, as they expand from a lower base. It means investors can find quality names with high returns on capital in the mid-cap space that could compete with larger companies, she concluded.

For Gervais Williams, head of UK equities at Premier Miton, “micro-caps continue to be the best area for active UK investors”.

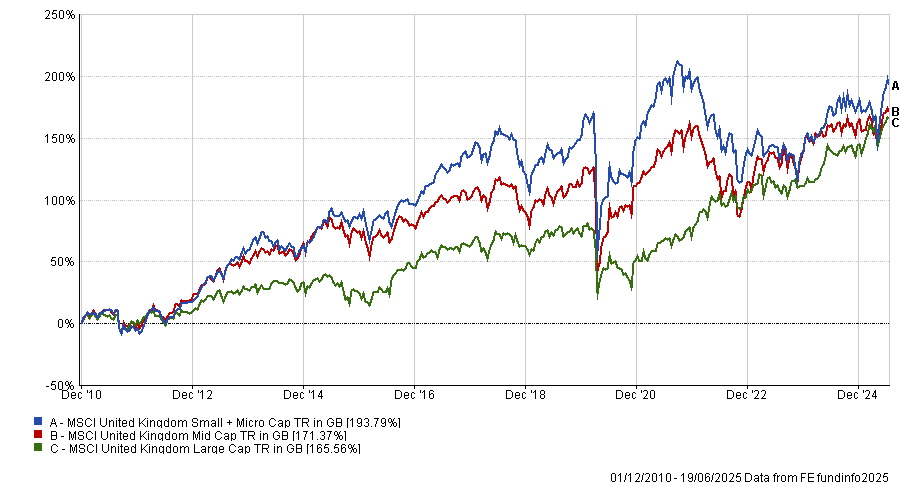

He argued that the UK micro-cap space is full of stocks that generate abnormally strong returns over the long term, even compared to mainstream names. The data seems to support this, with micro-caps and small-caps outperforming the rest of the market over the past 15 years, despite recent underperformance.

Performance of indices over the past 15yrs

Source: FE Analytics

For an historic example of this he highlighted retailer Next. In 1991, it was a micro-cap worth just £50m, but it has surged in value over the past three decades, entering the FTSE 100 and becoming a mainstay in the UK market.

Today, there are also plenty of stocks in the micro-cap space that can take advantage of larger structural trends as Next once did.

Concurrent technologies is up 86.9% over the past year, capitalising on the increased push for defence due to heightened geopolitical tensions.

With a market capitalisation of around £171m, it would be passed over by investors looking further up the market-cap spectrum, despite being “one of the UK’s most exciting defence stocks”.