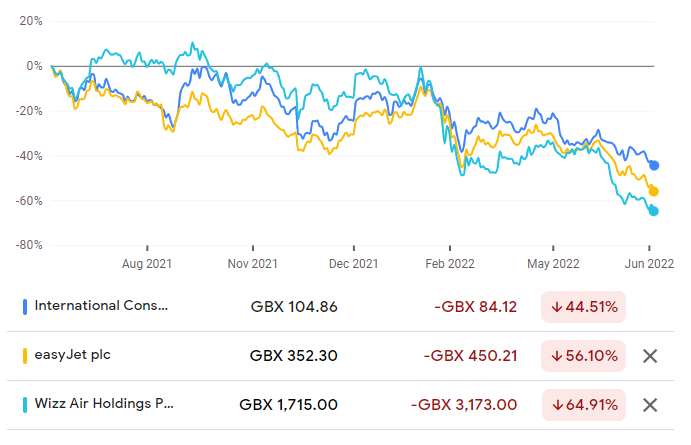

Airline companies were among the most shorted UK companies in June, with International Consolidated Airlines (IAG) flying up the rankings.

Short positions in the company that owns British Airways (BA) reached 5.2% throughout the month after staff shortages led to flight cancellations and chaos at airport terminals.

Investors’ views on the company have declined rapidly as planned strike action is expected to lead to hundreds more cancellations in the busy summer period.

Many BA staff have been dissatisfied with management after the company cut and froze wages as a cost-cutting measure in 2020 but failed to remove these measures post-pandemic.

Tensions heightened when the airline announced plans to cut up to 12,000 jobs in April, leading to a series of planned strikes this summer, which will impact BA during its busiest period as holidaymakers plan trips abroad.

Strikes at Heathrow, the UK’s largest airport, will likely affect other companies such as budget airline, EasyJet, which also leapt up the list of shorted companies with five firms betting against the business in June.

Short positions stood at a modest 0.7% at the start of the month but increased to 4.1% within a few weeks as the outlook for UK air travel appears increasingly dire.

Another low-cost airline, Wizz Air, held a short position of 3.7% last month as firms betted against the company’s ability to handle this summer’s delays.

Share price of IAG, BA and Wizz Air over the past year

Source: Google Finance

Home improvement company, Kingfisher, overtook Cineworld to become the UK’s most shorted stock in June.

The chain, which owns names such as B&Q and Screwfix, took the top position after two new firms, Alliance Bernstein and Citadel Advisors, bought positions totalling 1.3%, bringing the overall number of shorted stocks to 8.4%.

This is the first time in several months that Cineworld has not been in the top position, although its 78.6% decline in share price over the past year is far worse than Kingfisher’s 35.2% drop.

Share price of Kingfisher and Cineworld over the past year

Source: Google Finance

The cinema chain remains popular among shorters however, with of 8.2% its shares our on loan after revenue slowed significantly throughout the pandemic due to lockdowns and Covid restrictions.

Even now as sales are improving, the company is facing $1.2bn (£800m) in damages to Canadian chain, Cineplex, after it pulled out of a $2.1bn takeover in 2020.

Although conviction in the company is low, twice as many firms are shorting online fashion retailer, Boohoo. A total of 10 groups have taken up short positions in the company after a string of controversies, meaning it has the greatest number of firms betting against it.

Trouble started for Boohoo when several campaign groups exposed poor working conditions in its Leicester facility, with many environmental, social and governance (ESG) funds cutting the stock from their portfolios.

There was also backlash against the reappointment of co-founder, Carol Kane, as almost 12% of Boohoo shareholders voted against her last year.

Sales have also slowed from their pandemic highs, dragging the share price down 83% over the past 12 months.

Share price of Boohoo over the past year

Source: Google Finance

Fellow online retailer, ASOS, also has 7% of its shares shorted as profit margins thin. Other consumer discretionary businesses to be impacted by higher inflation and reduced customer spending are drinks companies Naked Wines and Fever-Tree, which have short positions of 5.9% and 5.2%.