A recession is inevitable and investors should start to brace for it now, according to David Jane, fund manager within the multi asset team at Premier Miton Investors.

In recent months, analysts and commentators have spent numerous words on the likelihood of a recession, with worries mainly spurred by inflation and the interventions of central banks around the world to attempt to rein it in.

Analysts were also spilt between those who believed (or hoped) that inflation would peak and those convinced that it will plateau.

There has been a general consensus around economic growth, which is expected to continue to rise despite the central bank policies in the second half of the year on the back of unspent stimulus and strong employment.

Latest data from the Office for National Statistics (ONS), published in June, shows a small improvement in the UK employment figures, which have improved by a modest 0.2 percentage points. In the US, the number of unemployed persons has remained unchanged for the fourth month in a row in May, as pointed out in the June news release of US Bureau of Labour Statistics.

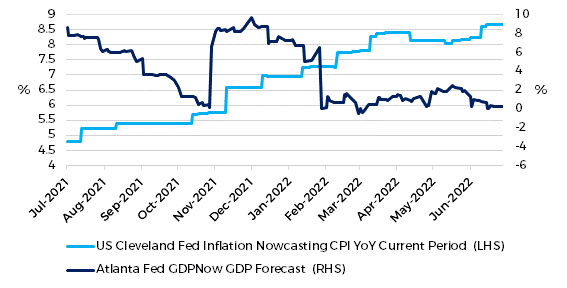

But Jane was not relieved. Looking at the consumer price index (CPI) and GDP forecast data graph below, which is designed to show a best guess of current economic conditions, he saw evidence that recession fears are more than founded.

Annualised US GDP growth and year on year US CPI inflation, from 01/07/2021 to 27/06/2022

Source: Bloomberg

“[These lines] do not paint a pretty picture. Growth is hovering around zero, while inflation continues to push higher. It seems clear that [a recession] is where we are heading, the question is how big a recession and how soon”, he said.

For that, he blames poor policy making. Whether inflation levels are caused by monetary stimulus during lockdowns or by the demand for goods and services exceeding supply, the cause is Covid policies.

“By handing out further free money to consumers, governments are increasing demand, hence stoking further inflation, and the same can be said of tax cuts, price caps and any of the other ‘attractive’ policy options. Sadly, there are no attractive policy options, the only way to fix inflation is to reduce demand, e.g. a recession,” he said.

In terms of fund positioning in such an environment, Jane detained a significant bias to defensive industries across the board and suggested gold might be a good option for diversification.

Assuming that equity valuations will continue to be forced down by inflation and that the recession will eat into profits, Jane shifted funds further away from cyclical areas and reduced even inflation beneficiary industries if there was a concern for cyclicality or profit margins. Persuaded that growth stocks will remain unattractive, he retained exposure to energy and materials.

Longer dated bonds are also “unlikely to work” in an inflationary environment, making him “very cautious” in this space.

While Jane was unsure how deep the recession will be, James Henderson from Janus Henderson sweetened the pill.

“You need quite a lot of heavy leverage [for a deep recession] and it is the unwinding of the leverage that spirals it down”, he said in a recent interview with Trustnet.

But corporate borrowing isn’t particularly high and ever since the banking crisis the ability to mortgage up by the consumer has been pretty controlled, he noted. So “this one will be quite flat”, he said.