Many environmental, social and governance (ESG) investors will be scarred by the current bear market and may not return to the sector for years, according to Alex Rowe, manager of the Nomura Global Sustainable Equity fund.

In an article published earlier this year, Ian Lance, manager of the Temple Bar Investment Trust, claimed the majority of ESG funds were just a proxy for growth funds, with an “almost perfect” correlation.

As a result, they have been among the funds hardest hit by the compression in share price multiples caused by rising inflation and interest rates.

Rowe said this should not have come as a surprise, as the market demonstrated many characteristics of a bubble.

“At the end of 2020 and the start of 2021, a lot of people decided they were really interested in sustainability and mitigating climate change, and piled into renewables,” he said.

“We saw absolutely absurd valuations in some pockets of the market. You were seeing ‘impact at any price’ as well as ‘growth at any price’, and there were some spectacular blow-ups.”

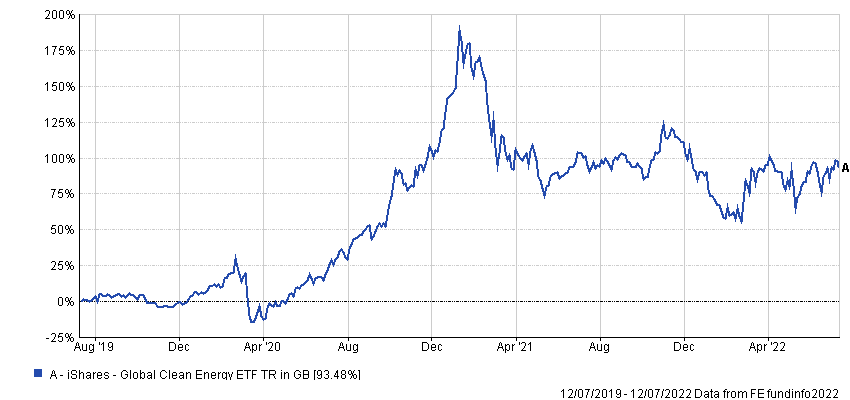

Data from FE Analytics shows the iShares Global Clean Energy ETF made 240.6% from its lowest point in 2020 to its highest point in 2021. It has fallen by a third since then and is down by about 40% in local currency terms.

Performance of ETF over 3yrs

Source: FE Analytics

“I think the scars are going to run deep for a lot of investors,” Rowe added. “We clearly got into a bubble and I think it’s going to be a few years before people get back to that type of behaviour.”

Yet Rowe claimed there are still plenty of opportunities in ESG stocks if you look away from the small number of pure renewable plays that got caught up in the bubble.

The manager takes what he calls a quality, discount-valuation approach to sustainable investing. Once he has identified a company he wants to invest in, it needs to be signed off by a stock-selection committee.

“I can't go to the committee with a really high-impact name that’s not a very good company or doesn’t represent good value,” he said, adding this approach helped him avoid the areas of the market that reached “absurd” prices and led him to those that still look cheap.

One of these is building products.

“Buildings account for 30 to 40% of emissions,” he explained. “You can invest in a number of companies producing exceptionally efficient air conditioning systems and building management systems, which can drastically help manage your building’s ultimate efficiency.

“Obviously the Biden administration and the EU have said we have to start retrofitting our buildings at a much faster rate. And you can achieve emission reductions of 50% to 60% through proper retrofitting.”

Rowe said this focus on valuations is the reason he has outperformed this year. Nomura Global Sustainable Equity has fallen 6.9% compared with 9.9% from the MSCI ESG World Leaders index. Since the fund’s launch in April 2019, however, there is less than a percentage point in it, although both are well ahead of the MSCI AC World index over this time.

Performance of fund vs indices since launch

Source: FE Analytics

Despite Rowe’s fears about how the bursting of a renewables bubble will hit ESG investors, money is still pouring into the sector. Data from Calastone shows ESG equity funds have seen inflows of £2.3bn year-to-date, bucking the trend of outflows across the industry.

But the manager said that within the sector, the money is moving away from investing with a negative-screening mindset and towards making a positive impact.

“For example, we would highlight a transition from favouring IT companies, which have naturally lower emissions and environmental impact, to a more mature understanding that certain higher emitting companies (operationally) are developing technology which is crucial to a low-carbon economy, and therefore have a more positive impact,” he explained.

“The earlier mindset was certainly better suited to growth investors, and it is our opinion that, as the sector continues to mature, the range of sustainable strategies will broaden and the current investment biases will decline.”

While the manager does engage with companies, he won’t invest in sectors such as oil & gas and auto manufacturers with the aim of encouraging them to mend their ways. This is not for ideological reasons though, but because he doesn’t have the clout.

“The issue you have is you actually need to achieve change,” he continued.

“We’re not big enough in the US to fulfil that role as an activist investor, to invest in a very bad company and quickly and credibly drive huge change. We could do that in Japan, but not in the US.

“It's more to do with focusing on investing in the best companies and engaging where possible.”