Investors have moved away from traditional mixed asset portfolios and into trackers that tackle climate change, according to the latest Trustnet study.

The first six months of the year have been a rocky ride for most investors, yet despite this they seemed keen to allocate to global equity funds, data from FE Analytics shows.

Indeed, the most bought funds in the IA Global sector were added to far more than the most sold funds had withdrawals, a reversal of the trend examined in the UK All Companies sector yesterday.

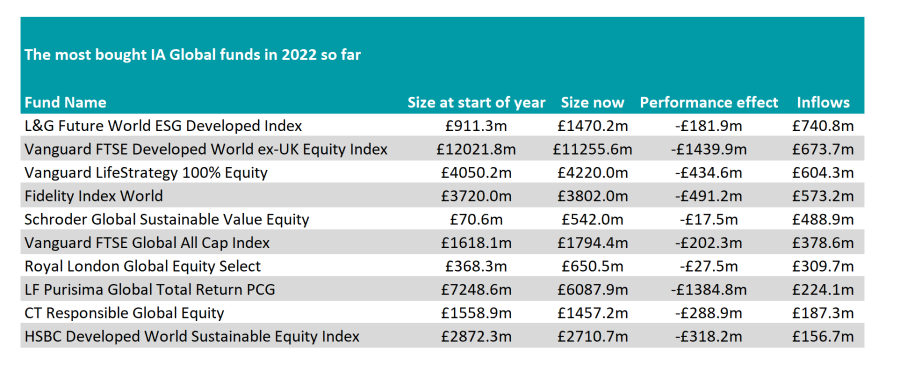

Topping the charts were environmental, social and governance (ESG) mandates, with L&G Future World ESG Developed Index fund raking in £740m over the first half of 2022.

It may be surprising to some that an ESG fund tops the list as the main sources of the market’s returns over the past six months have been from oil majors, defence companies and financials, typically areas not associated with saving the planet.

Yet investors have ploughed ahead into ESG portfolios despite the funds making losses in the first half of the year, as the below table shows.

Source: FE Analytics

In fact, four of the 10 funds on the list have an ESG mandate, including active strategies Schroder Global Sustainable Value Equity and CT Responsible Global Equity.

From an active perspective, Schroder Global Sustainable Value Equity gained as investors moved towards ESG strategies. It took the place of its sister fund – Schroder Global Recovery – which was among the most sold in the first half of the year.

It was not just ESG funds that were given money by investors, however, with the Vanguard FTSE Developed World ex-UK Equity Index and Vanguard LifeStrategy 100% Equity funds proving popular.

Tracker funds were particularly popular, as investors seemingly decided that active managers were not well placed to protect them from volatile markets, with six of the top 10 most bought portfolios taking a passive approach.

One exception was the Royal London Global Equity Select fund, which almost doubled in size, rising from £368m at the start of the year to £650m by the end of June.

The fund has been adept at protecting investors cash, losing just 2.5% over the past six months, a top-quartile effort in the IA Global sector.

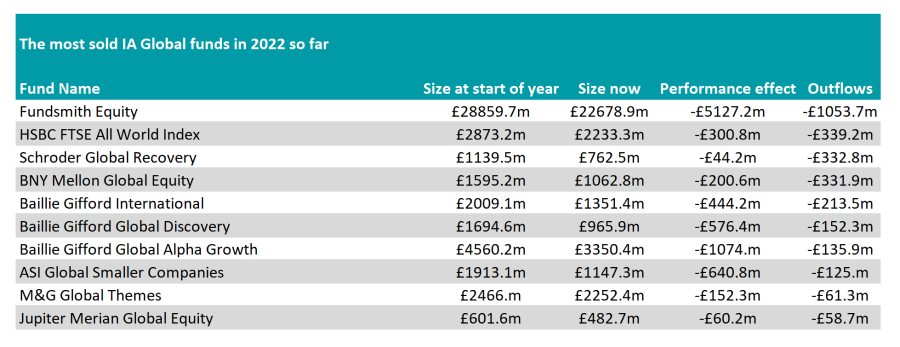

Turning to the other side of the coin, Fundsmith Equity was the most-sold fund in the global sector over the first six months of the year, although it remains a behemoth fund with £22.7bn in assets under management.

Investors pulled more than £1bn from the portfolio in the first half of the year as the quality-growth style employed by FE fundinfo Alpha Manager Terry Smith became out of favour, after more than a decade in vogue.

Active funds dominated the list, with three Baillie Gifford funds among the top 10 most sold IA Global funds. It comes at a time when growth stocks – the type of which are heavily owned by the Edinburgh-based investment firm – plummeted on the back of rising interest rates.

These stocks are often priced for earnings into the future, but any rise in rates means that the opportunity cost for owning this growth is higher.

Source: FE Analytics

Schroder Global Recovery made the list of most-sold funds despite making a much smaller loss than others. The fund received a lot of investors’ cash in 2021 and the withdrawal may be investors switching back into growth styles as they try to time the bottom of the market.

Another fund of note is ASI Global Smaller Companies, which has dropped in size mainly on the back of poor performance. The fund was taken over by Kirsty Desson in 2020, replacing veteran manager Harry Nimmo.

Smaller companies tend to be more growth-orientated and have therefore struggled mightily in the move away from this style of investing so far this year.